Fixing Broken Fiat Plumbing – Bitcoin Magazine

This is an opinion editorial by Dan, cohost of the Blue Collar Bitcoin Podcast.

A preliminary note to the reader: This was originally written as one essay that has since been divided into three parts for publication. Each section covers distinctive concepts, but the overarching thesis relies on the three sections in totality. Much of this piece assumes the reader possesses a basic understanding of Bitcoin and macroeconomics. For those who don’t, items are linked to corresponding definitions/resources. An attempt is made throughout to bring ideas back to the surface; if a section isn’t clicking, keep reading to arrive at summative statements. Lastly, the focus is on the U.S. economic predicament; however, many of the themes included here still apply internationally.

Series Contents

Part 1: Fiat Plumbing

Introduction

Busted Pipes

The Reserve Currency Complication

The Cantillon Conundrum

Part 2: The Purchasing Power Preserver

Part 3: Monetary Decomplexification

The Financial Simplifier

The Debt Disincentivizer

A “Crypto” Caution

Conclusion

Part 1: Fiat Plumbing

Introduction

When Bitcoin is brought up at the firehouse, it’s often met with cursory laughs, looks of confusion or blank stares of disinterest. Despite tremendous volatility, bitcoin is the best-performing asset of the last decade, yet most of society still considers it trivial and transient. These inclinations are insidiously ironic, particularly for members of the middle class. In my view, bitcoin is the very tool average wage earners need most to stay afloat amidst an economic environment that is particularly inhospitable to their demographic.

In today’s world of fiat money, massive debt and prevalent currency debasement, the hamster wheel is speeding up for the average individual. Salaries rise year over year, yet the typical wage earner often stands there dumbfounded, wondering why it feels harder to get ahead or even make ends meet. Most people, including the less financially literate, sense something is dysfunctional in the 21st century economy — stimulus money that magically appears in your checking account; talk of trillion dollar coins; stock portfolios reaching all-time highs amidst a backdrop of global economic shutdown; housing prices up by double-digit percentages in a single year; meme stocks going parabolic; useless cryptocurrency tokens that balloon into the stratosphere and then implode; violent crashes and meteoric recoveries. Even if most can’t put a finger on exactly what the issue is, something doesn’t feel quite right.

The global economy is structurally broken, driven by a methodology that has resulted in dysfunctional debt levels and an unprecedented degree of systemic fragility. Something is going to snap, and there will be winners and losers. It’s my contention that the economic realities that confront us today, as well as those that may befall us in the future, are disproportionately harmful to the middle and lower classes. The world is in desperate need of sound money, and as unlikely as it may seem, a batch of concise, open-source code released to members of an obscure mailing list in 2009 has the potential to repair today’s increasingly wayward and inequitable economic mechanics. It’s my intention in this essay to explain why bitcoin is one of the primary tools the middle class can wield to avoid current and forthcoming economic disrepair.

Busted Pipes

Our current monetary system is fundamentally flawed. This is not the fault of any particular person; rather, it’s the result of a decades-long series of defective incentives leading to a brittle system, stretched to its limits. In 1971 following the Nixon Shock and the suspension of dollar convertibility into gold, mankind embarked on a novel pseudo-capitalist experiment: centrally-controlled fiat currencies with no sound peg or reliable reference point. A thorough exploration of monetary history is beyond the scope of this piece, but the important takeaway, and the opinion of the author, is that this transition has been a net negative to the working class.

Without a sound base layer metric of value, our global monetary system has become inherently and increasingly fragile. Fragility mandates intervention, and intervention has repeatedly demonstrated a propensity to exacerbate economic imbalance in the long run. Those who sit behind the levers of monetary power are frequently demonized — memes of Jerome Powell cranking a money printer and Janet Yellen with a clown nose are commonplace on social media. As amusing as such memes may be, they are oversimplifications that often indicate misunderstandings regarding how the plumbing of an economic machine built disproportionately on credit1 actually functions. I’m not saying these policymakers are saints, but it’s also unlikely they are malevolent morons. They are plausibly doing what they deem “best” for humanity given the unstable scaffolding they are perched on.

