Efficiency, Green Tech • CoinLaw

Picture a small town quietly humming with energy, a power grid supplying thousands of homes. Now imagine that same amount of electricity being devoured by a handful of computers solving puzzles all day. This is the world of Bitcoin mining in 2025.

As cryptocurrencies become more embedded in our digital lives, their environmental cost has drawn increasing scrutiny. Bitcoin, in particular, sits at the epicenter of this debate due to its vast energy consumption. In this article, we break down the numbers behind Bitcoin’s energy use, how it compares globally, and the evolving efforts to make mining more sustainable.

Key Takeaways

- 1The average energy use per Bitcoin transaction is now approximately 1,335 kWh, roughly equivalent to the power consumed by an average US household in 45 days.

- 2In 2025, the Bitcoin mining network’s hash rate peaked at 617 exahashes per second (EH/s), a 38% year-over-year growth.

- 3Renewable energy usage in Bitcoin mining hit 54% in 2025.

- 4Bitcoin’s total annual energy consumption reached 173 terawatt-hours (TWh) in 2025.

- 5The Cambridge Bitcoin Electricity Consumption Index (CBECI) estimates that Bitcoin’s network consumes 0.78% of global electricity.

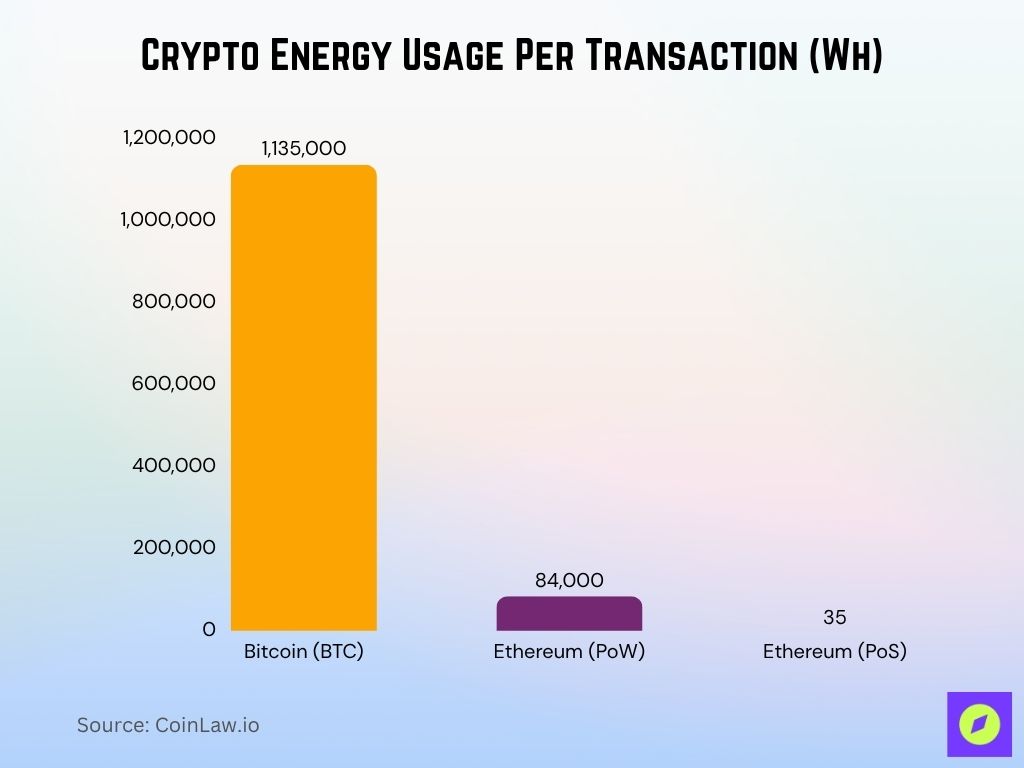

Crypto Energy Usage Per Transaction (Wh)

- Bitcoin consumes approximately 1,135,000 Wh per transaction, making it the most energy-intensive among major cryptocurrencies.

- Ethereum (Proof-of-Work) uses about 84,000 Wh per transaction, significantly lower than Bitcoin but still high.

- Ethereum (Proof-of-Stake) drastically reduces energy usage to just 35 Wh per transaction, showcasing the efficiency of PoS over PoW.

- Transitioning from PoW to PoS results in a >99.9% reduction in energy consumption per transaction for Ethereum.

Global Energy Consumption by Bitcoin Mining

- Bitcoin mining’s global energy consumption now rivals that of entire nations, Ukraine, for instance, which uses around 160 TWh annually.

- The Bitcoin network in 2025 is responsible for 0.5% of global electricity demand.

