Why You Should Sell Your Bitcoin

If you are panicking right about now, I implore you, in fact, I urge you to sell all of your bitcoin now. All of it.

No this is not a joke.

This article is not some trading analysis, pick-me-up full of hopium or copium.

This is going to outline a series of straight up facts and reasons why you should dump your bitcoin, especially before it goes any lower. Because believe me, it will.

Nature is healing.

42 Reasons to sell your Bitcoin:

1. If you believe it won’t go lower:

Then you’re in for a rude awakening. Sell your bitcoin.

2. If you believe it won’t go higher:

Then what are you even doing here?

Sell your bitcoin.

3. If you believe in 14-year-old tea-leave analysts with large Twitter accounts:

If this is the basis upon which you bought bitcoin, then you should definitely sell it all. Drawing lines on a screen helps you understand “why bitcoin” just as much as watching someone else train at the gym helps you lose weight.

To understand bitcoin is to acquire some, use it, store it, read endlessly about how it works, why it’s important, the disciplines it touches (energy, economics, anthropology, complexity) and more.

The price and market don’t matter unless you think you can outsmart it.

Which of course you’re now starting to realize, you can’t. So either change your tune, get off Pornhub and TradingView and find something useful to do with your life that adds real value, like engineering, or gardening, or reading.

Or … get the fuck out, sell your bitcoin and go be a degenerate drawing lines on other screens.

4. The government cares about you:

If you’re dumb enough to beleive this mantra, or that you are “represented,” or that “muh dEmoCrAcY” is a good idea, just give it up man. Bitcoin is not for you. The Department of Motor Vehicles and Internal Revenue Service have open positions.

5. “Some other crypto is going to take over”

Then you must be new here.

Everyone has to climb Mt. Stupid at some point in their lives. If this is your first time climbing, I suggest you make your way back down the other side, quickly.

This article shall assist you in that journey, assuming you’d like to come down.

If you don’t, or you’ve been up there for a while, then I suggest you stay up there. Save the rest of us some oxygen and resources. We’ll put them to good use.

There is no fixing stupid: there is only freezing, out in the cold, meaningless vacuum of insanity where the belief in Lord Vitalik [or insert new overlord] prevails.

6. Bitcoin is about “muh gainz:”

Bitcoin has a way of humbling everyone who gets involved with it. Some of us learn that earlier on, others decide to try and outsmart the market through the application of intellectual felatio and the drinking of convoluted mental Kool-Aid.

Bitcoin is a force of nature, and like any such thing, cannot be controlled or channeled.

Just when you think you understand it, and have drawn a few lines on a chart, it will teach you the lesson, “No you don’t have me figured out.”

No amount of dots, lines, rainbows, analysis or listening to 14-year-olds with big Twitter accounts will save you.

There is so much more at stake here, and whilst you will certainly over the longer term see a marked increase in your purchasing power, if you’re here to make money, you’re in for a rude awakening.

You should just sell your bitcoin now and go work at McDonald’s.

7. If you’re A16Z:

Venture Capital firms such as Andreessen Horowitz are the enemy. They simply want to develop modern political advantage from the economic power they have amassed, by funding, building, pumping and then dumping shitcoins, NFT scams, Web 3.0 scams and the like. They aspire to be the next fiat-overlords by transitioning a wetware-centered kleptocracy into a software-centered panopticracy.

As such, they have no need for Bitcoin. They should stick with that which they can control.

Come on @pmarca – do it. Sell the bitcoin you have. To Bitcoin you are insignificant. To your shitcoins, you can be the fat little lord.

8. If you’re Conbase:

Likewise, Brian and friends should dump all their bitcoin. I mean, you have barely any on your balance sheet anyway, so we all know how much you care. You’ve been shilling shitcoins for almost a decade now, and you’ve built a product that enables degenerate gambling instead of long-term saving. You don’t care about Bitcoin. You don’t care about time preferences. All you care about is becoming a modern, digital, fiat bank with bitcoin merely listed as “one of the tradable assets.” So stand by your business model. Sell it. Take it off your balance sheet.