To zero in on one key example, let’s look at the Global Financial Crisis (GFC) of 2007-2009. The U.S Department of the Treasury and the Federal Reserve Board are often maligned for bailing out banks and acquiring unprecedented amounts of assets during the GFC, via programs like Troubled Asset Relief and monetary policies like quantitative easing (QE), but let’s put ourselves in their shoes for a moment. Few grasp what the short and midterm implications would have been had the credit crunch cascaded further downhill. The powers in place did initially spectate the collapse of Bear Stearns and the bankruptcy of Lehman Brothers, two massive and integrally involved financial players. Lehman, for example, was the fourth-largest investment bank in the U.S. with 25,000 employees and close to $700 billion in assets. But what if the collapse had continued, contagion had spread further, and dominoes the likes of Wells Fargo, CitiBank, Goldman Sachs or J.P. Morgan had subsequently imploded? “They would have learned their lesson,” some say, and that’s true. But that “lesson” may have been accompanied by a huge percentage of citizens’ savings, investments and retirement nest eggs wiped out; credit cards out of service; empty grocery stores; and I don’t feel it extreme to suggest potentially widespread societal breakdown and disorder.

Please don’t misunderstand me here. I am not a proponent of inordinate monetary and fiscal interventions — quite the contrary. In my view, the policies initiated during the Global Financial Crisis, as well as those carried out in the decade and a half to follow, have contributed significantly to the fragile and volatile economic conditions of today. When we contrast the events of 2007-2009 with the eventual economic fallouts of the future, hindsight may show us that biting the bullet during the GFC would have indeed been the best course of action. A strong case can be made that short-term pain would have led to long-term gain.

I highlight the example above to demonstrate why interventions occur, and why they will continue to occur within a debt-based fiat monetary system run by elected and appointed officials inextricably bound to short-term needs and incentives. Money is a base layer of human language — it is arguably mankind’s most important tool of cooperation. The monetary tools of the 21st century have worn down; they malfunction and require ceaseless maintenance. Central banks and treasuries bailing out financial institutions, managing interest rates, monetizing debt and inserting liquidity when prudent are attempts to keep the world from potential devastation. Centrally-controlled money tempts policymakers to paper over short-term problems and kick the can down the road. But as a result, economic systems are inhibited from self-correcting, and in turn, debt levels are encouraged to remain elevated and/or expand. With this in mind, it’s no wonder that indebtedness — both public and private — is at or near a species-level high and today’s financial system is as reliant on credit as any point in modern history. When debt levels are engorged, credit risk has the potential to cascade and severe deleveraging events (depressions) loom large. As credit cascades and contagion enters overly-indebted markets unabated, history shows us the world can get ugly. This is what policymakers are attempting to avoid. A manipulatable fiat structure enables money, credit and liquidity creation as a tactic to try and avoid uncomfortable economic unwinds — a capability that I will seek to demonstrate is a net negative over time.

When a pipe bursts in a deteriorating home, does the owner have time to gut every wall and replace the whole system? Hell no. They call an emergency plumbing service to repair that section, stop the leak, and keep the water flowing. The plumbing of today’s increasingly fragile financial system mandates constant maintenance and repair. Why? Because it’s poorly constructed. A fiat monetary system built primarily on debt, with both the supply and price2 of money heavily influenced by elected and appointed officials, is a recipe for eventual disarray. This is what we are experiencing today, and it’s my assertion that this setup has grown increasingly inequitable. By way of analogy, if we characterize today’s economy as a “home” for market participants, this house is not equally hospitable to all residents. Some reside in newly-remodeled master bedrooms on the third floor, while others are left in the basement crawl space, vulnerable to ongoing leakage as a result of inadequate financial plumbing — this is where many members of the middle and lower classes reside. The current system places this demographic at a perpetual disadvantage, and these basement dwellers are taking on more and more water with each passing decade. To substantiate this claim, we’ll begin with the “what” and work our way to the “why.”

