Voyager’s bid reopening process might have this impact on VGX holdings

- As FTX US filed for bankruptcy, Voyager announced the re-commencement of the auction process of its assets

- This caused VGX to rally astronomically in the past 24 hours

Bankrupt crypto lender Voyager [VGX] announced the reopening of the bidding process for its assets on 11 November. The announcement was made after news broke that crypto exchange FTX US had filed for Chapter 11 bankruptcy protection.

Today, after a competitive auction aimed at returning maximum value to customers, @FTX_Official US was selected as the highest and best bidder. Press release linked below. More information about what this agreement means for customers to follow.https://t.co/OmOd7pvSza

— Voyager (@investvoyager) September 27, 2022

Read Voyager [VGX] Price Prediction 2023-2024

Earlier in September, the now-failed FTX US won the auction for the assets of the bankrupt crypto brokerage firm with a bid of around $1.4 billion.

Voyager stated in the new press statement that it had opened “discussions with alternative bidders.” It further confirmed that with the Voyager Official Committee of Unsecured Creditors (UCC), it was,

“Moving with all due care and deliberate speed to identify an alternative plan of reorganization consistent with the core objective throughout this process: maximizing the value returned to customers and other creditors.”

Although FTX US had won the bid for its assets in September, Voyager claimed that it did not transfer any assets to the exchange “in connection with the previously proposed transaction.” It, however, clarified that FTX US submitted the sum of $5 million as a “good faith” deposit as part of the auction process, which was held in escrow.

Also, Voyager said it had no outstanding loans made out to FTX’s sister trading company, Alameda Research.

“Voyager successfully recalled loans from Alameda Research for 6,500 BTC and 50,000 ETH. At this time, Voyager has no loans outstanding with any borrower,” the crypto brokerage firm claimed.