9. That blockchain is some kind of “underlying technology:”

Once again, climbers of Mt. Stupid (including myself) have at some point seen this mirage and believed it was real.

To help heal your ailment, I give you the following short write-ups on why this is neither a technology, nor in any way useful outside of being a single ingredient in the recipe that makes Bitcoin useful.

10. That it’s Bitcoin and Crypto:

If you’ve got a “crypto portfolio,” then just sell your bitcoin.

Seriously.

If you think that they are in any way alike other than some technical architecture, then you’re either hallucinating on Mt. Stupid, you’re a potato, or you’re new.

If you’re new, once again I’ll give you the benefit of the doubt, in which case, I suggest you read the article linked to above (“Why Bitcoin, Not Shitcoin”) and learn WHY bitcoin was designed to eliminate fiat money of any kind, including “cRyPto” that is just issued by nerds and VCs instead of central bankers and governments.

You should also review this incredible thread by Gigi.

Crypto is an effective attack on Bitcoin insofar as it attracts people who choose not to look any deeper, who have a “save me complex” and think they need some overlord or group to issue their money, or a “savior complex” and think they should be the next Klaus Schwab.

If that’s the case, and you believe bitcoin and crypto are of the same ilk, then trust me, there’s way better cryptos. Sell your bitcoin and build up your crypto portfolio with all the fabulous coins you can choose from on Binance or Conbase.

11. That bitcoin is democratic:

If you think you “get a vote” with Bitcoin, and that this “vote” of yours has any bearing on anybody else, you’re also in for a rude awakening.

Bitcoin is entirely incompatible with democracy or any other “government of the majority” and downward spiraling “tyranny of the lowest common denominator.”

Bitcoin is entirely voluntary, has no legislature, has no voting or on-chain governance and, like nature, doesn’t give a fuck like Nayib, your political views or your group identity. For some harsh truths, bookmark this piece.

Bitcoin enables excellence and hierarchies of competence in which the best rise to the top. There is no equalization or redistribution to and at the hands of the masses.

If that’s what you’re looking for, sell your bitcoin now and go elsewhere.

12. If you believe NFTs are art:

At this point, if you’re holding an NFT which you paid a lot of money for, you should be searching for God and for repentance. Or a cliff.

If you were stupid enough to conflate art with a digital signature on a broken tech project run by a group of nerdy tyrants that aspire toward swapping mothers out for synthetic wombs … then I have little hope for you … or your future.

If you think that digital information, whose very nature is to be free and available to all, can somehow have its essence captured in a signature and be made “non-fungible,” then I don’t know what to tell you … except …

NFTs are like having a marriage certificate while your husband or wife is sleeping with someone else. Congratulations.

Perhaps you didn’t know this. Perhaps you climbed Mt. Stupid. Perhaps you work at Twitter. I don’t know. Maybe you believe in unicorns too. Whatever the case, if you think “muh NFTs” are going to change the world, then just go hard bro. Sell all your bitcoin and buy those jpegs while they’re worth zero.

In fact, send me your bitcoin and I’ll send you some images in exchange:

bc1q486eze440cjgwjk2zarlj82hchu65gxdmauesh

In fact, the following QR code is an NFT, and to get it, you just open your bitcoin wallet and send bitcoin there:

If perhaps you no longer believe in unicorns, and want salvation … I suggest you read this thread by the ever-brilliant Gigi.

13. If you think PoS > PoW:

If you think proof-of-stake is anything other than monetary seigniorage and that you can somehow cheat nature (work) through convoluted abstractions, then PLEASE, I implore you; sell your bitcoin.

Prove it. Go hard, like a good little slave, into everything and anything that is proof-of-stake, like the USD, the Venezuelan Bolivar, Solana, Cohrdano and whatever other new shiny shitcoin your future overlords want to issue you.

14. If you think Bitcoin wastes energy:

Then you should definitely sell it. In fact, you should sell your fridge, your drier, washing machine, television, stove, car and Christmas lights too.

If you’re dumb enough to believe that transforming electricity directly into an incorruptible monetary unit and network is somehow less efficient than the entire payments + merchant facility + banking, judicial + government + central banking + military industrial complexes that exist not just in the U.S. but globally, then have I got a leprechaun NFT to sell you!

