BTC, ETH and XRP Price Analysis for October 24

Are the top coins powerful enough to rise against Bitcoin (BTC)?

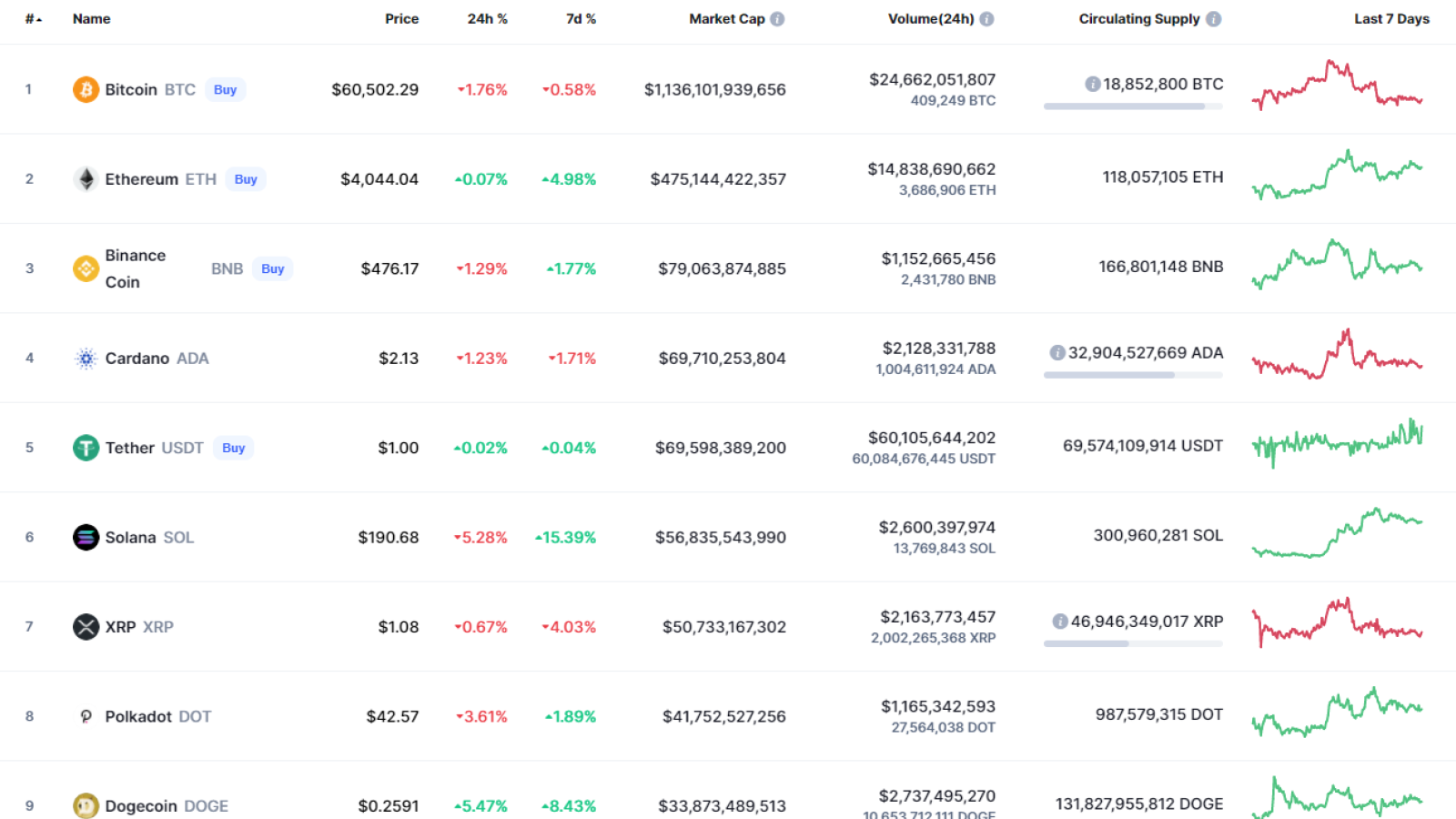

The last day of the week is rather bearish than bullish as only some coins are in the green zone.

