Here are 4 Altcoins to Watch This Week and Forecasts

Analyst Rakesh Upadhyay says that if Bitcoin breaks above $60,000, altcoin projects AVAX, MATIC, EGLD and MATIC could give strong indications. This is due to the search for ATH observed in selected altcoins, even though BTC is stretching below $60,000. For example, AVAX was appreciated by more than 120% in November and attracted the attention of investors until the announcement made by Deloitte.

There are also news about adoption from El Salvador, where Bitcoin is accepted as the official currency. President Nayib Bukele has announced the launch of the Bitcoin city, which will be powered by geothermal energy and initially financed by $1 billion in Bitcoin bonds. So, can strong buying at the lower levels push Bitcoin above $60,000 and will altcoins join the recovery? Let’s examine the charts of the top 5 cryptocurrencies that may attract the attention of investors in the short term.

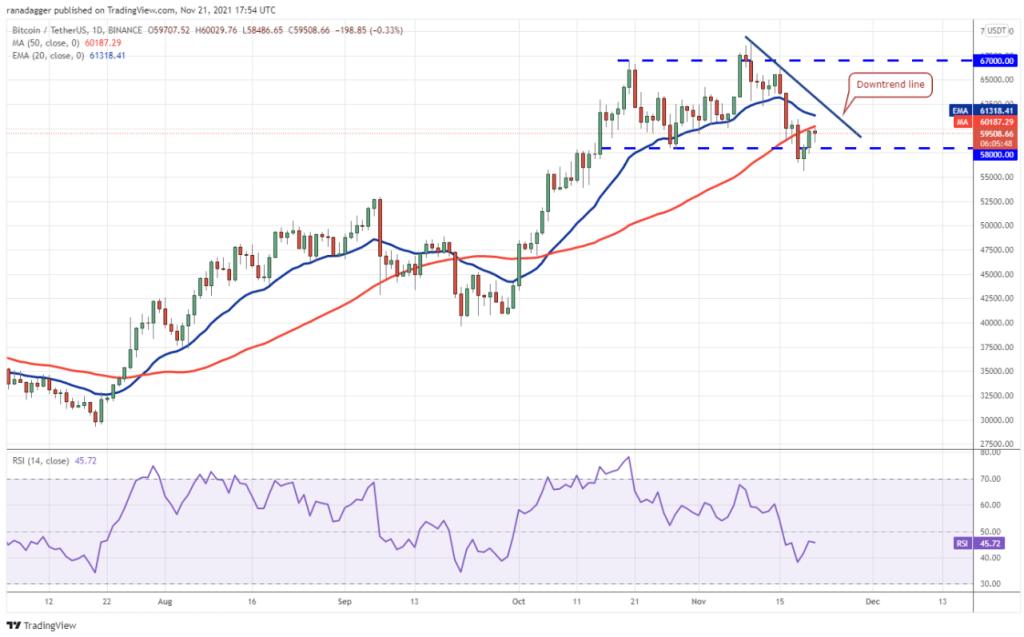

Bitcoin technical analysis

Bitcoin faced the $60,187 resistance with the support it found at $55,600 on November 19. The analyst says the MAs are bearish and the RSI is in the negative area, indicating that the bears are making a strong comeback. If the price declines, the bears’ first target will be to extend the decline below $55,600. Then the next bullish supports are between $52,550 and $50,000. A strong reaction from this zone will start the bulls move to push the price above the MAs and the downtrend line. The bulls could then push the $69,000 ATH.