Furthermore, if you think that energy usage is somehow bad, and that increasing the carrying capacity of a species by harnessing more energy is evil, then you should not only sell your bitcoin, but go move to the African Sahara, or Antarctica.

If by any chance, you’ve made the mistake of conflating energy usage with energy wastage, then maybe there’s still hope for you. In which case, I suggest the following remedy.

15. If you think ESG is about anything other than more political power and waste:

Then just hurry up and sell your bitcoin.

Only a bureaucrat could be stupid enough to think that more bureaucracy is how we achieve efficiency, across any dimension.

16. That bitcoin is about “equality:”

Lol … then maybe you should go buy Worldcoin from your best friend Sam Altman.

17. If you’re ready to own nothing and be happy:

I mean, need I say more here? If this is the future you aspire toward, then just donate your bitcoin to me on the address listed above. I’ll own it and find meaning.

18. If you want to live in the beta verse:

You should sell your bitcoin for a plastic doll and some Cialis.

19. If you want to remain plugged into the matrix:

Then as Morpheus said, you are not on my team. If you are so inured by and attached to the system, then keep it. Stay there. You’re my enemy, and the last person who I’d like to have bitcoin is a potential agent.

“The Matrix is a system, Neo. That system is our enemy. But when you’re inside, you look around. What do you see? Business people, teachers, lawyers, carpenters. The very minds of the people we are trying to save. But until we do, these people are still a part of that system, and that makes them our enemy. You have to understand, most of these people are not ready to be unplugged. And many of them are so inured, so hopelessly dependent on the system that they will fight to protect it.” -Morpheus, “The Matrix”

20. If you want to be the lowest version of yourself:

If your definition of safety and health is Netflix, BetaVerse Goggles, Uber Eats, a series of injections, staying inside and living on Tik Tok, Instagram or Facebook, then please stay there and leave the rest of us the fuck alone.

Just eat your Cheetos, consume your government handouts and if you stumbled onto any bitcoin, just swap it for more food and porn.

21. If you believe in The Great Reset:

Then sell it all. Klaus needs more lemmings in his world of the lowest common denominator. You will be doped up on anti-depressants, happy, with nothing, not even your soul or dignity remaining.

For this form of bipedal creature, no amount of bitcoin can help.

22. If you believe in the World Economic Forum and the rest of the three-letter agencies:

Then congratulations. You’re an idiot. You’ll never understand bitcoin, and for your safety, you should sell it now.

23. If you think $69,000 was the top:

Then you should sell it.

24. If you think $600 to $300 is any different from $60,000 to $30,000:

Then you can’t do math … so you should sell it.

25. If you think $42,000 was the bottom:

Then you should sell it.

26. If you’re still watching Real Vision:

Then fuck me … you’re definitely beyond help or reason. These clowns have been right once in 10 years and you’re still watching them?

I suggest you not only sell your bitcoin, but buy some BSV, make a poster of Raoul, put it on your wall, take a photo, make an NFT and pretend like you just made some innovation in Web 3.0.

27. If you think “Toxic Maximalism” is a problem:

Then like Udi, your lack of getting laid is the problem.

You may also have difficulty in understanding how markets self-regulate, have no idea what white blood cells are or what they do, you may think that we should “mandate” the removal of “bullying” because it’s “mean” and that truth is somehow all sunshine and rainbows.

In that case, you should sell your bitcoin before it falls any lower and we bully you into selling it then.

28. If you have posters of Nassim Nicholas Taleb and Paul Krugman on your wall:

If you think Taleb actually wrote his books, and not some Lebanese ghostwriter, or that Paul Krugman has more than an ounce of a brain, then have I got some squid ink and a fax machine to sell to you.

If they’re your level of hero, sell your bitcoin before the black swan comes to consume whatever is left of your fragile intellect.

29. If you’re an academic:

Then you’ve got little hope. Bitcoin is largely incompatible with your model of the world, so unless you can think beyond it, you should just sell it, get a blue checkmark and go peer review some paper nobody is ever going to read.

