Ethereum slides close to $1600 – This buying opportunity may not last long

- Ethereum MVRV drops to 0.77, signaling a buying opportunity for ETH.

- Ethereum is seeing increasing demand as buying pressure recovers

Over the past four months, Ethereum [ETH] has struggled to keep an upward movement. Inasmuch so, ETH has traded in a multi-month descending triangle.

Thus, Ethereum has made significant losses over the same period. In fact, as of this writing, ETH hovered around $1610—an 18.21% drop over the last 30 days.

Amidst this decline, ETH has seen its MVRV score drop to recent lows. According to crypto analyst Burak Kesmeci, Ethereum’s MVRV has dropped below 1 and settled at 0.77.

Historically, a drop to these levels has signaled a buying opportunity with the altcoin being oversold.

In the past cycles, as per Ali Martinez, the best buying opportunities for ETH have historically occurred when the price dips below the lower MVRV Price Band, and that’s exactly where it is now.

In other words, the current MVRV positioning may offer investors a strategic chance to accumulate at a discount.

Is ETH set for a trend reversal?

According to AMBCrypto’s analysis, Ethereum buyers are back in the market and are currently accumulating the altcoin.

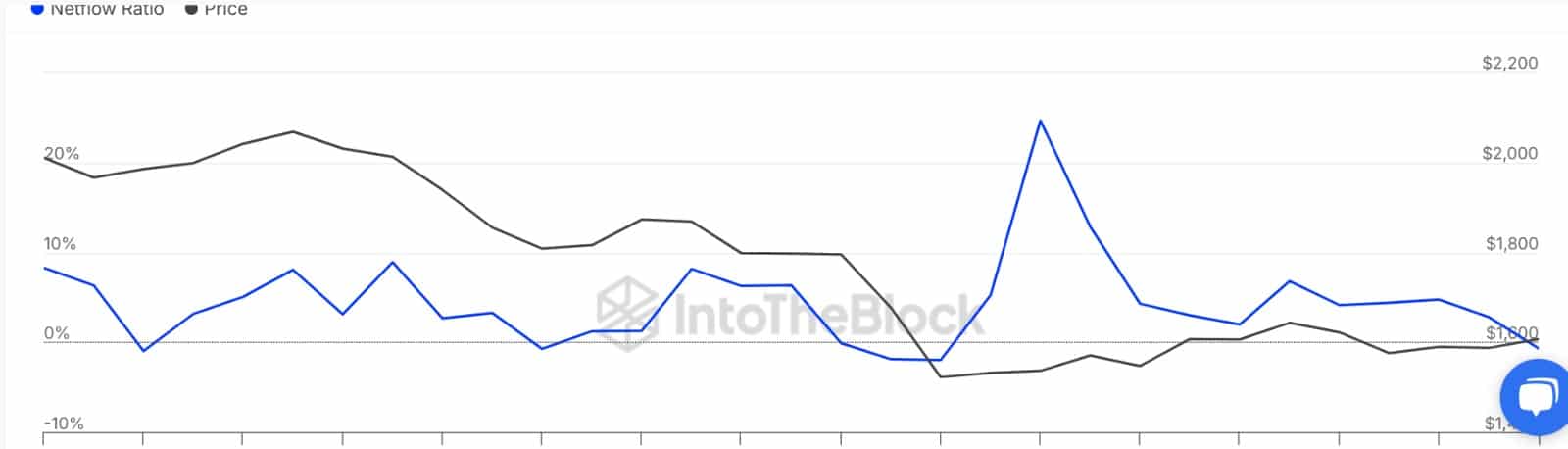

Looking at whale behavior, large holders have stopped selling the altcoin. As such, the Large Holders’ Netflow to Exchange Netflow Ratio has declined for the past seven days, hitting -0.71.

When this reaches negative territory, it suggests that whales are not transferring their Ethereum into exchanges but withdrawing.

Accumulation underway?

Additionally, Ethereum’s Taker buy-sell ratio has remained above 1 for two consecutive days. When the taker ratio is set like this, it reflects strong buying pressure in the market.

As such, there are more buyers and they are currently dominating the market. Such a trend signals rising demand across all market participants.

Finally, Ethereum’s Exchange Supply Ratio has declined sustainably over the past four days, hitting 0.135.

A sustained drop in this metric points to market participants—both retail and institutional—pulling ETH off exchanges, typically a sign of growing confidence and reduced sell pressure.

What next for ETH?

Simply put, with MVRV dipping into oversold territory, investors have interpreted it as a buying opportunity. Inasmuch so, buyers are now strongly back in the market to accumulate the Ethereum.

With the current conditions, it seems the MVRV score will not remain below 1 for a long time and ETH could rebound.

A rebound on ETH price charts could see the altcoin attempt a move towards $1706. However, if the MVRV continues to stay below 1, ETH could drop to $1551 then start another upward movement.