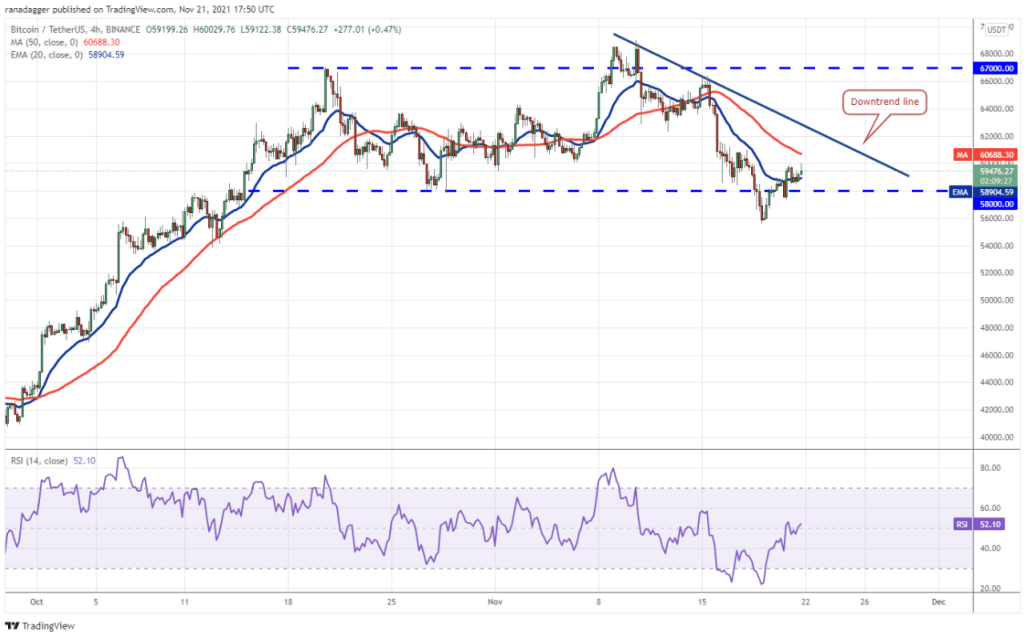

50. A break of the $ 000 support may also result in a breach of the $45,000 and then $40,000 supports. Looking at the 4-hour chart, the analyst says that the bears pulled the price below the strong support below $58,000, but they were unable to develop this advantage. If the price stays above $58,000, the bulls could gain the upper hand. Bitcoin could then rally to $62,000 and then to $67,000. Conversely, if the price declines from the current level and dips below $55,600, it would signal the possible start of a deeper correction.