30. If you’re a progressive or Marxist Bitcoiner (whatever the fuck that means):

Then you need help. Seriously.

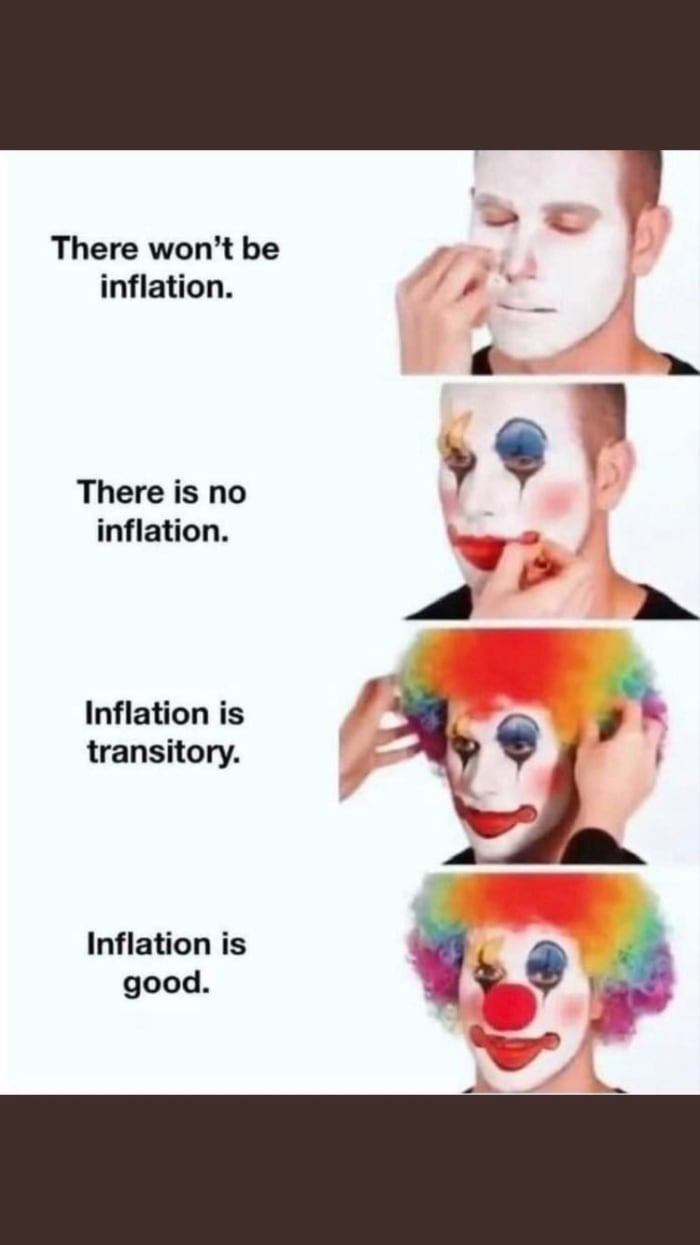

31. If you believe the “inflation is transitory:”

I mean … I heard clown suits are on sale, and you get a discount for paying in bitcoin.

Here’s the address:

Bc1q486eze440cjgwjk2zarlj82hchu65gxdmauesh

32. If you eat Beyond Meat:

You can join Samuel Bankman-Fried, Vitalik Buterin, Balaji Srinivasan and the rest of the soy-eating Silicon Valley nerds and grow man boobs whilst writing smart contracts and dreaming of your brains being transplanted into vats.

Bitcoin doesn’t work in that world. Bitcoin will make real beef and real food great again. It will bankrupt Beyond Meat and the rest of your fake fiat food alternatives. If that’s the food you want, then holding bitcoin is not going to help you. So sell it now.