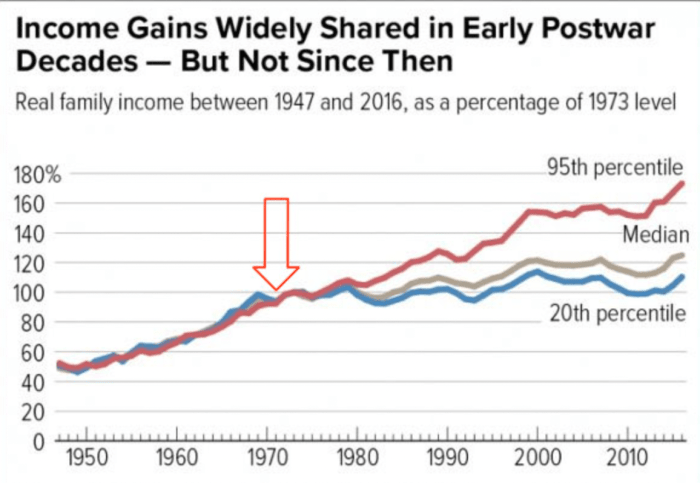

Consider the widening wealth gap in the United States. As the charts below help to enumerate, it seems evident that since our move toward a purely fiat system, the rich have gotten richer and the rest have stayed stagnant.

Chart Source: WTFHappenedIn1971.com

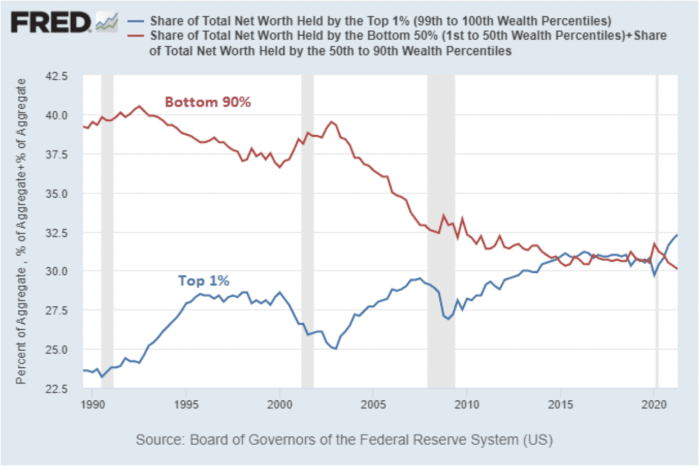

Chart Source: “Does QE Cause Wealth Inequality” by Lyn Alden

The factors contributing to the wealth inequality are undeniably multifaceted and complex, but it’s my suggestion that the architecture of our fiat monetary system, as well as the increasingly rampant monetary and fiscal policies it enables, have contributed to broad financial instability and inequality. Let’s look at a couple examples of imbalances resulting from centrally-controlled government money, ones that are particularly applicable to the middle and lower classes.

The Reserve Currency Complication

The U.S. dollar sits at the base of the 21st century fiat monetary system as the global reserve currency. The march toward dollar hegemony as we know it today has taken place incrementally over the last century, with key developments along the way including the Bretton Woods Agreement post-WWII, the severance of the dollar from gold in 1971, and the advent of the petrodollar in the mid-1970s, all of which helped move the monetary base layer away from more internationally neutral assets — such as gold — toward more centrally-controlled assets, namely government debt. United States liabilities are now the foundation of today’s global economic machine3; U.S. Treasurys are today’s reserve asset of choice internationally. Reserve currency status has its benefits and trade-offs, but in particular, it seems this arrangement has had negative impacts on the livelihood and competitiveness of U.S. industry and manufacturing — the American working class. Here is the logical progression that leads me (and many others) to this conclusion:

- A reserve currency (the U.S. dollar in this case) remains in comparatively constant high demand since all global economic players need dollars to participate in international markets. One could say a reserve currency remains perpetually expensive.

- This indefinitely and artificially elevated exchange rate means the buying power for citizens in a country with reserve currency status stays comparatively strong, while the selling power stays comparatively diminished. Hence, imports grow and exports fall, causing persistent trade deficits (this is known as the Triffin dilemma).

- As a result, domestic manufacturing becomes relatively expensive while international alternatives become cheap, which leads to an offshoring and hollowing out of the labor force — the working class.

- All the while, those benefiting most from this reserve status are the ones playing part in an increasingly engorged financial sector and/or involved in white-collar industries like the tech sector that benefit from diminished production costs as a result of cheap offshore manufacturing and labor.