- Energy intensity per coin mined increased to 209 MWh per Bitcoin, up from 202 MWh last year, as mining difficulty continues to rise.

- Kazakhstan’s share of global mining energy use dropped to 7% in 2025, due to stricter state control and energy rationing.

- Texas, known for its favorable mining conditions, now hosts facilities using over 2.3 GW of electricity, about 6% of the US total mining power.

- Iran, once a major mining hub, contributed under 1.5% to global mining energy use in 2025.

- Bitcoin mining operations in Canada consumed 5.1 TWh in 2025, bolstered by hydroelectric-rich provinces like Quebec and British Columbia.

- The Bitcoin mining share of Paraguay’s energy exports reached 18%, driven by low electricity costs from the Itaipú Dam.

- Norway continues to power over 99% of its Bitcoin mining with renewables, maintaining its status as a sustainability leader in crypto.

- Globally, mining farms operating above 100 MW capacity now account for 31% of Bitcoin’s energy consumption.

Interest in Cryptocurrency Mining

- Public interest in Bitcoin mining saw a 12% increase in 2025, as measured by Google search trends.

- Over 19% of miners in 2025 are newcomers, entering the industry within the past 12 months.

- Mining rig sales surged by 23% year-over-year, driven by newer generation models like the Antminer S21 and WhatsMiner M63.

- Institutional miners now make up 34% of the total mining power.

- Retail mining operations, those under 1 MW, declined to just 8% of the global network, as profitability narrows.

- YouTube channels and influencers discussing crypto mining grew by 15% in subscriber base.

- The number of countries hosting mining operations increased to 58 in 2025, up from 54 the previous year.

- Mining pool consolidation continues, with the top 5 pools now controlling 76% of Bitcoin’s hash rate.

- Web-based mining profitability calculators like WhatToMine and ASIC Miner Value received 11 million unique visits in 2025.