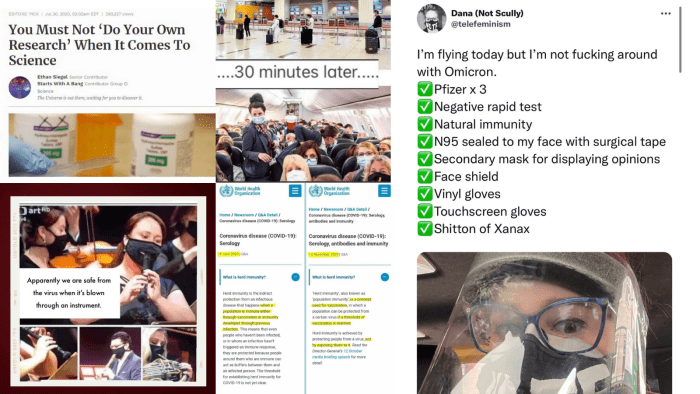

33. If you “trust the science:”

I know that if you do, you’re likely a supposed “atheist,” who’s failed to understand that science is not something one believes in, but a process of disproving a hypothesis or idea that one may or may not believe in.

So in reality you just created a new deity called “muh science,” in a religion of scientism, whose patron saints are Bill Gates and Dr. Anthony.

Congratulations. You deserve the Darwin Award, and you should certainly sell every single sat that you own because in your worldview, it is sacrilege.

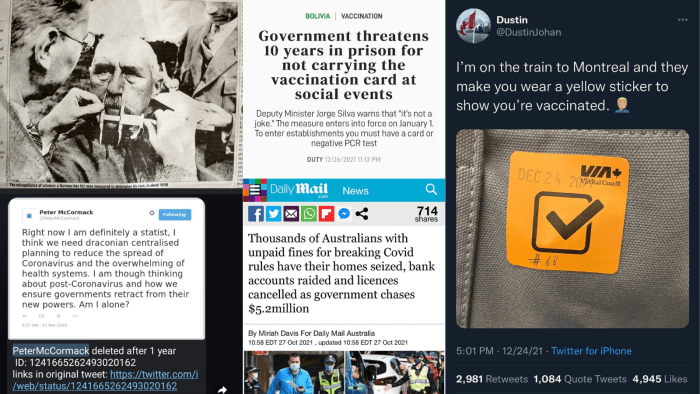

34. If you believe any of this is normal:

If you are the person on the right hand side, or an individual who believes that the stupidity perpetuated by bureaucrats is in any way normal, or that hiding behind face diapers, spending your final years in isolation, mentally deranging children by covering up everyone’s faces, dancing with your backs to each other, training at the gym with a mask or fist bumping each other at a distance is in any way an acceptable form of life, then once again, PLEASE sell your bitcoin. You’re far better off with an ESG-compliant CBDC issued by the World Ethereum Forum’s economic committee.

If you’re blind enough to have not seen through the lies, and stupid enough to beleive that tyranny is something that just “appears” from out of a vacuum, then you just don’t get it. In fact, you are the perfect candidate for guard or Capo, and for your kind bitcoin doesn’t work.

36. If you think politics comes before economics:

Then you neither understand what bitcoin is or why it exists.

You may even parrot tropes like “separating money and state,” but what you don’t realize is that Bitcoin goes far deeper. It separates economics from politics, and if you think that the new era Bitcoin ushers in is one where economically virtuous individuals can be outcompeted by politicians, you’re NGMI.

Sell your bitcoin now.

37. If you think political decree can outcompete physical reality:

Then you must also believe that jumping and telling yourself that “there’s no gravity, there’s no gravity, there’s no gravity” will save you.

You may as well sell your bitcoin, change your name to Icarus, make some wax wings and attempt it for yourself.

38. If you think the map is the territory:

Then you are by definition lost.

If you think the model comes before reality then central planning is the job for you, and once again, you should sell all your bitcoin, because it doesn’t give a shit about any of your models, maps or cycles. It will break every single one of them and you’ll have no idea what’s going on.

Save yourself the pain. Sell your bitcoin.

39. If you believe complex systems can be modeled:

If you think multidimensional humans can be reduced into simple numbers and complex humanity distilled into equations, then you should go join the world bank, the Chinese Communist Party, the IMF or some other three-letter agency and build a CBDC. You should be the last person on the planet holding bitcoin.

40. That transforming the world was going to be easy:

If you wanted salvation and thought it would come with no sacrifice, if you thought that winning was going to be a walk in the park and that we were not going to have to earn this over decades of ridicule, then I’m sorry, you were gravely mistaken.

