Best cryptos to buy amid tariff market crash

Posted April 7, 2025 at 4:14 pm EST.

Crypto continues to fall with the rest of the market as a result of President Trump’s large and indiscriminate global sanctions announcement last Wednesday.

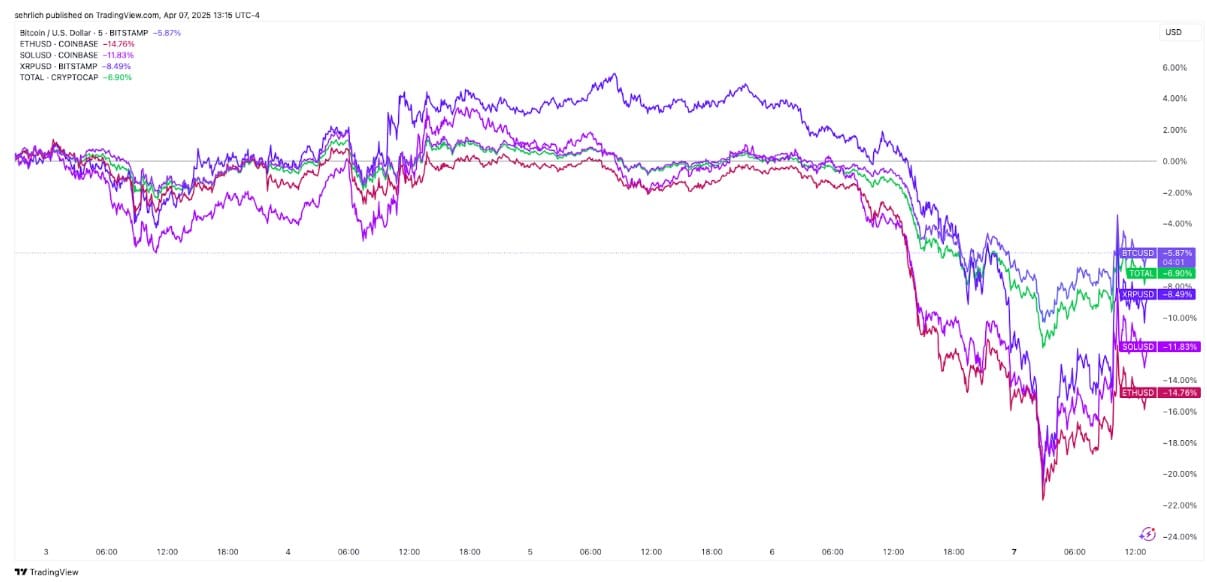

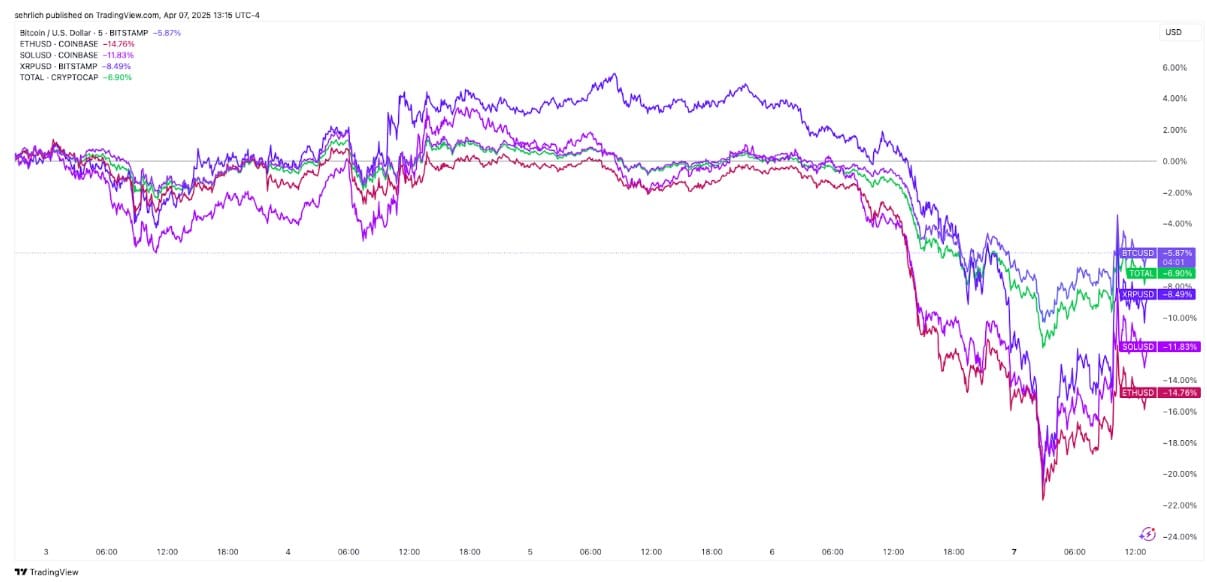

As of this writing bitcoin is down 5.86% since then, and that is after a recovery from a stumble below $75,000 for the first time since the Nov. 5 election. Other large-cap cryptos like ether, solana, and xrp trail the market leader over this time period.

Traders are understandably in a panic. Cboe’s VIX, a measure of expected stock market volatility, touched 60 for the first time since the onset of the COVID pandemic, and Deribit’s Bitcoin Volatility Index (DVOL), crypto’s closest VIX substitute, has risen almost 30% in the past week.

It is natural for investors to run for cover — or in this case U.S. Treasury bonds. However, a common refrain in the investing world is to be “greedy when others are fearful, and fearful when others are greedy.” And that means there are opportunities for investors to purchase blue-chip assets at a discount.

To get a sense of how professional money is playing the crypto field during this volatile period, I spoke with two major venture capital investors who requested anonymity to share insight into their respective firms’ strategies.

They provided critical insight into which categories and sectors are likely to perform the best in the ensuing weeks and months, and shared some thoughts on emerging use cases that will be the next big winners.

The Stores of Value: Bitcoin and Ethereum

The first answer is not entirely novel or interesting, but the reasoning is noteworthy. The financial press has been inundated with stories about gold setting all-time highs throughout the early spring. As the original safe-haven asset, it makes sense.