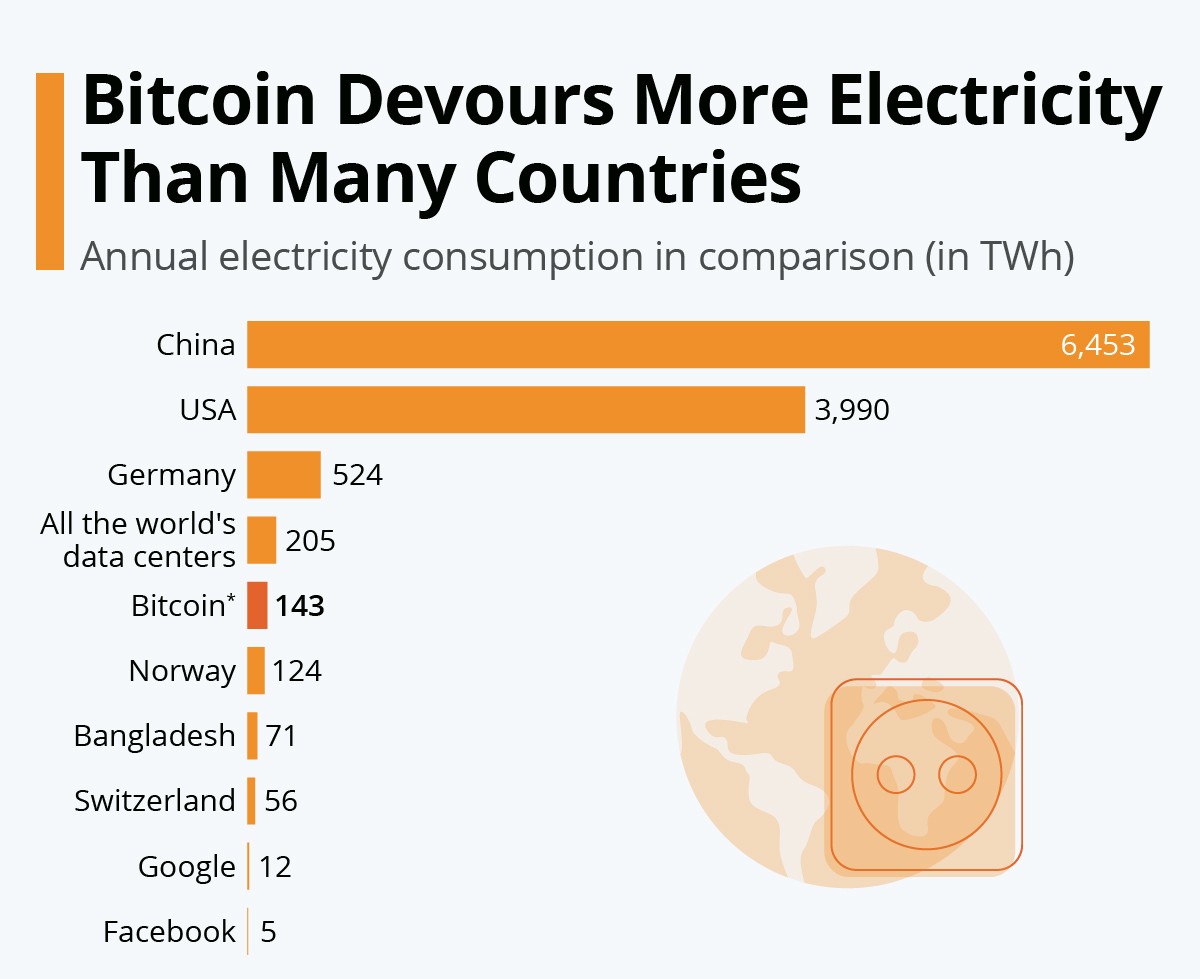

Bitcoin’s Annual Electricity Use Compared to Nations and Companies

- Bitcoin consumes about 143 TWh of electricity annually, more than countries like Norway (124 TWh) and Bangladesh (71 TWh).

- Its usage exceeds the global data centers’ total electricity consumption of 205 TWh.

- By comparison, China leads with 6,453 TWh, and the USA follows with 3,990 TWh annually.

- Bitcoin also outpaces Switzerland (56 TWh), Google (12 TWh), and Facebook (5 TWh) in power consumption.

Methods for Estimating Energy Use in Cryptocurrency Mining

- The Cambridge model, considered the industry standard, estimates energy use based on device efficiency and network hash rate.

- In 2025, newer models include geo-distribution-based adjustments, which factor regional energy mixes into emissions calculations.

- The Bitcoin Energy Consumption Index (BECI) includes hardware obsolescence rates in its assumptions for 2025 estimates.

- The kWh-per-transaction model, although still used, is increasingly criticized for not reflecting economic reality or network scaling.

- Mining equipment telemetry is now integrated into several large-scale operations, offering near real-time energy usage reporting.

- Blockchain-based reporting protocols emerged in 2025, offering verifiable energy data logs via smart contracts.

- Environmental auditors now collaborate with mining firms in 13 countries to certify energy transparency reports.

- Estimates now include cooling and auxiliary energy, adding approximately 8-12% to raw hardware consumption figures.

- Satellite imagery and power grid load data are increasingly used to validate large mining site activity.

- Artificial intelligence tools, such as ML-based load estimation models, are in experimental use for real-time global energy tracking.

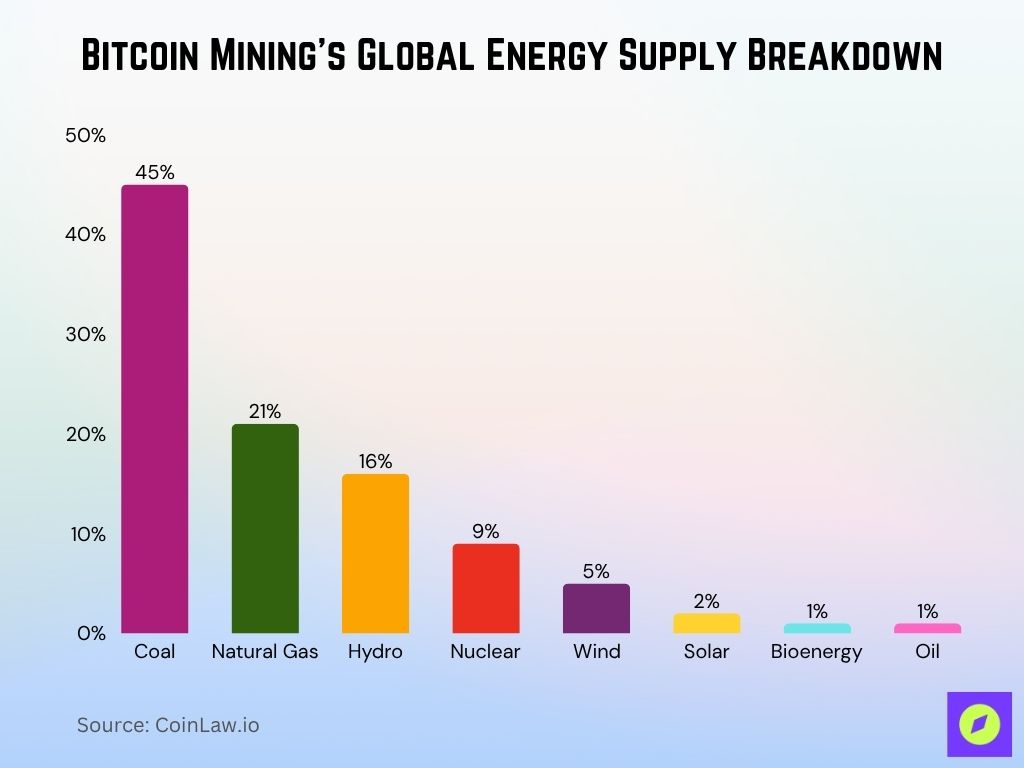

Bitcoin Mining’s Global Energy Supply Breakdown

- Coal is the dominant energy source for Bitcoin mining, making up 45% of the total energy mix.

