Canada’s crypto industry turns to Alberta’s ATB Financial

Alberta wants the crypto and technology industry to reach $5 billion in revenue by 2030

Article content

Crypto companies in Canada have found an unlikely ally — a bank owned by the Alberta government.

Article content

Article content

ATB Financial, a provincial crown corporation, has become one of the most reliable banking partners for the crypto and blockchain industry at a time when other financial institutions are refusing service — and when Alberta’s government is targeting billions more in revenue from blockchain firms.

Advertisement 2

Article content

“Crypto companies saw that Alberta is a business-friendly province, and so they started moving there and sort of lobbying for better requirements and for more access to banking,” said Eric Richmond, general counsel and head of business development at Shakepay Inc., a Canadian crypto trading platform and a client of ATB.

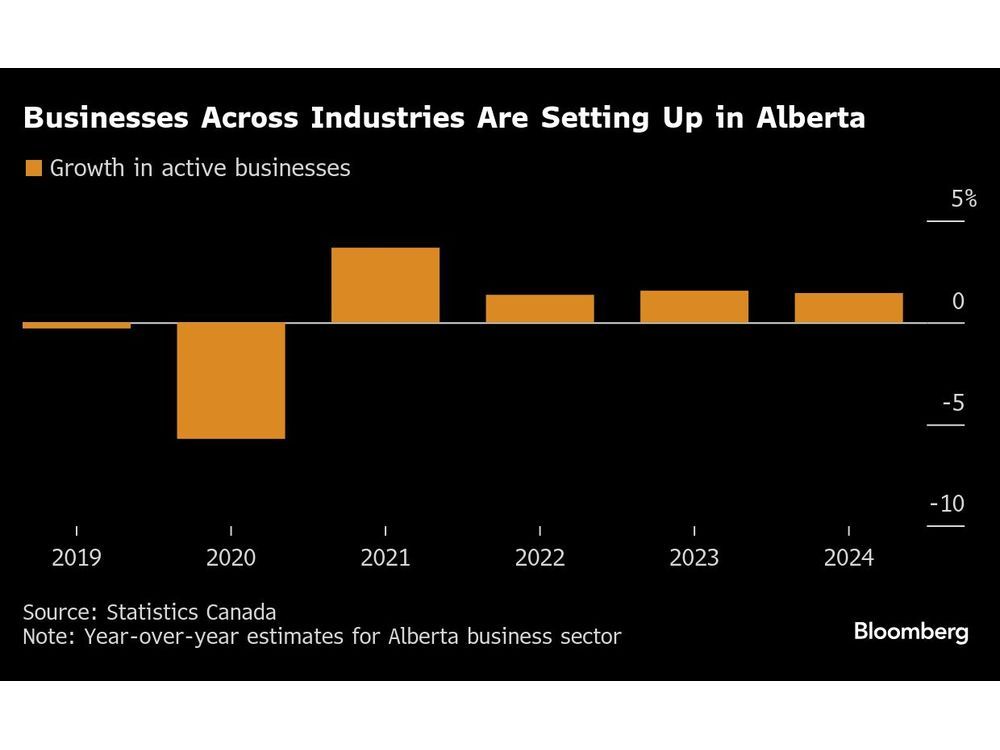

The province at the centre of Canada’s oil and gas industry is used to booms and busts. Home to 4.9 million people, Alberta began wooing the crypto industry in 2021, during the currencies’ last bubble.

“There was one point where many companies in Canada actually moved operations to Alberta just to be able to work with ATB,” said Koleya Karringten, executive director of the Canadian Blockchain Consortium, an industry group.

The Alberta government wants the crypto and technology industry to reach $5 billion in revenue by 2030.

“We identified crypto and blockchain as a key part of our business a few years ago,” said Rick Christiaanse, chief executive officer of provincial crown corporation Invest Alberta. “Our abundant energy and just our friendly regulatory environment make this a priority for this government.”

Article content

Advertisement 3

Article content

Invest Alberta offers services to the industry, such as guidance on paperwork filing and location suggestions, and can recommend banks that are open to serving crypto firms.

“We know who plays and who doesn’t and we can make those connections — and do make those connections every day,” Christiaanse said.

One of the recommendations is ATB. The bank, with $40.6 billion in total deposits in the 2024 fiscal year, said it’s been supporting the crypto industry for more than six years, but declined to share figures related to those clients.

ATB has a team focused on crypto and fintech clients that works with groups across the organization to provide secure and compliant financial solutions for the sector, the bank said in a statement.

“ATB’s leadership in the crypto and blockchain industry stems from our early recognition of its potential and our commitment to providing comprehensive and responsible banking solutions,” Brian Ford, vice president of business solutions at ATB Financial, said in a statement.

Larger banks in the country have been reluctant to take on crypto companies as clients and to hold funds for exchanges due to perceived risks.

Advertisement 4

Article content

“Our industry has gotten larger, but it’s not large enough yet to push the banks to really push for our business,” Shakepay’s Richmond said.

Following the FTX exchange collapse, the Canadian financial consumer watchdog released a statement noting that crypto may present opportunities and pose significant risks to the stability and integrity of the financial system.

Canada’s six largest banks, which account for over 90 per cent of federally regulated bank assets in the country, directed comment to the Canadian Bankers Association.

“The decision to provide banking services to any business is made independently by banks, based on their risk appetites,” Maggie Cheung, spokesperson for the CBA, said in a statement. “This generally takes into consideration applicable laws, regulatory requirements, and institution-specific factors along with risks that may be specific to a particular prospective client.”

South of the border, a lack of banking access has been an ongoing concern for crypto companies. While in Canada the crypto industry sees the reluctance as coming from the banks themselves, in the US, companies blame government regulators and guidances for discouraging banks to take on crypto clients. Since President Donald Trump’s election one of those guidelines has been repealed.

Advertisement 5

Article content

Smaller banks such as ATB and credit unions have been more receptive to working with crypto exchanges in Canada such as Kraken, but don’t always offer the same services as larger institutions, said Alex Mehrdad, general manager of Canadian operations for Kraken.

“So what happens is you end up having to use a lot of different intermediaries to do money processing and transfers and all of these come at a cost and at a fee,” Mehrdad said.

Over the past year, the crypto industry in Canada has gotten more oversight, with the Canadian Securities Administrators and the Canadian Investment Regulatory Organization issuing a notice in August calling on crypto trading platforms to register as investment dealers.

“Now that we’re supervised, we’ve really taken on the responsibility of mitigating the large majority of risks that banks are ultimately concerned with,” said Lucas Matheson, CEO of crypto exchange Coinbase Canada.

But with many of Canada’s largest banks having limited involvement in crypto, increased regulation may not change their risk aversion, said Darcy Daubaras, chief financial officer of Bitcoin miner Hive Digital Technologies Ltd.

Recommended from Editorial

“As regulatory clarity improves and the industry matures, banks are becoming more open to working with legitimate, compliance-focused blockchain companies,” Daubaras said. “However, the pace of change remains gradual.”

With assistance from Christine Dobby

Article content