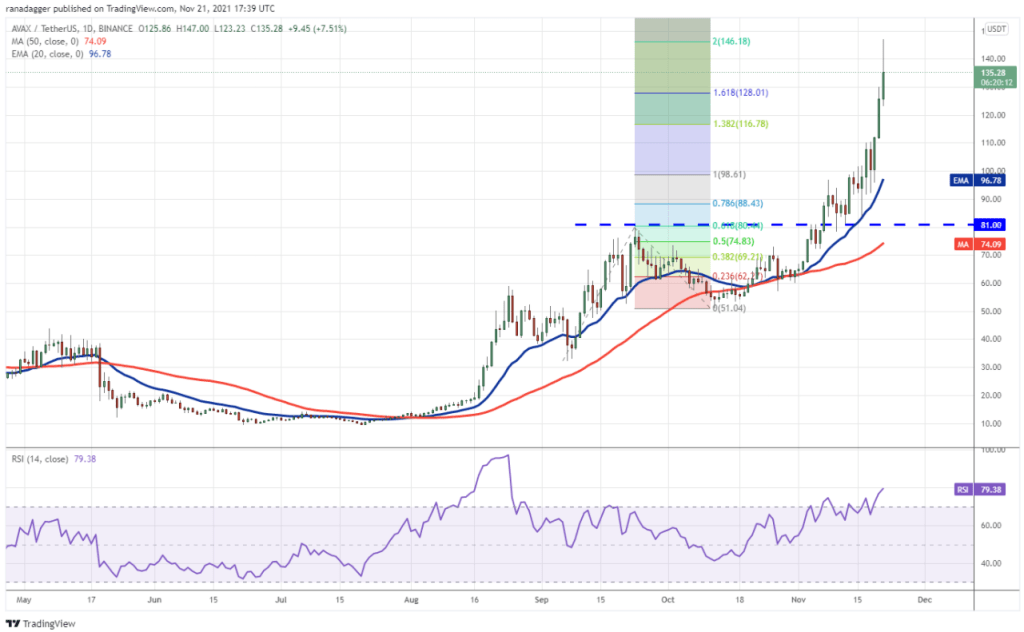

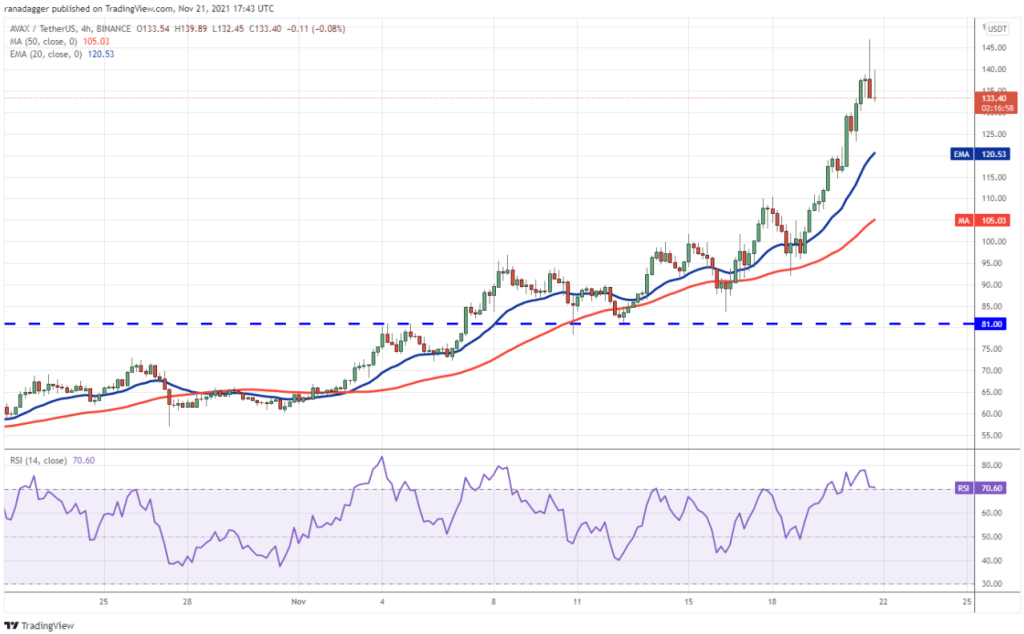

November becomes the month of altcoin project AVAX

Cryptocoin. com, AVAX is in a strong uptrend and has been constantly seeking new highs for the past few days. One of the technical indicators, the RSI is close to 80 and the high 20-day EMA shows that the bulls dominate. According to the analyst, a correction can be expected in the coming days. If the price breaks down from the current levels, the first support will be at $110. Future purchases from this level could lead AVAX to $175.58 later. Contrary to this assumption, if the price drops from $110, the price of AVAX could retreat to $81.

The price of altcoin project AVAX previously reached $147, the ensuing correction indicates aggressive profit booking. The bears may now try to pull the price towards the 20-EMA, which is likely to act as a strong support. If the price bounces back from the 20-day EMA, it will indicate strong buying on the dips. Contrary to this assumption, if the price drops below the 20-day EMA, the sell-off could accelerate and the AVAX could drop to $110.

