Bitcoin closes above $95k and targets $100k as Altcoins show mixed signals

BTC breaks resistance, invalidates short-term bearish setup

Bitcoin has officially closed above $95,000, breaking its six-day rejection streak and invalidating the previously anticipated pullback scenario. With price action now clearly above the daily, 4h, and weekly TBO Clouds, this marks a strong bullish shift. Daily RSI has remained overbought for 10 days, signaling sustained momentum, though daily Volume remains slightly below the yellow MA line.

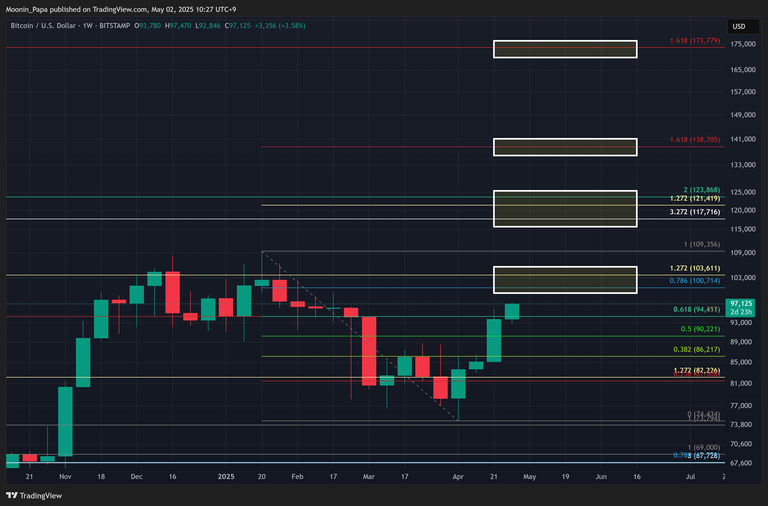

Weekly signals are growing more bullish. OBV is expected to cross back above its moving average, and RSI continues to rise. A weekly close above 70 on RSI would open the door to a move beyond the current ATH of $109K. With major Fibonacci levels now mapped, the next resistance zones are: $100–$103K, $117–$123K, $138K, and $173K. However, overhead resistance drawn from 2021 still looms around $99,800, reinforcing the importance of this next leg higher.

Dominance and market structure show BTC leading the way

Stablecoin dominance continues to fall inside the daily TBO Cloud, signaling a shift toward risk-on assets. While current action mirrors the whipsaw behavior of September 2024, this typically leads to broader market rallies. Bitcoin Dominance (BTC.D) is still climbing with RSI at 77.47 and weekly resistance at 71.39% in sight, signaling ongoing capital inflow into BTC.

Meanwhile, Top 10 Dominance continues to struggle. The daily and weekly charts are both bearish, while OTHERS.D has broken prior resistance but now contends with dominance shifting back toward BTC. RSI has broken support, but the OTHERS market cap chart still looks strong with continued OBV growth and a recent TBO Open Long.

Total market structure reflects BTC pause, altcoin sentiment remains cautiously bullish

TOTAL remains stalled just below $3T, while TOTAL3 (excluding BTC and ETH) has already confirmed a TBO Open Long. Although a TBO Close Long printed on the 4h chart, this is an early warning rather than a guaranteed reversal. OTHERS also closed a TBO Open Long, though 4h signals show potential short-term weakness.

Volatility remains low with BVOL7D back in the Bounce Zone. The setup resembles October 2024—another signal suggesting the market may be coiling for a breakout.

TradFi trends upward while Gold confirms cooling

The VIX continues to fall, signaling reduced volatility, while Gold has retraced into its daily TBO Cloud, signaling bearish consolidation. PAXG/BTC confirmed a TBO Open Short, and BTC/Gold is close to confirming an Open Long—favoring Bitcoin’s outperformance over Gold in the months ahead.

Altcoins begin to diverge with mixed signals across the board

ETH and SOL are slowly benefiting from BTC’s momentum but are both limited by weak volume. ADA, LINK, and LTC are outperforming, with LINK confirming a TBO Open Long and LTC closing above long-term resistance. AAVE followed suit but still needs to close above the 0.5 Fibonacci level to confirm.

SUI and TAO are showing signs of exhaustion, while S, QNT, IMX, and KAIA are seeing renewed interest with TBO Open Longs printing or forming. OM flashed a 4h TBO Breakdown, indicating potential downside risk, while TWT printed a second TBO Close Short yesterday.

Conclusion

Bitcoin closing above $95K is a significant milestone and clears the way for a run to $100K and beyond. While BTC shows strong macro signals, short-term volume remains soft. Dominance remains firmly with BTC, causing altcoin momentum to remain inconsistent. As long as BTC stays above key levels and TradFi maintains its risk-on tone, the broader crypto market is likely to continue its bullish expansion into Q2.

For in-depth strategy and tools, visit The Complete Cryptocurrency Investor by Mastering Assets.

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Kitco Metals Inc. The author has made every effort to ensure accuracy of information provided; however, neither Kitco Metals Inc. nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in commodities, securities or other financial instruments. Kitco Metals Inc. and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.