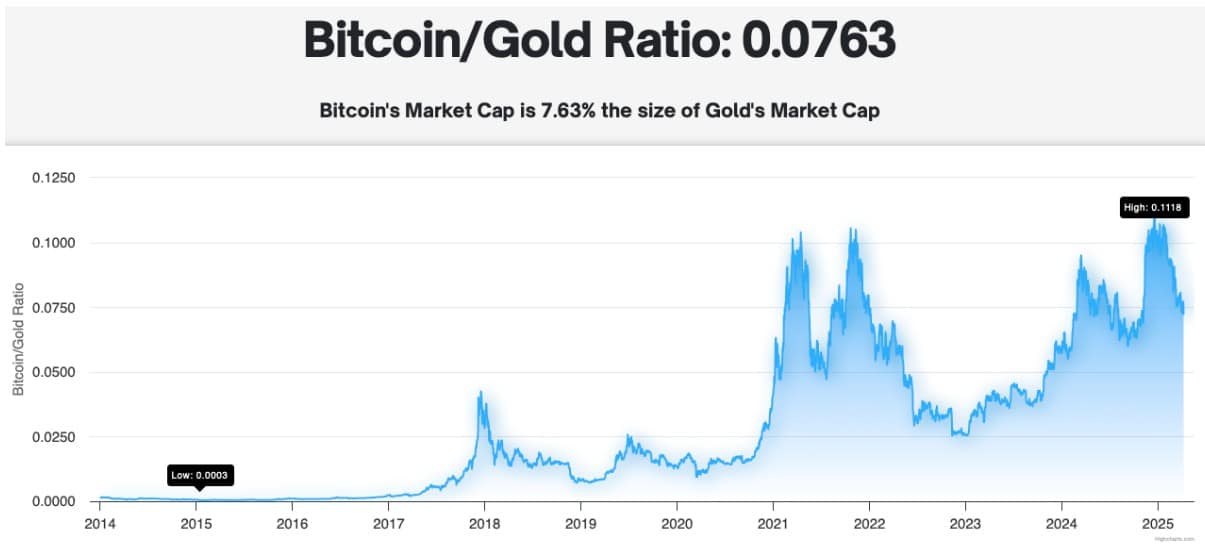

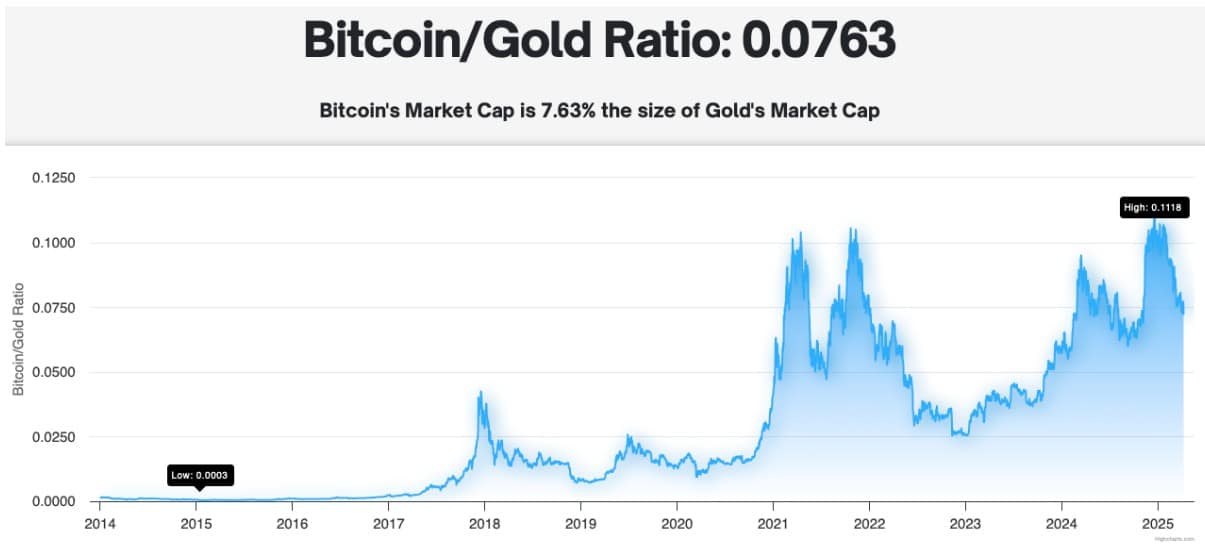

However, what may not be obvious to everyone is that bitcoin, while remaining a speculative asset, is starting to perform more like the digital store of value that it is supposed to be. If you look at a chart plotting bitcoin and gold’s market capitalizations, there is a clear upward pattern (these past two months notwithstanding).

Plus, there is plenty of room to grow. Gold’s market capitalization is $20.4 trillion. Bitcoin’s is $1.64 trillion. In the words of one venture capitalist, that means multiples of catching up to do for the digital asset. “That’s like a 12 or 15 X for Bitcoin to just get to 1:1 parity with gold. To me it is the easiest and most obvious,” they said.