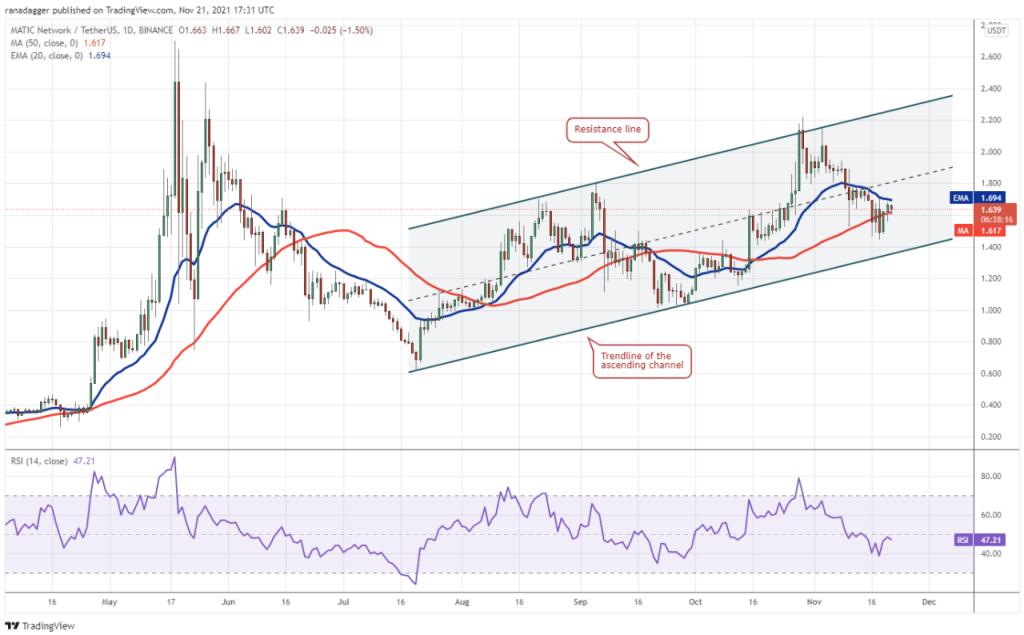

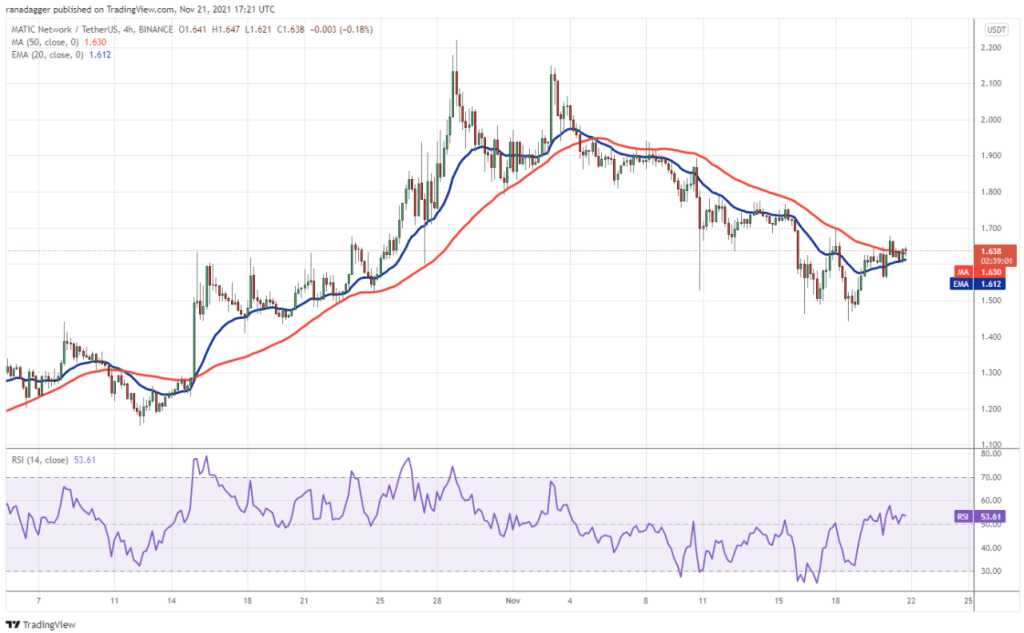

Altcoin MATIC price seeks support in ascending channel

MATIC has been trading inside an ascending channel for the past few days. The bulls pushed the price above the resistance line of the channel on October 28 and 29 but failed to sustain the breakout. If the price drops from the current level, the bears could target the trainline below. The bulls are expected to defend this level aggressively. A reaction from this region may accelerate the price upwards, according to the analyst. Contrary to this assumption, if the bears sink the price below the trendline, it will cause psychological support to drop at $1.

The 4-hour chart shows that the bulls are attempting to organize a relief rally from the strong support zone between $1.50 and $1.40. If the bulls propel the price above $1.70, the price could start an upward move towards $1.80 and then $2.15. On the downside, selling could accelerate if the bears pull the price below $1.40.