- Natural gas follows at 21%, contributing significantly to mining operations.

- Hydropower accounts for 16%, showing the role of renewable energy in the sector.

- Nuclear energy provides 9%, indicating some reliance on low-carbon but non-renewable sources.

- Wind power contributes 5%, while solar energy makes up just 2%.

- Bioenergy and oil are the least used sources, each representing only 1% of the energy mix.

Comparison of Bitcoin’s Energy Use to Countries and Industries

- In 2025, Bitcoin’s annual electricity consumption of 173 TWh surpassed that of Pakistan, which consumed 158 TWh.

- Bitcoin mining energy use outpaced the entire gold mining industry, which used an estimated 131 TWh globally in 2025.

- The global airline industry’s energy use remained higher at 246 TWh, but Bitcoin’s share is catching up rapidly.

- Data centers worldwide consumed about 214 TWh in 2025, keeping Bitcoin just behind in this sectoral comparison.

- The cement industry in the US consumed 92 TWh, just over half of Bitcoin’s global footprint.

- Bitcoin’s energy demand is now equivalent to powering 16.2 million US households for an entire year.

- The entire banking system, by contrast, is estimated to use 260 TWh annually worldwide, only 1.5x Bitcoin’s demand.

- Bitcoin energy use in 2025 equals the combined consumption of Belgium and the Netherlands, both sitting under 90 TWh each.

- The agriculture sector in Brazil uses slightly less energy than the global Bitcoin network, totaling about 170 TWh.

- Streaming services like Netflix and YouTube consumed a combined 204 TWh, only 18% more than Bitcoin’s mining operations.

Trends in Bitcoin Mining Efficiency

- In 2025, ASIC miners achieved new milestones in energy efficiency, with top-tier models reaching 46 joules per terahash (J/TH).

- This is a 12% improvement from the best 2024 models, which averaged around 52 J/TH.

- Mining profitability per kWh rose slightly to $0.093, due to moderate Bitcoin price gains.

- Average mining farm PUE (Power Usage Effectiveness) improved to 1.18, down from 1.23, indicating more efficient energy use beyond computing power.

- Immersion cooling technologies are now used in 27% of all large-scale mining facilities, improving heat management and reducing energy loss.

- Dynamic mining software that adjusts workloads based on real-time energy pricing is deployed across 41% of operations.

- Power curtailment agreements, especially in energy-intensive states like Texas, are signed by 36% of US-based miners.

- Liquid-cooled ASICs entered mass production in 2025, providing a 20% efficiency gain over air-cooled models in hot climates.

- Energy recovered from mining operations, mainly in the form of waste heat, is now being repurposed in urban heating networks in regions like Canada and Sweden.

- The carbon intensity per mined Bitcoin dropped to 358 kg CO₂e, down from 371 kg last year, largely due to cleaner energy inputs.