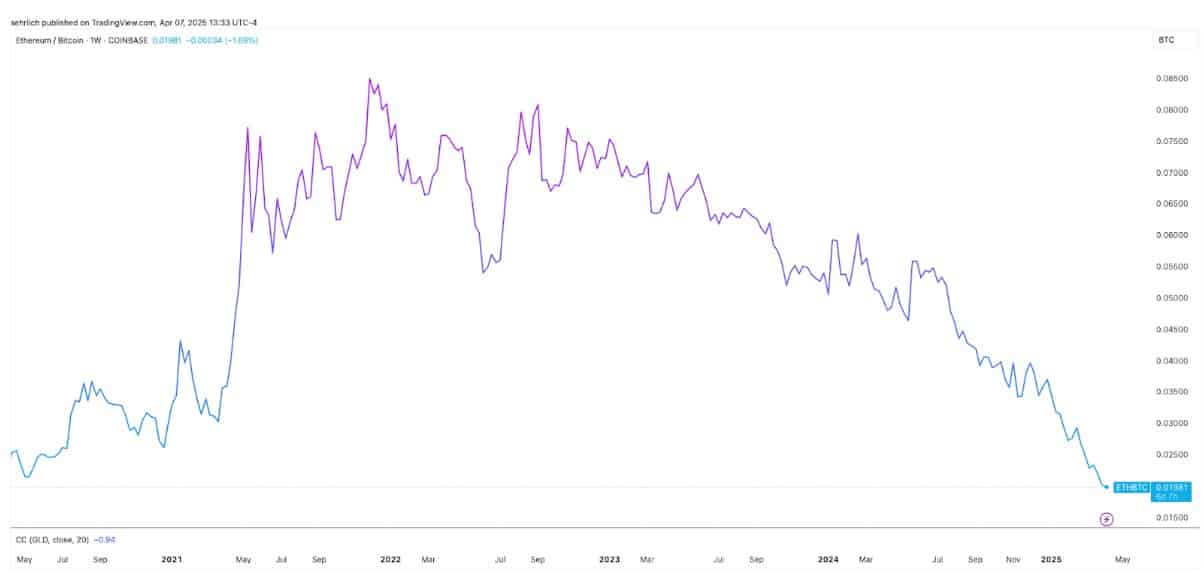

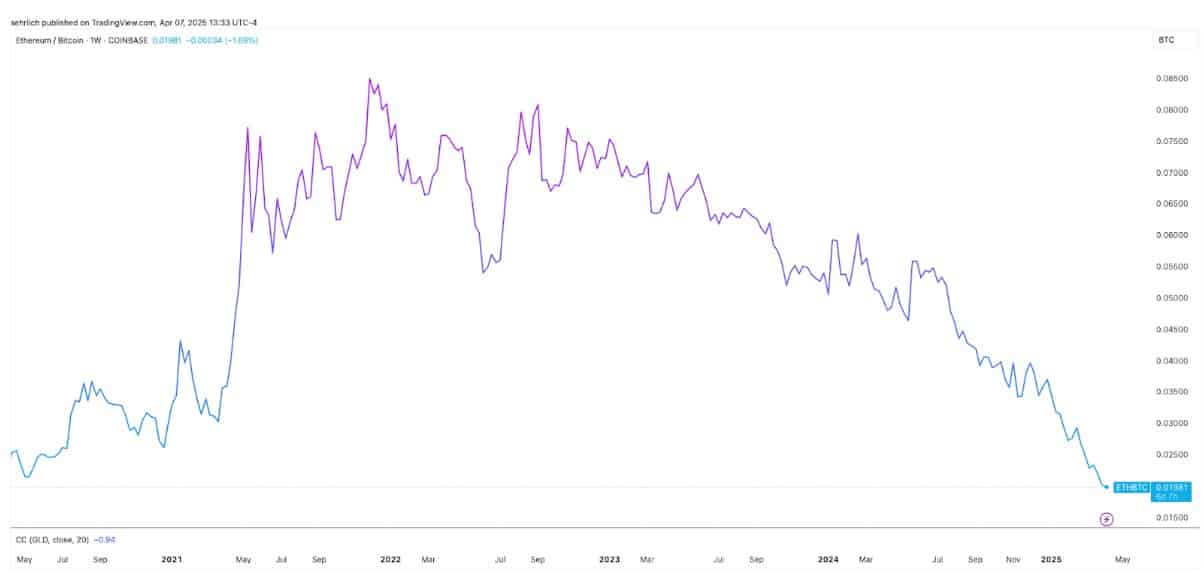

Both respondents also felt that ether could be a good buy in this climate. This response might seem unusual to regular followers of crypto news. After all, ether has vastly underperformed bitcoin in recent years. In fact, it is at its lowest point in relation to Bitcoin since early in the pandemic. But there is still reason for optimism.