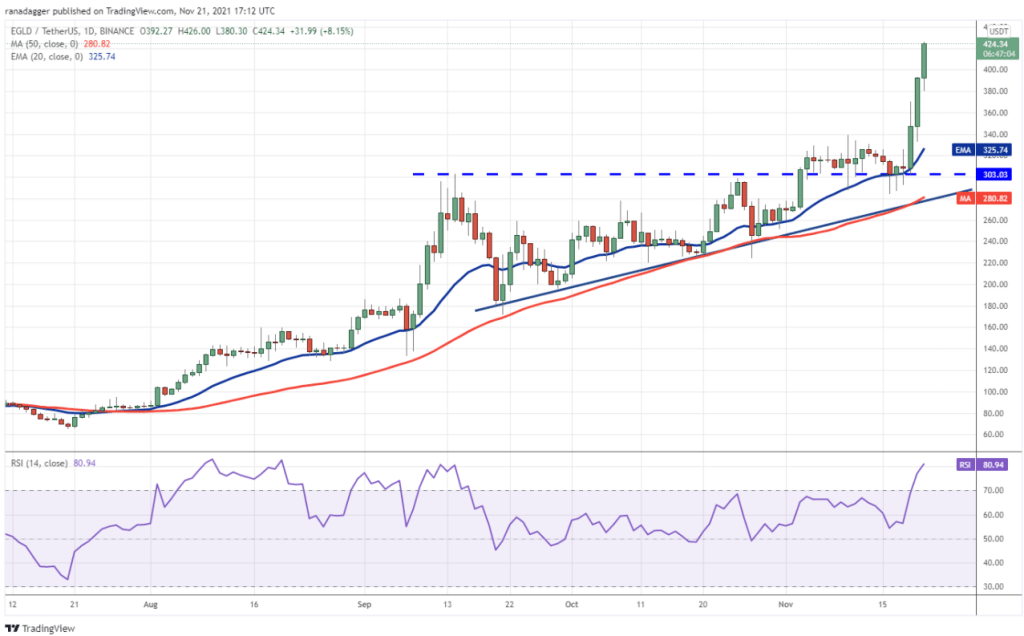

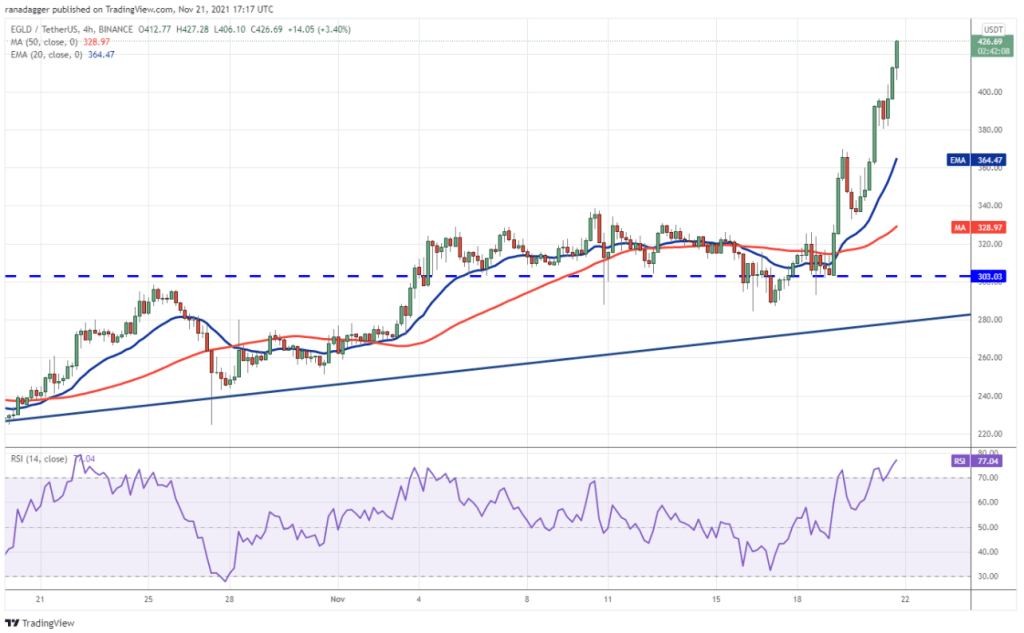

Let’s take a look at ELGD

The bears tried to push EGLD below the $303.03 breakout level from November 16 to November 18, but the bulls continued to buy on the dips as seen from its chart. This restarted the uptrend and it approached the $427 target. Initial support on the downside is at $338.70 and $325. The bulls will then try to continue the uptrend with the next target target at $500. This positive view will be invalidated if the price declines and breaks below the $303 breakout level.

The 4-hour chart shows that the bears are trying to stop the upside move at $400, but the bulls are not in the mood to give up. The first important level to watch on the downside is $380. Next, the 20-day EMA should be noted.