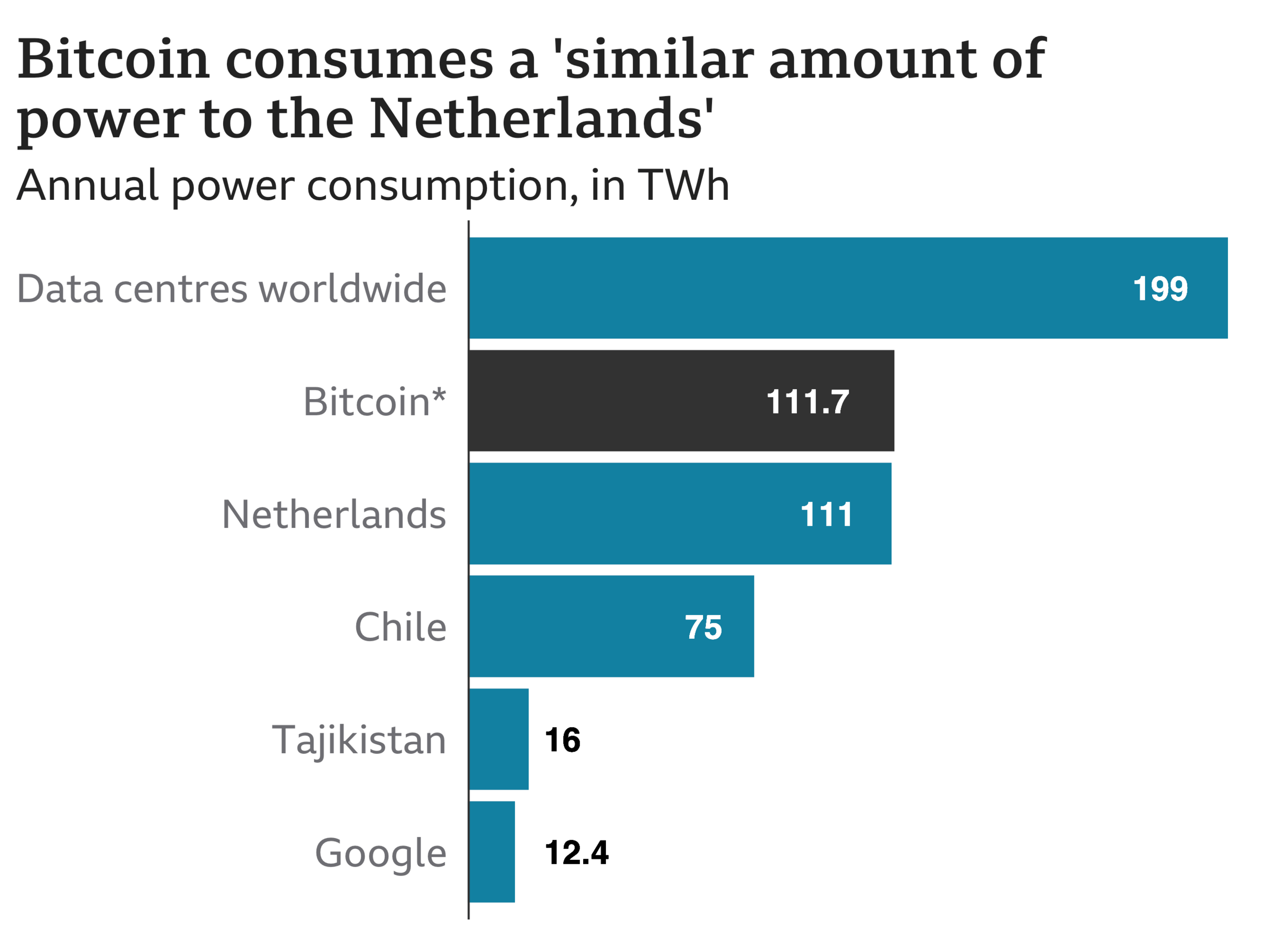

Bitcoin vs. Global and National Power Consumption

- Bitcoin consumes approximately 111.7 TWh annually—almost the same as the entire Netherlands, which uses 111 TWh.

- It also surpasses Chile, which has an annual consumption of 75 TWh.

- Global data centers use more power than Bitcoin, consuming 199 TWh each year.

- Bitcoin’s energy usage is nearly 7 times higher than Tajikistan’s (16 TWh) and nearly 9 times higher than Google’s (12.4 TWh).

Environmental Impact and Carbon Emissions

- Bitcoin mining in 2025 is responsible for emitting approximately 61 million metric tons of CO₂e.

- The carbon intensity of mining is 353 gCO₂e per kWh.

- This drop is mainly due to increased renewable usage, now at 54% of the Bitcoin mining energy mix.

- Methane flaring mitigation projects linked to Bitcoin mining offset about 2.3 million tons of CO₂e in 2025.

- Blockchain-based carbon credit verification has expanded, with over 9.2 million tons of verified offsets tied to crypto mining in 2025.

- Green Bitcoin labels, certifying renewable-powered coins, are supported by exchanges like Bitstamp and Kraken.

- Noise and heat pollution from mining continues to attract attention, prompting local ordinances in seven US states.

- Water usage for cooling in Bitcoin mining is estimated at 9.8 billion liters annually, mostly in large hydro-mining regions.

- A 2025 report shows that mining with hydropower produces only 36 gCO₂e/kWh, compared to 690 gCO₂e/kWh from coal-powered setups.

- Environmental protests related to mining were reported in 14 countries, primarily concerning land use and grid impact.

Regulatory Responses to Bitcoin’s Energy Consumption

- In 2025, 16 countries have implemented direct energy regulations targeting cryptocurrency mining.

- The European Union’s MiCA regulation now requires mandatory sustainability disclosures for mining operations above 25 MW.

- New York State upheld its two-year moratorium on new fossil-fueled crypto mining permits, set to expire in late 2025.