The reserve currency dilemma highlighted above leads to exorbitant privilege for some and inordinate misfortune for others.4 And let’s once again go back to the root of the issue: unsound and centrally-controlled fiat money. The existence of reserve fiat currencies at the base of our global financial system is a direct consequence of the world moving away from more sound, internationally neutral forms of value denomination.

The Cantillon Conundrum

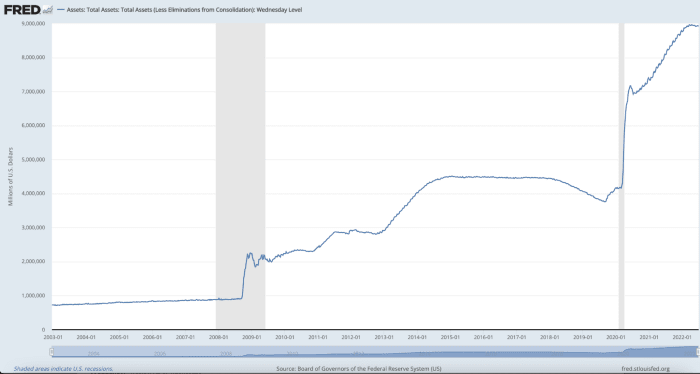

Fiat money also sows the seeds of economic instability and inequality by actuating monetary and fiscal policy interventions, or as I’ll refer to them here, monetary manipulations. Money that is centrally controlled can be centrally manipulated, and although these manipulations are enacted to keep the brittle economic machine churning (like we talked about above during the GFC), they come with consequences. When central banks and central governments spend money they don’t have and insert liquidy whenever they deem it necessary, distortions occur. We get a glimpse at the sheer magnitude of recent centralized monetary manipulation by glancing at the Federal Reserve’s balance sheet. It’s gone bananas in recent decades, with less than $1 trillion on the books pre-2008 yet fast approaching $9 trillion today.

Chart Source: St. Louis Fed

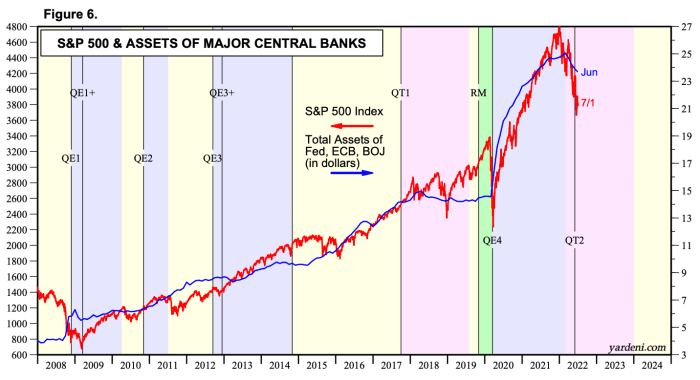

The Fed’s ballooning balance sheet shown above includes assets like Treasury securities and mortgage-backed securities. A large portion of these assets were acquired with money (or reserves) created out of thin air through a form of monetary policy known as quantitative easing (QE). The effects of this monetary fabrication are hotly debated in economic circles, and rightfully so. Admittedly, depictions of QE as “money printing” are shortcuts that disregard the nuance and complexity of these nifty tactics<FN5>; nonetheless, these descriptions may in many regards be directionally accurate. What’s clear is that this massive amount of “demand” and liquidity coming from central banks and governments has had a profound effect on our financial system; in particular, it seems to boost asset prices. Correlation doesn’t always mean causation, but it gives us a place to start. Check out this chart below, which trends the stock market — in this case the S&P 500 — with the balance sheets of major central banks:

Chart Source: Yardini Research, Incundefined(credit to Preston Pysh for pointing this chart out in his tweet).

