Midnight For Crypto In China, But Hong Kong Keeps Lights On

From a ban on banks handling crypto-related transactions to a crackdown on crypto data centers that sent miners scrambling abroad, China has taken an uncompromising approach to controlling — some might say crushing — the cryptocurrency industry over the years. In September, Beijing outperformed even its own harsh standards as the central bank imposed a blanket ban on not only crypto transactions but essentially all forms of activity in the sector.

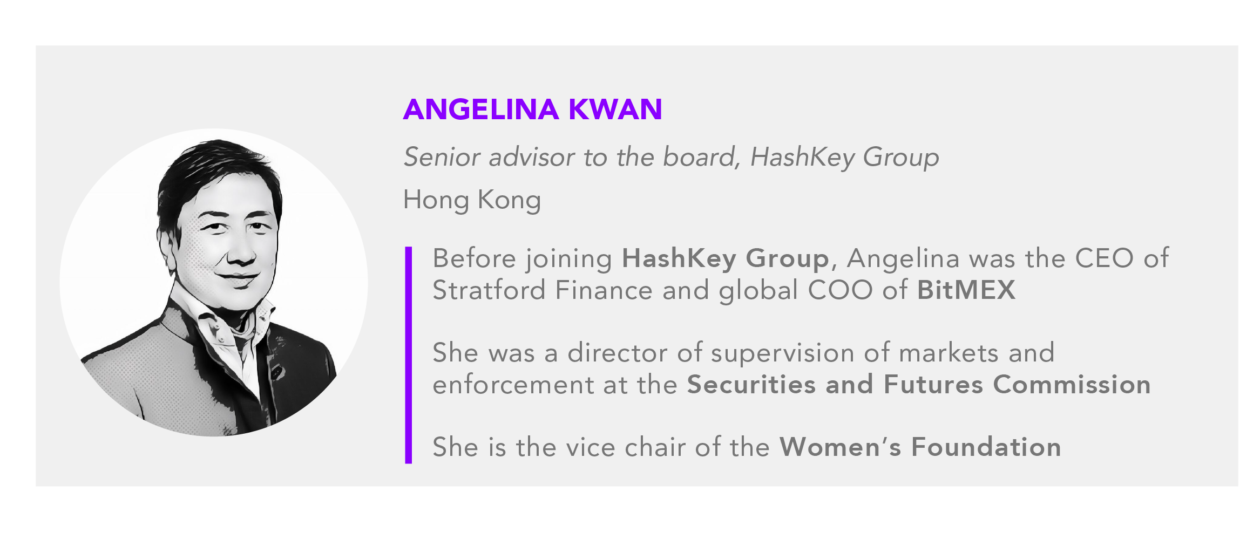

Why has China taken such a tough stance on a potentially prosperity-generating emerging industry? Is the People’s Bank of China’s latest move really a radical departure from previous pronouncements on the sector? And how will it affect what remains of the crypto ecosystem in China and elsewhere? Forkast.News put these questions to regulatory veteran Angelina Kwan, who once oversaw enforcement and the supervision of financial markets for the Hong Kong Securities and Futures Commission. Kwan is now a senior advisor to the board of HashKey Group, a digital assets management firm.

This interview has been edited and condensed.

How did the Chinese central bank’s announcement of a ban on cryptocurrencies last month differ from Beijing’s previous crackdowns on cryptos?

The move was pretty expected. It was just a matter of time when it would be again reinforced. The digital assets industry has known about this for some time — and crypto exchanges and mining firms have known — that it’s prohibited in China.

Most crypto firms can’t even get through the Great Firewall, so their services aren’t even offered in China. It’s not just a matter of them being prohibited. But this time it was quite explicit in terms of the People’s Bank of China, which is a very, very important government body, coming out to make the announcement. PBOC is the regulator of Chinese banks, and it’s very high up in the Chinese hierarchy if you look at how the government works. And it really sends a message about the seriousness of their directive. So, not expected, but I think it’s something that China did want to do, and now they’ve made it undoubtedly clear.