- Kazakhstan introduced a new tiered energy tariff system for miners, with rates as high as $0.12 per kWh for non-renewable users.

- Texas Grid Council established a voluntary curtailment program where miners agree to shut down during peak demand, now adopted by 48% of local mining facilities.

- China continues to enforce a formal ban, but tolerance exists in Xinjiang and Inner Mongolia, leading to gray-area mining growth.

- Iran reinstated mining licenses for clean energy-powered operations only, targeting 85% renewables in 2025.

- Russia’s Ministry of Energy issued its first national guidelines to regulate the mining load on regional grids.

- Canada’s Quebec province revised its hydro-allocation policies, giving miners with >75% renewable certification priority access.

- The UN’s Climate Technology Centre began evaluating blockchain-based tools to track mining sustainability compliance internationally.

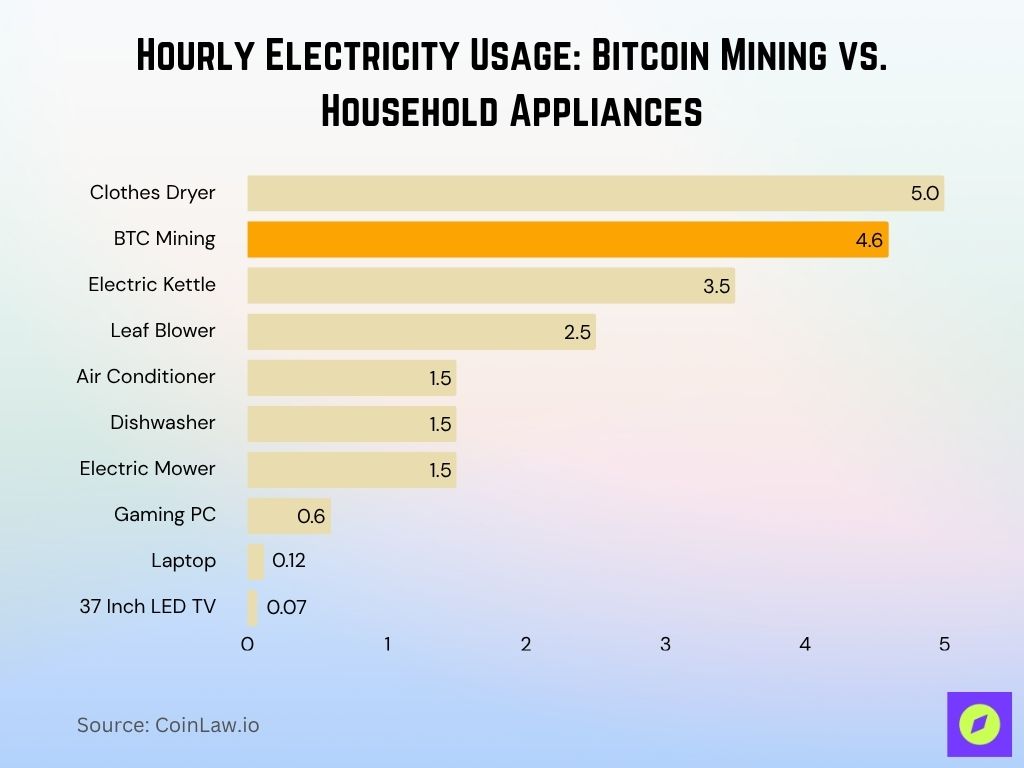

Hourly Electricity Usage: Bitcoin Mining vs. Household Appliances

- Bitcoin mining consumes 4.6 kWh per hour, nearly as much as a clothes dryer at 5.0 kWh.

- It uses more energy than an electric kettle (3.5 kWh) and a leaf blower (2.5 kWh).

- Common appliances like air conditioners, dishwashers, and electric mowers each consume around 1.5 kWh, which is about 3 times less than Bitcoin mining.

- A gaming PC uses only 0.6 kWh, while a laptop consumes 0.12 kWh, and a 37-inch LED TV uses just 0.07 kWh per hour.

Bitcoin vs. Other Cryptocurrencies in Energy Usage

- Bitcoin accounts for 81% of the total cryptocurrency energy footprint in 2025, remaining the dominant energy consumer.

- Ethereum, following its full switch to proof-of-stake, consumes just 0.02 TWh annually, a 99.9% reduction from its pre-merge levels.

- Litecoin mining dropped to 3.7 TWh, down 9.7% year-over-year, due to efficiency-focused network upgrades.

- Monero, known for its CPU-focused RandomX algorithm, consumed 0.67 TWh, with a stable network size.

- Dogecoin, thanks to merged mining with Litecoin, still uses about 1.4 TWh, largely piggybacking on Litecoin infrastructure.