One respondent pointed out how Ethereum has the ability to borrow Bitcoin’s store-of-value narrative as a result of a monetary policy change instituted in 2022, when the network switched from a Proof-of-Work to Proof-of-Stake consensus mechanism that let it to become deflationary. Lower than expected usage has made the network inflationary once again, but if you buy ether now, you are getting it at its low point.

“Ether is so low, it’s a really good time [to buy],” said the other investor.

Solana and DeFi

DeFi tokens have gotten crushed so far this year. Traditional tokens for exchanges and lending protocols like Uniswap, Aave, Curve, and Compound are all down almost 50% year to date. However, both respondents think that action is going to come back to these platforms with a vengeance if these tough economic conditions continue.

“I would definitely think about buying a bunch of DeFi because if stablecoin yields are going to be low, then DeFi is where people are going to have a loop of lending and borrowing,” says one respondent, who believes that investors are going to put more of their money to work in these protocols to stretch out extra yield. “This is how it happened in 2021 too,” they added.

Two tokens worth paying particular attention to here are Raydium and Hyperliquid. The first is a traditional automated market maker exchange like Uniswap based on top of Solana, while the other focuses on perpetual futures, a type of cash-settled derivative contract.

But if you do not want to try and pick individual tokens, one investor said, “Solana is sort of an index on DeFi. They’ve got a lot of really cool DeFi stuff happening.”

EigenLayer and Near

Both respondents feel like the artificial intelligence fad in crypto got a little overblown last year. “Yeah, it’s all vaporware,” said one investor about the slew of tokens and projects that put artificial intelligence in their name but had little usage. “But the thing with this stuff is usually the first wave is vaporware. All of the ICO stuff 2017 was vaporware, but there’s a little nugget of truth in there where you’re like, ‘Oh, this is interesting.’ And then the reality of it comes to fruition over the next couple of years.”

One of these second-generation use cases that could get a lot of attention is AI agents that people will use for a wide variety of tasks, such as booking a vacation. “If you’re running this little travel bot, let’s say, and you deposit your money into it, how do you know that the money won’t get stolen? Well, one way you can know that is that the cost to try to steal your money is the cost of breaking Ethereum.”

But Ethereum is not suited for every type of project or application due to its high transaction costs, and because various applications have to move across blockchains. So a couple of years ago, EigenLayer created a data layer that applications can use to outsource their security.

Essentially, EigenLayer is a way to get the security of Ethereum without having to re-create it or be stuck inside its walls. “It’s a shared trust layer,” says one investor. “But the reason the shared trust layer is important is that if you’re running an application on top of it, you have all of Ethereum security backing your money.”

The investor also felt that near, the token of the eponymous blockchain, is also poised to benefit from this trend.