Voyager doing numbers

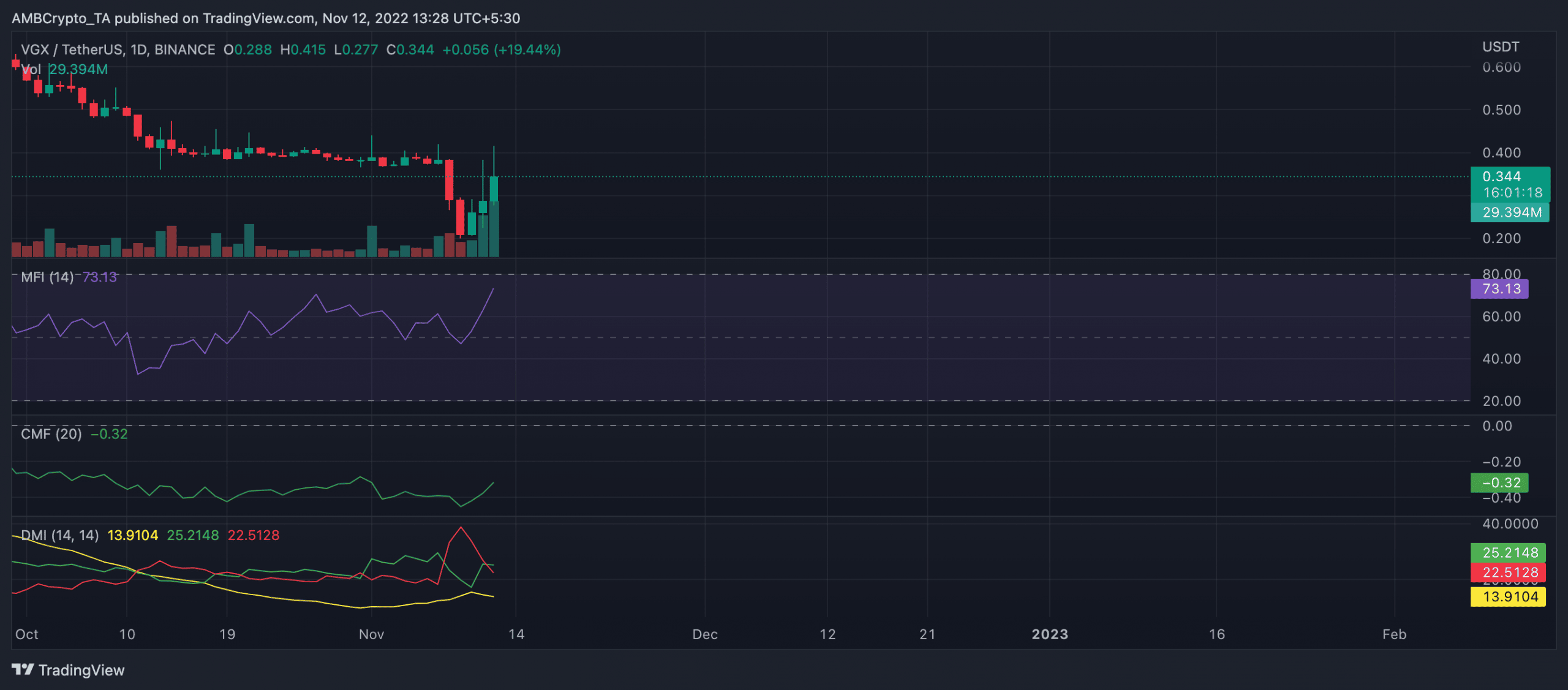

Following Voyager’s confirmation that it had reopened bidding for its asset, VGX’s price rallied. According to data from CoinMarketCap, VGX exchanged hands at $0.329, having gone up by 27% in the last 24 hours. Trading volume was also up by over 500% within the same period.

