Charlie Munger Doesn’t Believe In Bitcoin, But You Should

Eoneren/iStock via Getty Images

I give a buy rating to Bitcoin (BTC-USD) as an excellent way to diversify a portfolio. In particular, Bitcoin is not for everyone and is not for investors who want very low-risk portfolios.

What Did Charlie Munger Say?

Charlie Munger was quoted on February 16th saying:

I hate the Bitcoin success … I don’t welcome a currency that’s so useful to kidnappers and extortionists and so forth, nor do I like just shuffling out of your extra billions of billions of dollars to somebody who just invented a new financial product out of thin air… I think I should say modestly that the whole damn development is disgusting and contrary to the interests of civilization… It’s really kind of an artificial substitute for gold. And since I never buy any gold, I never buy any Bitcoin

There is a lot in that quote so let’s dive into it. Charlie Munger does not like Bitcoin. One of the reasons he gives is he dislikes it for its ability to be used in kidnapping and extortion, which is a valid point. Bitcoin is almost entirely untraceable and, as a result, is used by many criminals, but the same argument could be made about cash. The second point is that a new financial product was made out of thin air. This is true, in a sense. It was created from nothing but now has comprehensive documentation, a large following, a massive computer network behind it, and a long adoption period that we are only at the beginning of. I believe his third point about Bitcoin being contrary to the interest of the civilization is because of Bitcoin’s speculative nature. Unlike a stock that represents part of a tangible company where value can easily be derived from the money it makes, Bitcoin has nothing behind it. Its value is based on its scarcity and the blockchain and decentralized technology. His final point is a continuation of this if he does not invest in Gold, why would he invest in the “new gold”? I agree that this investment is not for him. Still, for many people looking at investing in Gold or diversifying their portfolio, Bitcoin is an attractive investment to consider.

Historical Returns

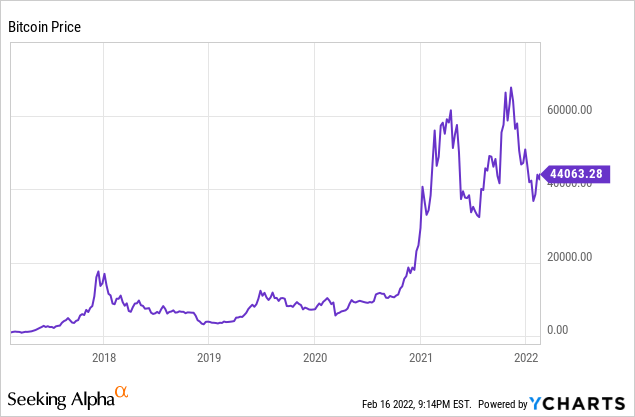

4,320% returns over the previous five years, chart below:

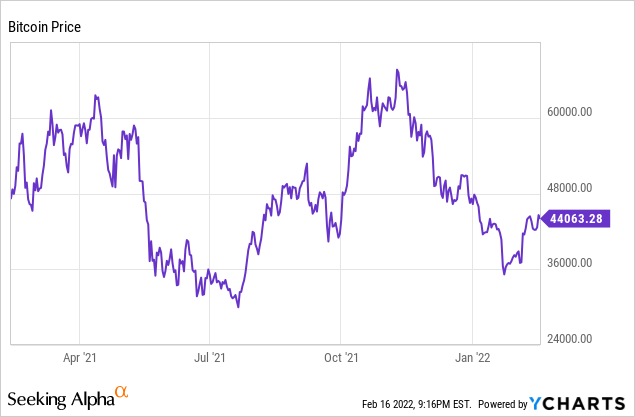

-7% returns over the previous year, chart below:

One thing Bitcoin is known for, besides the massive returns that have been made, is the even more significant volatility. The enormous price swings that occur across days or even months can be seen in the charts above. Volatility is scary to many investors, and it should be. Something that moves so much is not very stable. However, volatility can be used to an investor’s advantage if they buy when it falls.

Most importantly, the chart for Bitcoin over the past ten years is a consistent rise. While there are large swings, the general trend remains upwards. For this reason, we can reasonably expect that Bitcoin has the potential to continue its upward momentum, especially when you consider its small market cap of under one trillion dollars. Considering that mass adoption has not happened and that corporations and financial institutions are only just starting to implement Bitcoin, there is still potential for significant returns in Bitcoin.

What a Small Allocation of Bitcoin Can do for Your Portfolio

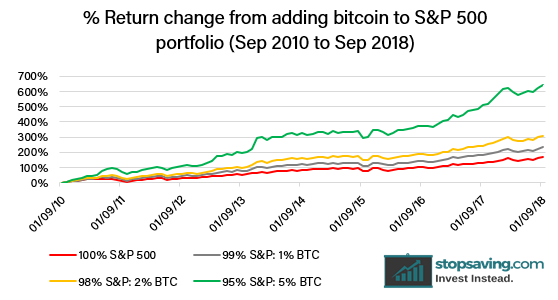

StopSaving

You should consider buying bitcoin because even a tiny allocation could increase yearly returns. I find the above photo to be incredible. By adding just a 5% stake in Bitcoin to a portfolio of the S&P 500, annual returns are noticeably much larger. Bitcoin can be a small portion of someone’s portfolio and give them some more diversification and the ability for increased growth. Bitcoin is an arbitrary bet, and five percent of a portfolio is a small portion to risk. The maximum downside is losing the initial five percent investment. If the previous five years repeat themselves, the maximum upside is 216% percent of the original portfolio – for a 1% allocation, 43.2% of the initial portfolio value was added. This potential gain dramatically outweighs the slight five percent maximum loss, and for this reason, it is a wise investment.

Other Reasons to Buy Bitcoin

Another reason you should buy Bitcoin is that it is decentralized. Because no government controls or regulates Bitcoin, the coin will not be affected by poor monetary policy that leads to high inflation and is not restricted by a border. Bitcoin can easily be spread to anyone, anywhere in the world, relatively anonymously. While not likely, this fact could become very important to an investor if a government starts to experience continuous periods of high inflation or economic instability.

Finally, you should invest in Bitcoin instead of another cryptocurrency because it has the first movers advantage. Bitcoin is the most well-known coin, has the largest market cap, and has the highest ownership of any cryptocurrency. While Bitcoin will most definitely not have the best yearly returns of a cryptocurrency, it is the most likely to continue to be a significant player in the space because of its massive name recognition from its first mover’s advantage. Additionally, the larger size of Bitcoin and higher amount of owners increases the liquidity when the coin is traded and helps provide stability to an already incredibly volatile asset in a super volatile asset class.

Risk

Bitcoin is highly volatile, and investors can see themselves lose huge percentages in a day and even larger percentages over months and years. An investment in Bitcoin is speculative and should be treated as such.

Conclusion

Bitcoin has historically provided excellent returns to investors. While it is not a sure thing, an investment in Bitcoin diversifies an investor into the cryptocurrency asset class. Bitcoin is best complemented by an investment portfolio, not as an investment portfolio itself.