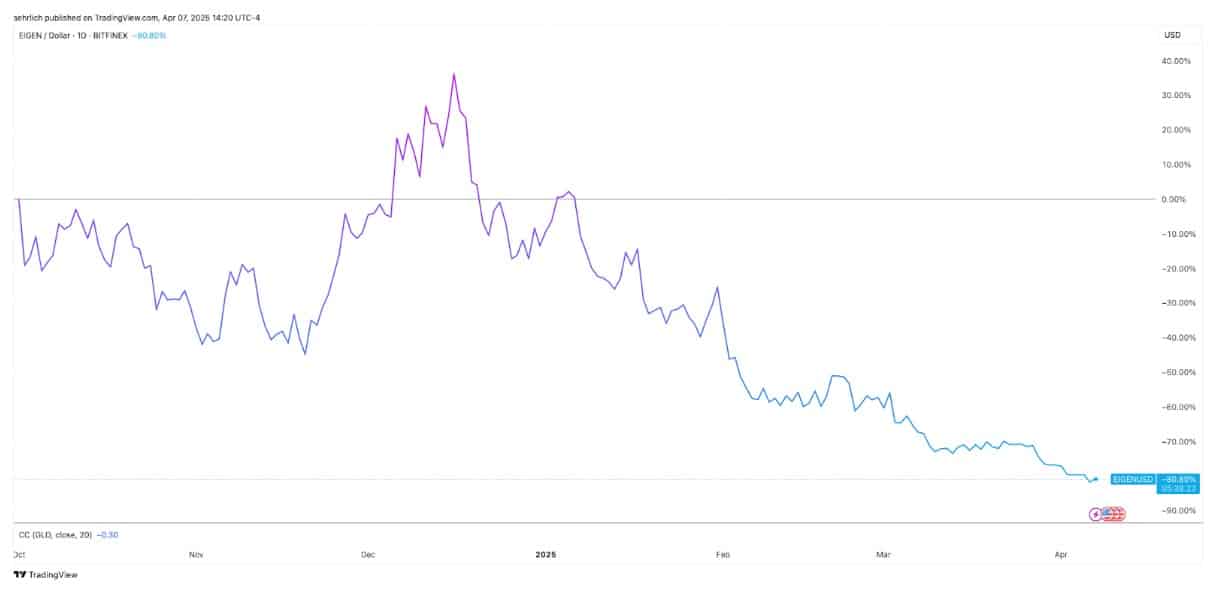

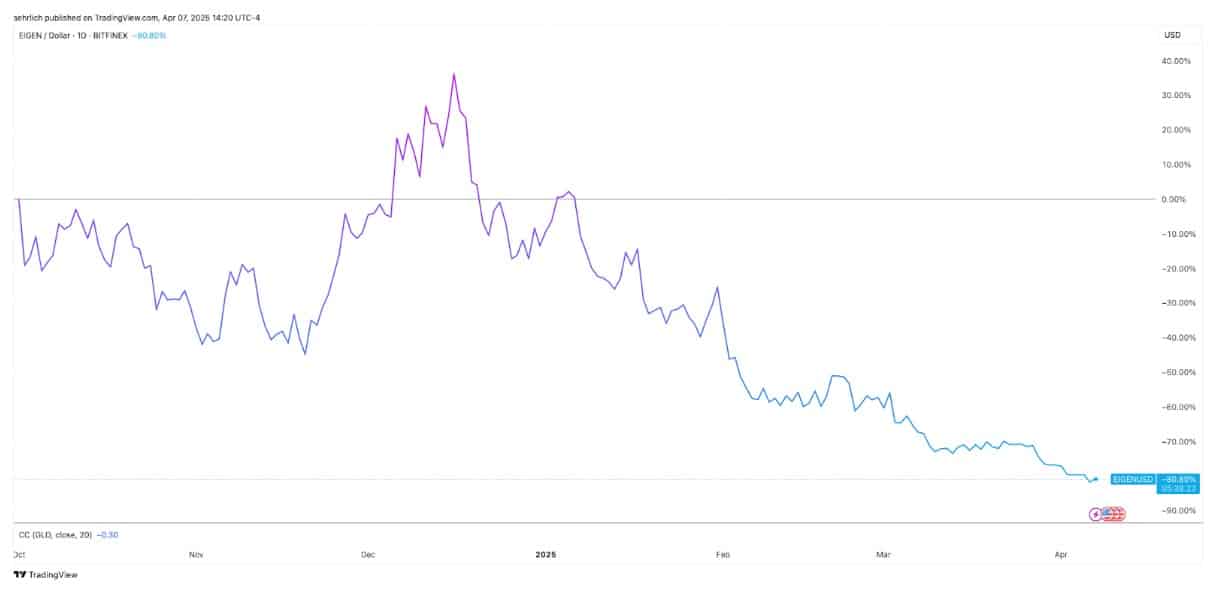

EigenLayer was one of the most hyped projects in crypto in recent years, but when its token launched in October — near the height of the bull market — it subsequently crashed by more than 80%. However, if this thesis is correct, then new purchasers can get into the asset at a sizable discount. The other investor agrees, saying, “Look at EigenLayer, it’s under a $1 billion market cap right now. This is a time to buy and hold.”

Editor’s Note – 5:16 pm EST: Text updated to clarify that Hyperliquid is an L1 blockchain.