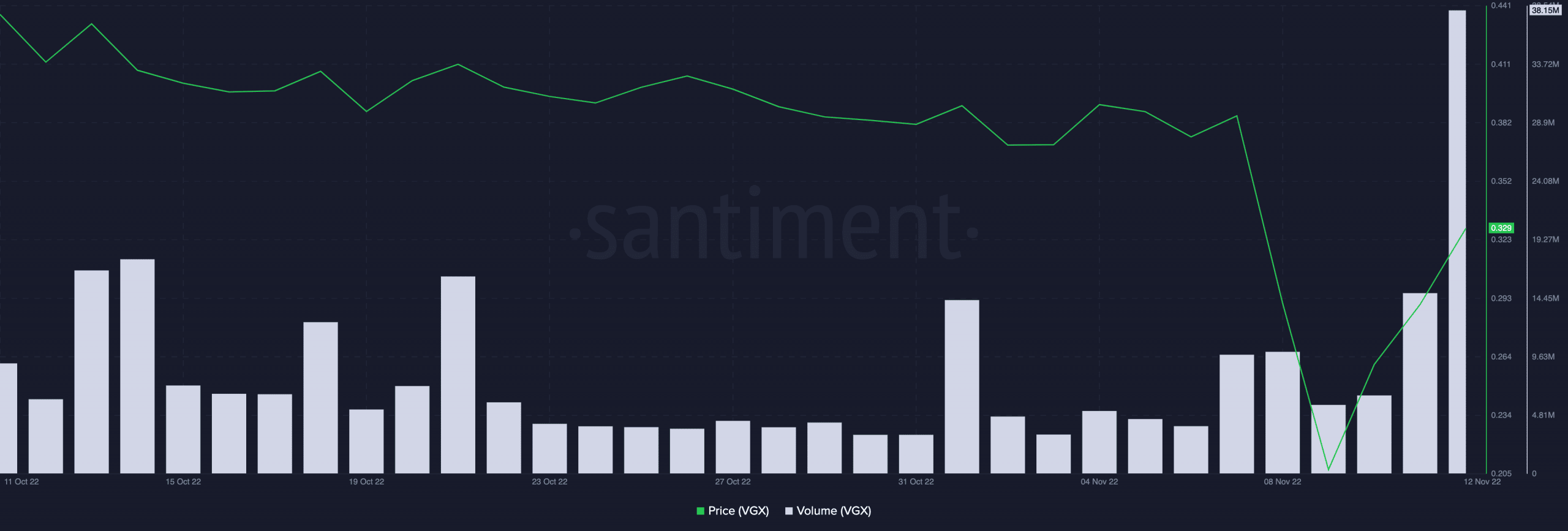

With $38.15 million worth of VGX tokens traded in the last 24 hours, the token logged its highest daily trading volume in the last month, data from Santiment revealed.

The recent surge in VGX’s price put the buyers in control of the market on a daily chart. The position of the asset’s Directional Movement Index (DMI) flipped in the last 24 hours to put the buyers’ strength (green) at 25.21 above the seller’s (red) at 22.51.

Additionally, buying pressure continued to climb at press time. As a result, VGX’s Money Flow Index (MFI) was at a high of 73.

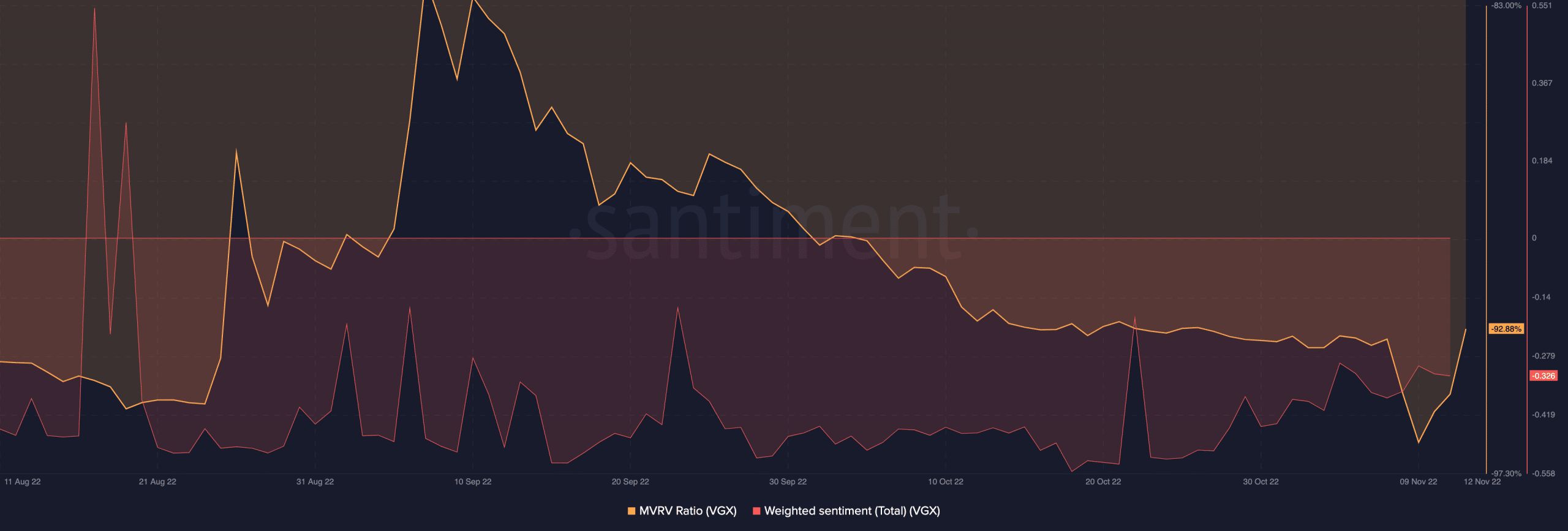

Interestingly, as prices climbed in the last 24 hours, many VGX holders were still at a loss. At press time, its Market Value to Realized Value (MVRV) ratio was 92.88%. Sentiment around VGX remained negative at -0.326.