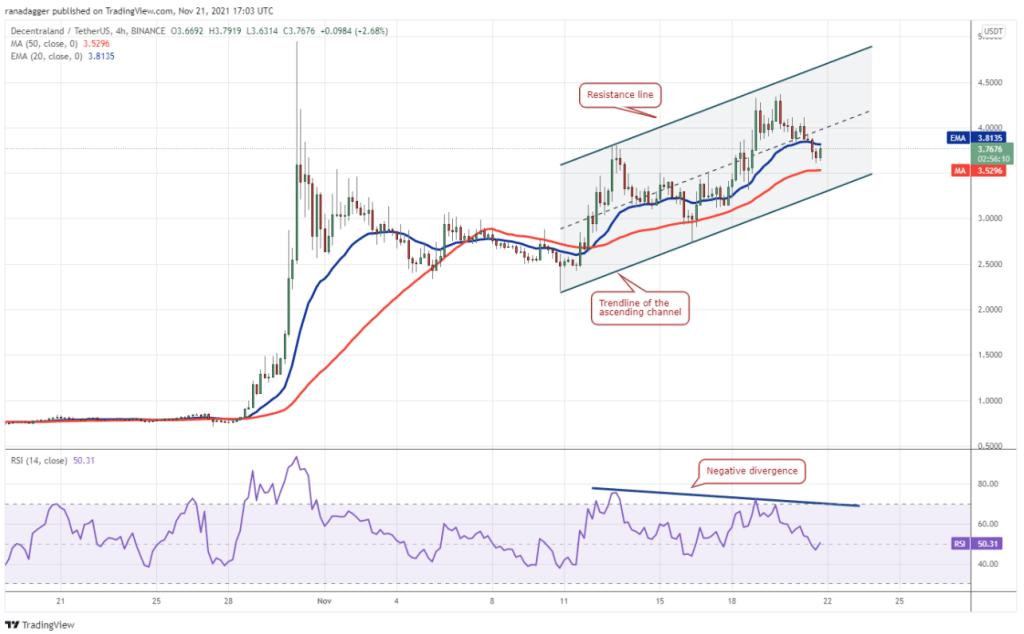

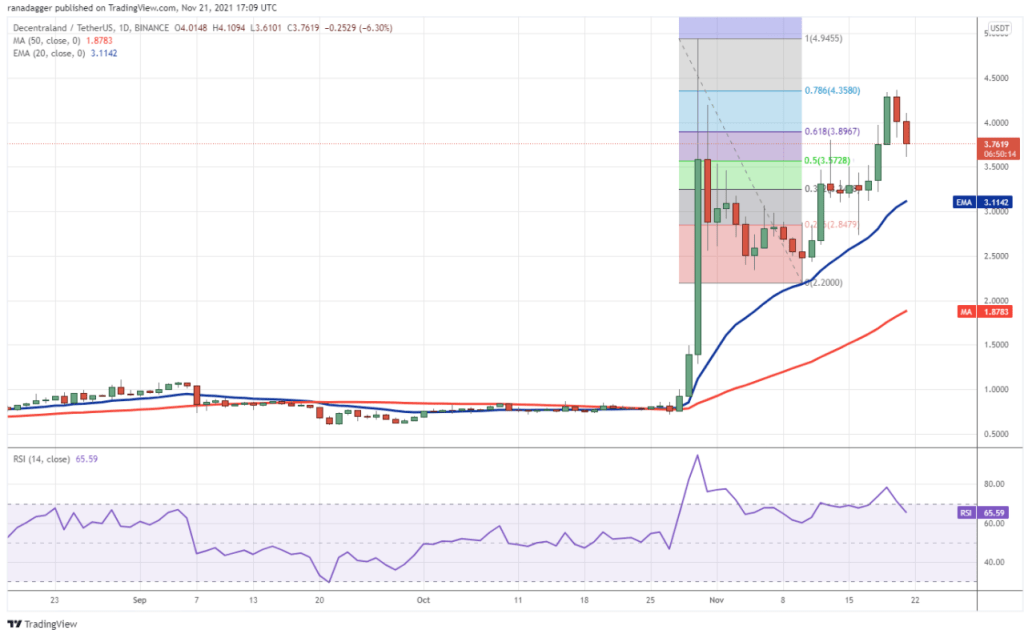

Decentraland (MANA)

Decentraland (MANA), 78% as of November 20. It dropped from the 6 Fibonacci retracement level to $4.35. It can now decline to the $3.50 support and if it continues, the decline could deepen to $3.11. If the price rebounds from both supports, it will indicate that the sentiment is positive and traders are buying on the dips. The bulls could target $4.36 followed by $4.94 later. This positive view will be invalidated if the price continues to decline and falls below the 20-day EMA.

MANA is also rising within an ascending channel. On the technical side, the MAs have flattened out and the RSI has dropped near the midpoint, suggesting that the bullish momentum may weaken. If the price breaks out of the trendline, the MANA price may continue its upward movement within the channel. Buyers will then try to push the price to the resistance line.