Trump’s 3-Point Rate Cut Could Trigger Biggest Crypto Bull Run

Wall Street is increasingly betting on US interest rate cuts before the end of 2025. At the same time, political pressure from Donald Trump has intensified, as he becomes more vocally aggressive toward Powell for rate cuts.

With inflation cooling and markets adjusting expectations, crypto could stand to gain the most from a looser monetary policy.

Trump Wants Fed to Bring Interest Rate Down to 1%

Earlier today, Trump renewed his attack on Federal Reserve Chair Jerome Powell. He called for a 3 percentage point rate cut and claimed it would save the US economy $1 trillion annually.

The US President also accused Powell of keeping rates high for “political reasons.”

While the Fed has held rates steady at 4.25%–4.50% since June, speculation is rising. Goldman Sachs now expects the first cut to arrive in September.

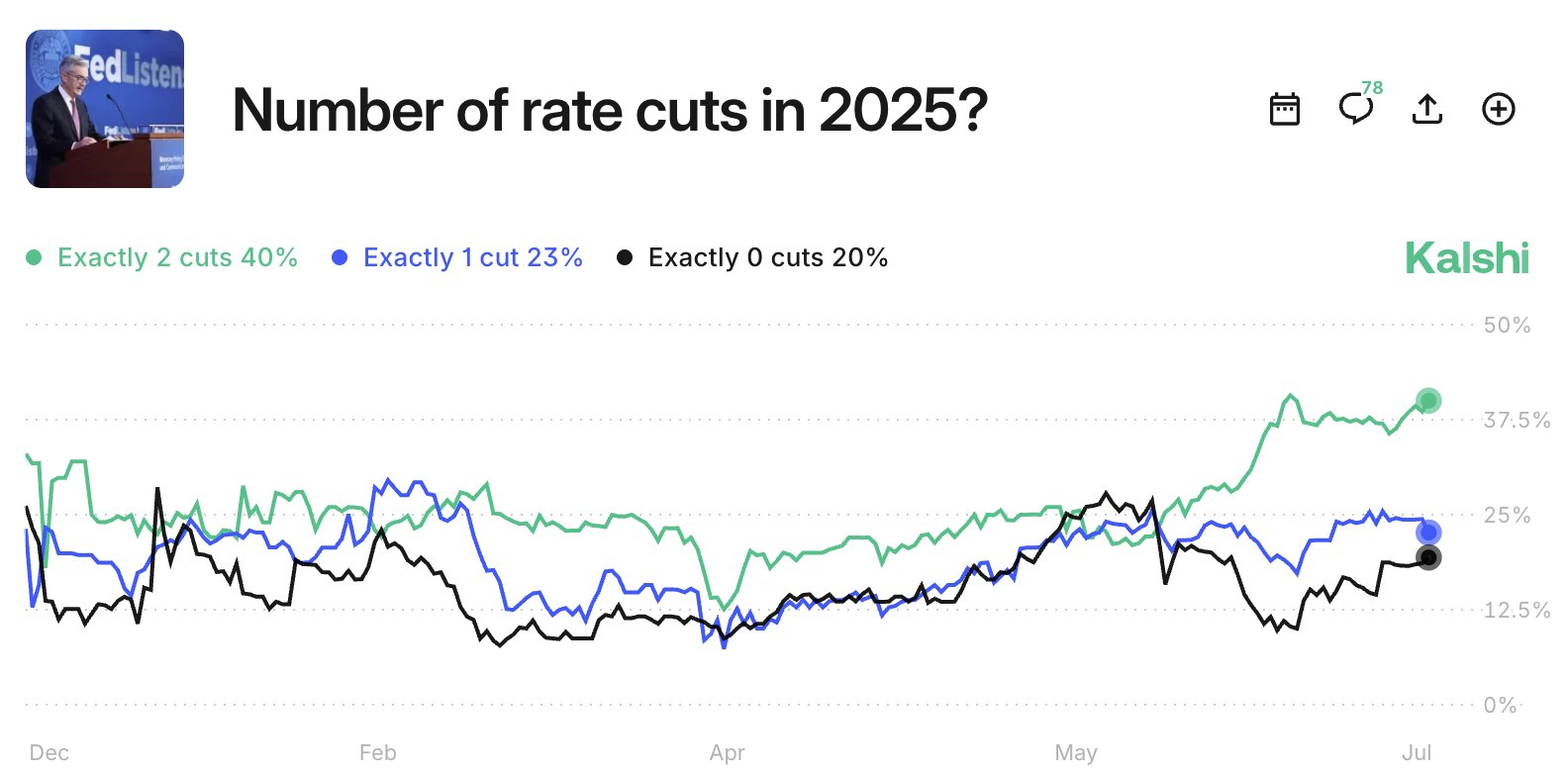

Meanwhile, traders on prediction market Kalshi see a 40% chance of two cuts before year-end.

This shift follows a steep drop in US inflation expectations. One-year consumer expectations fell to 4.4% in July, the lowest since February. That marks a 2.2 percentage point drop over just two months—one of the largest two-month declines in history.

Longer-term inflation expectations are also easing. Five-year outlooks dropped 0.8 percentage points in the last quarter, now sitting at 3.6%.

Overall, these trends suggest the Fed has more room to ease without sparking fears of a price spiral.

The crypto market is paying close attention.

Bitcoin remains above $118,000, while Ethereum holds near $3,700. Both assets have historically rallied after Fed rate cuts, benefiting from increased liquidity and investor risk appetite.

Could a Major Crypto Bull Run Begin?

Historically, rate cuts have kicked off strong crypto bull markets.

After the Fed slashed rates in March 2020 during the COVID-19 crisis, Bitcoin soared from under $10,000 to over $60,000 within a year. Ethereum followed, supported by DeFi and NFT growth.

If a new rate cut cycle begins in September, it could bring similar conditions. Lower yields push investors toward risk-on assets, including crypto.

Capital could also rotate from bonds and cash into Bitcoin, Ethereum, and high-conviction altcoins.

Additionally, falling inflation expectations and improving regulatory clarity—such as the GENIUS and CLARITY Acts—may reinforce investor confidence.

This convergence of macro and policy signals could extend the current cycle beyond previous all-time highs.

However, timing matters. Crypto is already near record levels, so momentum may depend on how fast and deep the cuts are. A delayed or shallow response from the Fed could limit upside.

Key Dates to Watch

The next Federal Reserve policy meeting will take place on July 29–30. While markets expect no change, Fed commentary will be closely parsed for signals about September.

The next critical date is September 16–17, when the FOMC reconvenes. This is widely seen as the first realistic window for a rate cut, especially if inflation continues to decline.

Other key indicators to monitor:

- July CPI print: Due early August, this will shape expectations for the September decision.

- Jackson Hole Symposium (Aug 22–24): Powell’s speech here could shift sentiment significantly.

- US Jobs Reports (August & September): Labor softness may strengthen the case for cuts.

For crypto traders, these dates offer cues for potential market inflection points. A confirmed Fed pivot could trigger renewed buying pressure, particularly in Bitcoin, Ethereum, and high-liquidity altcoins.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.