- Chia, utilizing proof-of-space-and-time, maintains low energy use at around 0.015 TWh, but remains a niche project.

- Filecoin, with its decentralized storage model, saw its energy use grow to 0.9 TWh.

- Stellar and Ripple (XRP) use under 0.001 TWh each, as they rely on consensus algorithms not require intensive computation.

- Cardano’s annual energy demand in 2025 is under 0.007 TWh, maintaining its low-carbon reputation.

- Overall, non-Bitcoin crypto mining collectively accounts for 20% of the sector’s energy usage, but Bitcoin’s share continues to dwarf all others.

Technological Innovations to Reduce Energy Demand

- Immersion cooling adoption grew by 39% in 2025, enabling mining in hot climates with reduced energy for cooling.

- Next-gen ASICs, such as Bitmain’s Antminer S21, achieved energy efficiency as low as 46 J/TH, the most efficient in market history.

- Liquid cooling rigs, now commercially available, reduce energy losses by up to 22% compared to traditional air-cooled setups.

- AI-driven workload optimization is used by 28% of large-scale miners, dynamically shifting operations based on energy pricing and grid conditions.

- Energy arbitrage mining software enables miners to switch between on-grid and off-grid sources in real-time, optimizing cost and environmental impact.

- Smart mining contracts, linked to real-time sustainability benchmarks, are under pilot by firms in Switzerland and Canada.

- Battery-backed mining farms, using lithium and vanadium tech, are deployed in areas with intermittent renewable access like Australia and Chile.

- Carbon offset token integration into mining reward protocols is being tested by three major North American mining pools.

- Waste heat recovery systems are now being used to warm greenhouses and residential buildings in Scandinavian facilities.

- Modular mining units, shipped in container formats, are being deployed near stranded or flare gas wells to minimize environmental waste.