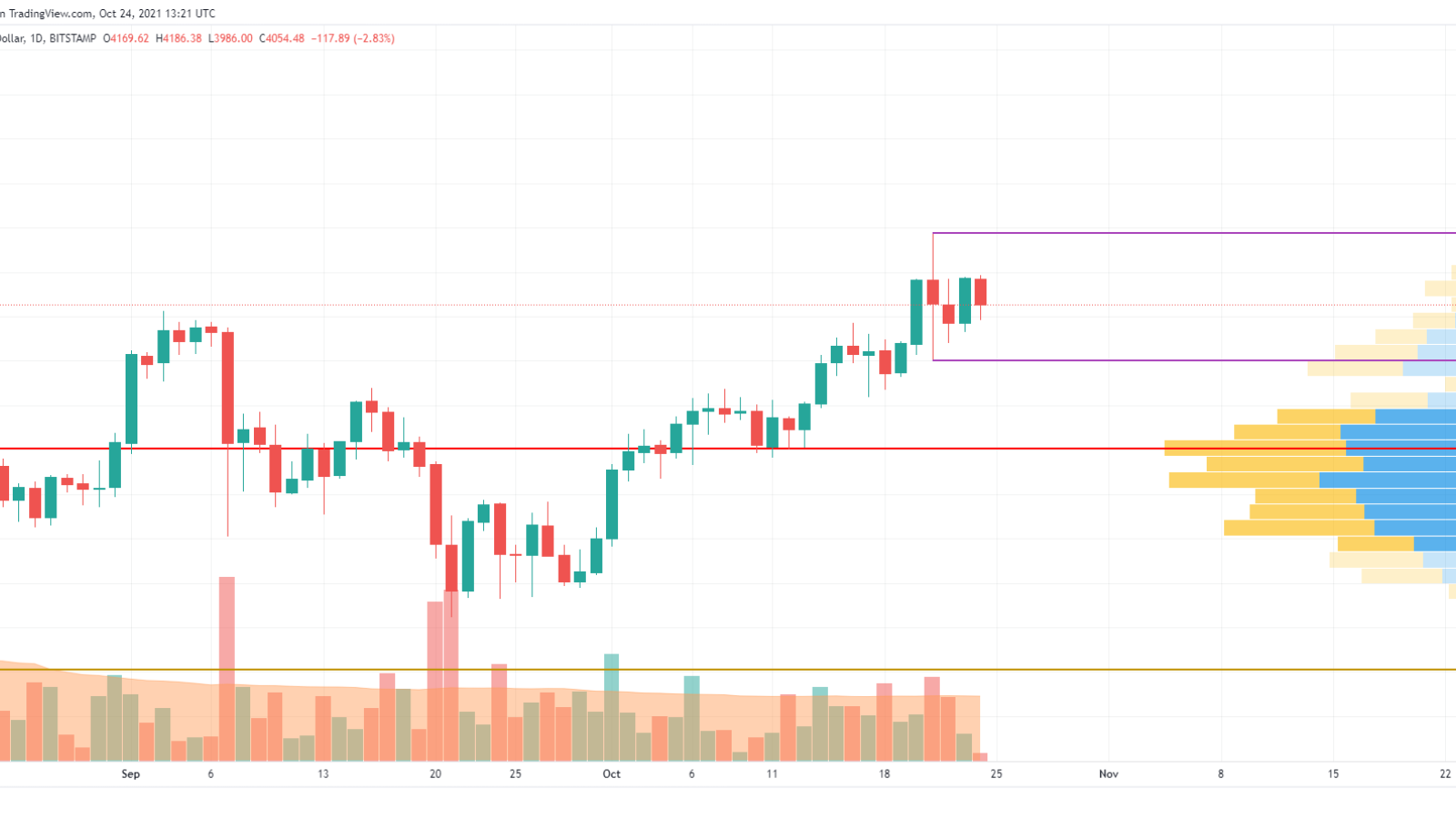

BTC/USD

The price of Bitcoin (BTC) has gone down by 1.76% since yesterday, with a price change over the last week of -0.58%.

Analyzing the weekly chart, Bitcoin (BTC) made a false breakout of the previous peak set in April this year. It shows that bulls have not accumulated enough energy to keep the rise above $67,000.

Bears’ pressure is also confirmed by a high selling trading volume. That is why there is a high probability to expect the test of the recently formed mirror level at $56,650 next week.

Bitcoin is trading at $60,250 at press time.

ETH/USD

Etheruem (ETH) has showed better price performance than Bitcoin (BTC) as the rate of the main altcoin has risen by 4.88%.

Despite the growth, Ethereum (ETH) is located in a wide range between the support at $3,800 and resistance at $4,375. In this case, neither bulls nor bears have seized the initiative so far.

Sideways trading is also confirmed by the low trading volume. Volatility may be low next week as well, as ETH may locate in a range between $4,000 and $4,200.

Ethereum is trading at $4,061 at press time.

XRP/USD

XRP is the main loser from the list as its rate has decreased by 4% over the last week.

XRP is trading similarly to Ethereum (ETH) as it is also located in the wide channel. In this regard, one should not expect any sharp moves next week while the volume remains low. All in all, sideways trading is about to continue between $1.06 and $1.10.

XRP is trading at $1.0877 at press time.