Whether it’s heightening the upside or limiting the downside, expansionary monetary policies seem to cushion elevated asset values. It may appear counterintuitive to highlight asset price inflation during a significant market crash — at time of writing the S&P 500 is down close to 20% from an all-time high, and the Fed looks slower to step in due to inflationary pressures. Nevertheless, there still remains a point at which policymakers have rescued — and will continue to rescue — markets and/or pivotal financial institutions undergoing intolerable distress. True price discovery is constrained to the downside. Chartered Financial Analyst and former hedge fund manager James Lavish spells this out well:

“When the Fed lowers interest rates, buys U.S. Treasurys at high prices, and lends money indefinitely to banks, this injects a certain amount of liquidity into the markets and helps shore up the prices of all the assets that have sharply sold off. The Fed has, in effect, provided the markets with downside protection, or a put to the owners of the assets. Problem is, the Fed has stepped in so many times recently, that markets have come to expect them to act as a financial backstop, helping prevent an asset price meltdown or even natural losses for investors.”6

Anecdotal evidence suggests that supporting, backstopping, and/or bailing out key financial players keeps asset prices artificially stable and, in many environments, soaring. This is a manifestation of the Cantillon Effect, the idea that the centralized and uneven expansion of money and liquidity benefits those closest to the money spigot. Erik Yakes describes this dynamic succinctly in his book “The 7th Property”:

“Those who are furthest removed from interaction with financial institutions end up worst off. This group is typically the poorest in society. Thus, the ultimate impact on society is a wealth transfer to the wealthy. Poor people become poorer, while the wealthy get wealthier, resulting in the crippling or destruction of the middle class.”

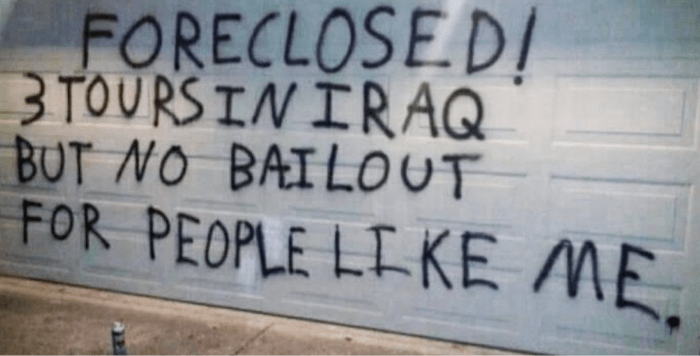

When money is fabricated out of thin air, it’s prone to bolster asset valuations; therefore, the holders of those assets benefit. And who holds the largest quantity and highest quality of assets? The wealthy. Monetary manipulation tactics seem to cut primarily one way. Let’s again consider the GFC. A popular narrative that I believe is at least partially correct depicts average wage earners and homeowners as largely left to fend for themselves in 2008 — foreclosures and job losses were plentiful; meanwhile, insolvent financial institutions were enabled to march on and eventually recover.

Image Source: Tweet from Lawrence Lepard

If we fast-forward to the COVID-19 fiscal and monetary responses, I can hear counterarguments stemming from the notion that stimulus money was widely distributed from the bottom up. This is partially true, but consider that $1.8 trillion went to individuals and families in the form of stimulus checks, while the chart above reveals that the Fed’s balance sheet has expanded by roughly $5 trillion since the start of the pandemic. Much of this difference entered the system elsewhere, assisting banks, financial institutions, businesses, and mortgages. This has, at least partially, contributed to asset price inflation. If you are an asset holder, you can see evidence of this in recalling that your portfolio and/or home valuations were likely at all-time highs amidst one of the most economically damaging environments in recent history: a pandemic with globally-mandated shutdowns.7

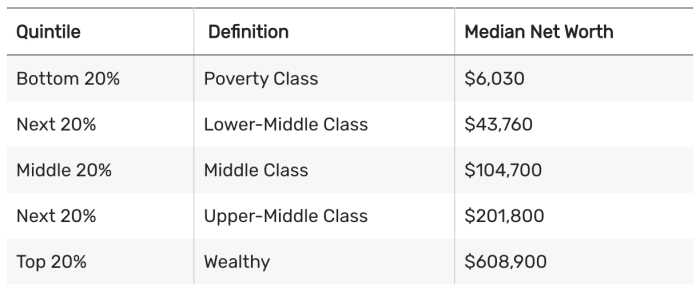

In fairness, many members of the middle class are asset holders themselves, and a good portion of the Fed’s balance sheet expansion went to buying mortgage bonds, which helped lower the cost of mortgages for all. But let’s consider that in America, the median net worth is just $122,000, and as the chart below catalogs, this number plummets as we move down the wealth spectrum.