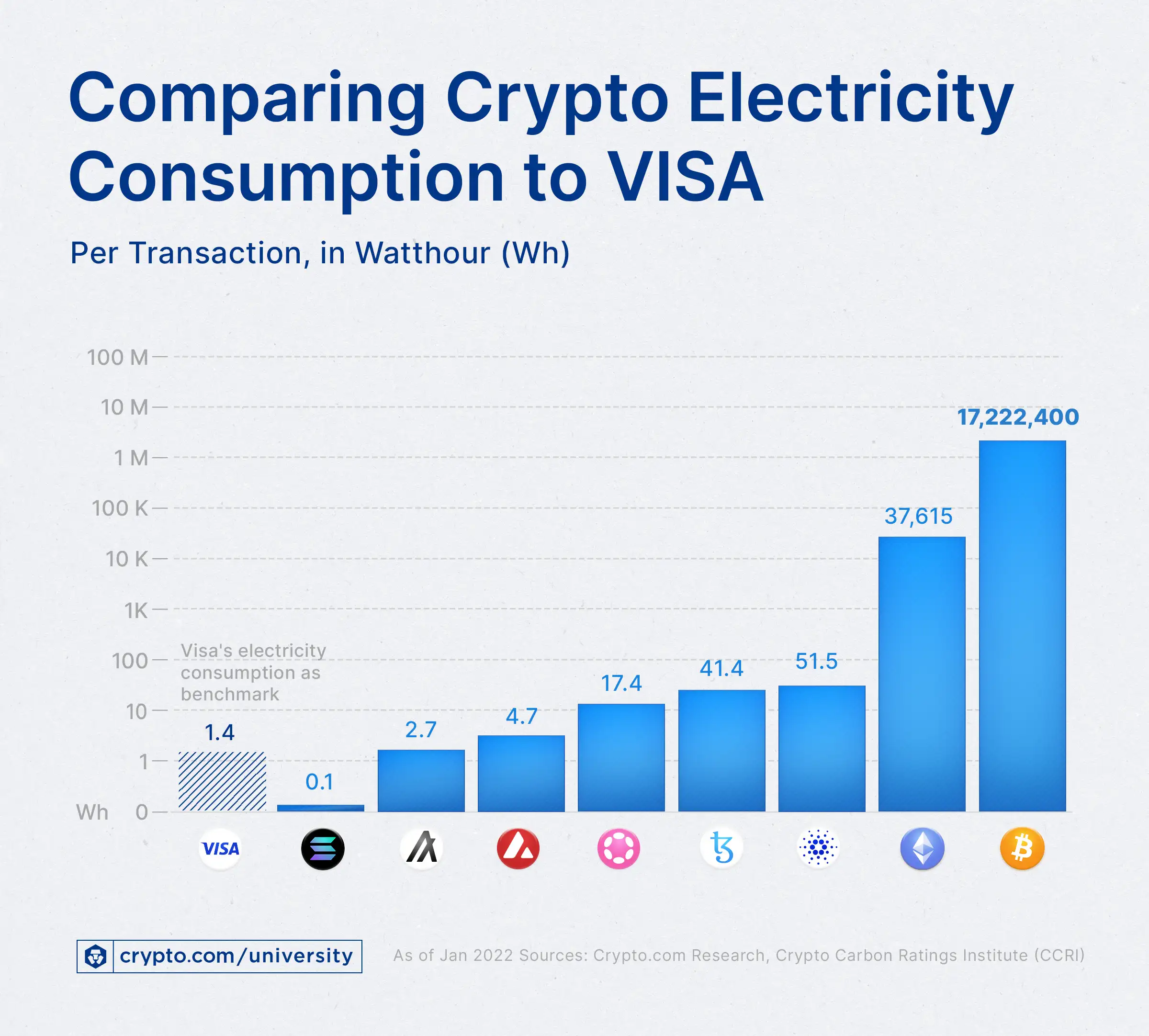

Crypto vs. Visa: Electricity Consumption Per Transaction

- Bitcoin is the most energy-intensive, using 17,222,400 Wh per transaction.

- Ethereum follows at 37,615 Wh, making it far more demanding than most platforms.

- Cardano (ADA) and Tezos (XTZ) consume 51.5 Wh and 41.4 Wh per transaction, respectively.

- Polkadot (DOT) uses 17.4 Wh, Avalanche (AVAX) uses 4.7 Wh, and Algorand (ALGO) sits at 2.7 Wh.

- Solana (SOL) is among the most energy-efficient cryptos, with just 0.1 Wh per transaction.

- Visa, in comparison, uses 1.4 Wh per transaction, a million times less than Bitcoin.

Public Perception and Media Coverage on Bitcoin Energy Use

- In 2025, 60% of surveyed US adults still perceived Bitcoin as “environmentally harmful.”

- Social media mentions of “Bitcoin energy use” peaked during Earth Week in April, with over 2.4 million mentions globally.

- Mainstream media sentiment was 39% negative, 46% neutral, and 15% positive in Q1 2025 regarding Bitcoin mining energy issues.

- Educational campaigns by mining firms have reached over 13 million users, aiming to improve understanding of energy sources and offsets.

- YouTube educational content on green mining practices grew by 31%, reaching 220 million cumulative views in 2025.

- Green Mining Alliance’s PR campaign, featuring public figures in the US and Europe, boosted awareness by 48% year-over-year.

- Media coverage in Germany and Canada has been increasingly favorable due to high renewable energy mining practices.

- Bitcoin’s ESG score, tracked by institutional investors, rose from 54 to 61 in 2025 due to better transparency and cleaner energy integration.

- Open-source tools for carbon tracking in mining were cited by 9 major publications, including the New York Times and Wired.

- Public trust in certified “green Bitcoin” coins rose to 32% in consumer crypto sentiment polls, up from 18% last year.

Recent Developments

- Over 70 mining companies now report using more than 90% renewable energy, verified by third-party audits.

- Bitcoin’s average emissions per coin mined fell to 358 kg CO₂e.

- Carbon-neutral Bitcoin ETFs, launched in 2025, include built-in offset purchases and have attracted over $1.2 billion in assets under management.

- BitRiver (Russia) and CleanSpark (US) announced partnerships to develop zero-carbon mining hubs using hydropower and nuclear energy.

- The “Green Hash Initiative”, a collective launched in 2025, aims to achieve 80% renewable-powered mining globally by 2027.

- Mining cooperatives in South America have started repurposing abandoned dams to supply clean power for localized Bitcoin operations.

- Energy grid balancing programs in Texas, where miners shut down during peak demand, saved over 4.1 GWh in 2025.

- Sweden-based miners are developing underwater cooling systems using fjord water, reducing cooling energy by 38%.

- Norway’s Green Block project piloted an AI model to optimize energy allocation across mining and local public infrastructure.

- The CleanCoin protocol, now in beta, enables blockchain validation based only on verified renewable input sources.

Conclusion

Bitcoin’s role as a decentralized digital asset comes with an energy price tag that continues to evolve. In 2025, the conversation has shifted from alarm to action, with a growing emphasis on efficiency, transparency, and renewable integration.

Although Bitcoin still consumes more electricity than many countries, the industry has made notable progress in reducing its carbon footprint and developing sustainable practices. Regulatory frameworks, technological innovation, and a more informed public are driving a cleaner future for digital currency mining.

Yet, the road ahead is long. Continued scrutiny will ensure that Bitcoin’s energy impact remains part of the broader discussion on climate, innovation, and responsible tech.