What’s the motivation behind the PBOC’s outright ban on cryptocurrencies?

If you look at the words in the announcement, it’s very serious about monitoring its monetary base and making sure that payments, investments, as well as transfers, are properly managed in China. They’re also really worried about volatility, and about funds coming in and out of China, which they want to be able to track.

So they’re worried about digital assets and social stability. And digital assets mean, to them, going around the system, and therefore they want to stop that. And if you’re going to buy digital assets, it’s probably going to be the central bank digital currency. So what is paramount is knowing who is buying what. And making sure of social stability and protecting the investing public are all-important factors.

FN: How will the ban affect cryptocurrency-related businesses around the globe?

Most global exchanges will be very careful of taking on Chinese clients, and in fact, they won’t take on Chinese clients directly, whereas possibly if Chinese clients from China have other passports, that might be the only workaround. But if you’re Chinese, the government has basically said you’re not allowed to trade crypto, and it’s pretty clear. And it’ll be interesting to see how regulators around the world, if any, will take part in enforcing this. But I think the PBOC — through the banks as well as other regulators around the world — will be looking to see how this all pans out.

How will the action affect the crypto space in China?

For China, I guess it’s better for regulatory clarity. Of course, it’s not good for the digital asset industry, but for China — which counts social stability as its No. 1 issue — and making sure that funds are tracked in and out, it’s very important for the country’s stability. For businesses and people wishing to invest in crypto, it may not be so good. But overall at least there’s clarity in the rules, and there’s clarity in what China’s going to do next. And you can see the different initiatives that are happening right now as China steps up social stability issues. So paramount to the policies, there is basically social stability.

Probably the effect would be, Chinese customers not being able to open accounts, and that will probably have an impact on some businesses. But it’s a really big world out there, and international firms go all over the world for customers. But China continues to be one of the most dynamic markets, so China is the place to be. And it has many, many blockchain developers, and it’s the leader in global blockchain development applications.

As China tightens its political control over Hong Kong, how will its crypto ban affect Hong Kong?

I think, going forward, Hong Kong will continue its autonomy and it’ll continue to maintain its autonomy in its financial and administrative affairs, which was granted in the Basic Law (the city’s mini-constitution). It’s also a major financial and business hub, so it makes sense for Hong Kong to continue as an interface for Chinese blockchain technology to find international uses and customers.

And, of course, the virtual asset service provider license and the whole regime that the [Hong Kong Securities and Futures Commission] has announced, they’re following it and they’re going through with it. So while the rules have just been articulated again, they’ve been in place for a while in China. But Hong Kong continues. There’s a new regime that will come, which will license other cryptocurrency or digital asset providers, and that’s under the money-laundering reporting ordinance. So there’ll be a new regime there, slowly winding its way through legislation.

How are other Asian countries managing regulation in the crypto space?

The Japanese market has already listed its licenses. In fact, HashKey got its licenses just recently, at the same time as a major U.S. digital asset firm. South Korea has come up with new digital asset rules. So all the other jurisdictions are already offering digital assets. Of course, Singapore, also. They’re all coming out with rules and clarity for investors that wish to deal in digital assets.

What will Hong Kong be like when its crypto market becomes more regulated?

As the digital asset industry becomes more regulated, Hong Kong will become more attractive, because it’s a financial center that’s governed by the rule of law, and it provides a level playing field for industry participants. We have 602 financial services securities brokers and futures brokers in Hong Kong, and that number has increased with new broking and family offices coming to Hong Kong. So we have a really vibrant financial services industry, and digital asset firms would do well to stay here in Hong Kong and grow here, because there are clients and there are international clients, and there are family offices that are moving and setting up in Hong Kong.

We believe a number of regulated firms are definitely going to stay here. Hong Kong is really convenient.