Chart Source: TheBalance.com

Furthermore, nearly 35% of the population doesn’t own a home, and let’s also discern that the type of real estate owned is a key distinction — the wealthier people are, the more valuable their real estate and correlated appreciation becomes. Asset inflation disproportionately benefits those with more wealth, and as we’ve explored in Part 1, wealth concentration has grown more and more pronounced in recent years and decades. Macroeconomist Lyn Alden elaborates on this concept:

“Asset price inflation often happens during periods of high wealth concentration and low interest rates. If a lot of new money is created, but that money gets concentrated in the upper echelons of society for one reason or another, then that money can’t really affect consumer prices too much but instead can lead to speculation and overpriced buying of financial assets. Due to tax policies, automation, offshoring, and other factors, wealth has concentrated towards the top in the U.S. in recent decades. People in the bottom 90% of the income spectrum used to have about 40% of US household net worth in 1990, but more recently it’s down to 30%. The top 10% folks saw their share of wealth climb from 60% to 70% during that time. When broad money goes up a lot but gets rather concentrated, then the link between broad money growth and CPI growth can weaken, while the link between broad money growth and asset price growth intensifies.”8

As a whole, artificially inflated asset prices are maintaining or increasing the purchasing power of the wealthy, while leaving the middle and lower classes stagnant or in decline. This also holds true for members of younger generations who have no nest egg and are working to get their financial feet underneath them. Although WILDLY imperfect (and many would suggest detrimental), it’s understandable why more and more people are clamoring for things like universal basic income (UBI). Handouts and redistributive economic approaches are increasingly popular for a reason. Poignant examples do exist where the rich and powerful were advantaged above the average Joe. Preston Pysh, cofounder of The Investor’s Podcast Network, has described certain expansionary monetary policies as “universal basic income for the rich.”9 In my view, it’s ironic that many of those privileged to have benefited most dramatically from the current system are also those who advocate for less and less government involvement. These individuals fail to recognize that existing central bank interventions are a major contributing factor to their bloated wealth in the form of assets. Many are blind to the fact that they are the ones suckling from the largest government teat in the world today: the fiat money creator. I am certainly not an advocate for rampant handouts or suffocating redistribution, but if we want to preserve and grow a robust and functional form of capitalism, it must enable equal opportunity and fair value accrual. This seems to be breaking down as the world’s monetary base layer becomes more unsound. It’s quite clear that the current setup is not distributing milk evenly, which begs the question: do we need a new cow?

Overarchingly, I believe many average folks are encumbered by 21st century economic architecture. We need an upgrade, a system that can be concurrently antifragile and equitable. The bad news is that within the existing setup, the trends I’ve outlined above show no signs of abatement, in fact they are bound to worsen. The good news is that the incumbent system is being challenged by a bright orange newcomer. In the remainder of this essay we will unpack why and how Bitcoin functions as a financial equalizer. For those stuck in the proverbial economic basement, dealing with the cold and wet consequences of deteriorating financial plumbing, Bitcoin provides several key remedies to current fiat malfunctions. We’ll explore these remedies in Part 2 and Part 3.

1. The words “credit” and “debt” both pertain to owing money — debt is money owed; credit is the money borrowed that can be spent.

2. The price of money being interest rates

3. For more on how this works, I recommend Nik Bhatia’s book “Layered Money.”

4. A disclaimer may be in order here: I am not anti-globalization, pro-tariff, or isolationist in my economic viewpoint. Rather, I seek to outline an example of how a monetary system built heavily on top of the sovereign debt of a single nation can lead to imbalances.

5. If you are interested in exploring the nuance and complexity of Quantitative Easing, Lyn Alden’s essay “Banks, QE, And Money-Printing” is my recommended starting point.

6. From “What Exactly Is The ‘Fed Put’, And (When) Can We Expect to See It Again?” by James Lavish, part of his newsletter The Informationist.

7. Yes, I admit some of this was the result of stimulus money being invested.

8. From “The Ultimate Guide To Inflation” by Lyn Alden

9. Preston Pysh made this comment during a Twitter Spaces, which is now available via this Bitcoin Magazine Podcast.

This is a guest post by Dan. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.