If you think that “The Great Transition” would somehow be a Kumbaya where we all hold hands and skip happily onto a Bitcoin standard, then you’re about as deluded as the next central planner and I would prefer that you just give up now. Go draw unicorns and build smart contracts on Ethereum.

Over here in Bitcoin, we need warriors: The 300, not the Arcadians.

41. If your name is Peter Schiff, Raoul Pal, Elon Musk, Mark Cuban or Lex Fridman:

We all know what kind of clowns you four are.

Raoul should stick to jpegs, rainbow dildos and MetaVerse dates with Vitalik;

Elon should put his entire fortune into Doge;

Cuban should buy bananas;

Lex should sell all his bitcoin with love.

And Peter…please, for the love of Satoshi, stay out of it. If you actually start buying bitcoin, then we all know it’s going to zero.

42. If you think I’m joking:

No I am not.

I get genuinely happy when bitcoin drops, not because I get to buy more cheap corn (that’s nice to have, but $20,000 differences now mean fuck all later), but because it shakes out all the lemmings and losers.

A new elite is forming, and one whose core principles and character is different from the “masses” that preceded them.

We’re building an ark, and whilst everybody is technically invited, the price of admission is high. This price is not a payment of toilet paper money issued by your overlords. The price is

one of character. The price to pay is pain, patience and perseverance.

No ”remnant” wants to go to war with the Acadians by his side. He goes to war with Spartans by his side.

Yes Bitcoin is for “anyone,” but it’s not for everyone. There is a difference.

So to sum up: If you’re in any way hurt by my comments, fuck you.

Sell your bitcoin. Put your money where your mouth is.

I gave many of you reasons to NOT buy Bitcoin in 2020.

Now I’ve given you another 42 reasons to do so.

Why did I pick 42?

I don’t know. Why did Satoshi pick 21 million?

Neither matter.

What matters is that there is a clear and defined, enforceable and verifiable maxima in Bitcoin, and there are clear reasons to SELL YOUR BITCOIN NOW if you qualify for any of the above.

If you do not, and after reading this are instead interested in acquiring more … then maybe … perhaps, just maybe you will become a real Bitcoiner, someone who puts in the work and can prove it via a deep understanding of why we’re here, what Bitcoin actually means, and why no amount of price movement in these first couple of formative decades means anything.

If you want to understand what it means to be a Bitcoiner, some characteristics may be found here.

The world is coming to terms with how to value perfect money and in the process Bitcoin will absorb the other half of everything.

If you’re panicking about a $30,000 drop, your ancestors will spit on your grave. And rightly so.

This interregnum, what I like to call “The Great Transition,” will not be straightforward. This is not some warm and fuzzy process where we’re all equal and nice to each other.

Bitcoin is reality.

There is no rewind or replay button.

It’s going to test you, and the test is real life.

Bitcoin cares as much about your well being as gravity does.

It applies to all, and there is no escaping it. Beautyon said it perfectly:

“Finally, Bitcoin doesn’t care what you think. It doesn’t care about anything. What you think doesn’t matter; that is the ultimate power of Bitcoin. Bitcoin is like a force of nature. You must conform to ethical standards of behavior in the Bitcoin-mediated world, or starve, since the option of violence is taken off of the table.” – Beautyon

This journey is a rite of passage. It’s not about getting rich, and it’s not even about a legacy. It’s about building a fucking dynasty.

Cheap Sats are a bonus, but it goes far beyond that.

It’s about unevenly distributing bitcoin into the hands of those who get it, who care and who are willing to go up with the rocket or down with the ship.

These shakeouts mean that the future kings, lords, emperors and gods will have more.

Whilst the parasites, slaves and lemmings will have less.

We are going back to the age of greatness

Bitcoin falling in price sharply, on a regular basis wipes out all the shitcoiners and get-rich-quick sub-humans so that the royals, nobles and pure bloods can collect.

Nature is healing.

This is what it looks like.

And as Randy Savage would say … “You may not like it, but accept it.”

This is a guest post by Aleks Svetski of anchor.fm/WakeUpPod, and https://bitcointimes.news. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.