Best Alt Coins To Buy in 2025? Onyxcoin, Stacks, and ONDO Gain Momentum As Bitcoin Surges

The cryptocurrency market is experiencing another explosive rally, with Bitcoin (BTC) surpassing the $109,000 mark to set a new all-time high and fueling optimism across the sector.

As Bitcoin continues to strengthen, traders and analysts are now turning their attention to altcoins that have outperformed the market. Among them, Onyxcoin (XCN), Stacks (STX), and Ondo (ONDO) stand out as top contenders for massive gains in 2025.

These three altcoins have demonstrated impressive growth recently, riding the wave of Bitcoin’s bullish momentum. But will they continue their upward trajectory? Let’s dive into their potential and look at why they might be the best cryptocurrencies to add to your portfolio in 2025.

Bitcoin’s Journey to $109K: What’s Driving the Surge?

Bitcoin hit $109,000 and then pulled back to $102,600 as sentiment cooled. This follows a big rally driven by institutional Spot ETF flows, softening regulations under President Trump, and bullish chart technicals.

Bitcoin is at $105,176, up 3% in 24 hours. It traded between $101,427.85 and $105,303.91 in the last 24 hours. Institutions are still accumulating, MicroStrategy alone added over 24,000 BTC in January.

Bitcoin hit $109,300 when Donald Trump was inaugurated as the 47th US president in January. His administration’s plans for a National Bitcoin Reserve sparked excitement across the markets and Bitcoin went on to new all-time highs. But that excitement faded and Bitcoin retraced.

Meanwhile, XRP’s market cap increased 51% after regulatory approval for Ripple Labs’ stablecoin RLUSD. Ripple’s partnership with Ondo Finance to issue tokenized US Treasury securities on the XRP Ledger added to the growing market confidence in XRP.

Bitcoin is back above $105,500, and traders are watching the $105,000 level. A break above that could take it to $107,000 and $108,800. Support levels are $103,200, $102,000, and $101,200.

BTC/USD daily chart. Source: Trading View

Onyxcoin (XCN): Can it 20X Again?

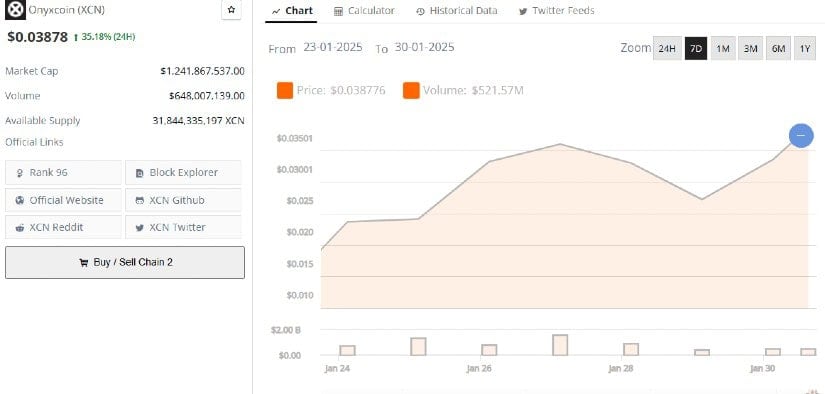

One of the biggest surprises in the crypto market was Onyxcoin (XCN) which went from $0.002 to $0.04 in a few months. That’s 20x. Now Onyxcoin is in the spotlight as one of the top altcoins for 2025.

Onyxcoin (XCN) weekly price action: Brave New Coin

The Ethereum Layer-2 solution is focused on enterprise blockchain adoption, providing companies with financial solutions.

Trading at $0.03063, Onyxcoin is up 1,161% in the last 30 days. Demand has been driven by partnerships with HTX Global and blockchain infrastructure platform Chain. The dispute with Tron’s founder Justin Sun has been resolved and that added to the market’s confidence.

Onyxcoin has also seen a 300% increase in trading volume, it’s now in the top 100 by market cap. Analysts say strong community and OIP-51 proposals are supporting the positive sentiment.

Onyx DAO announced the Onyx XCN Ledger, a new blockchain to improve scalability, security, and efficiency.

Also, the recent token burn proposal discussion in the community will impact supply and add to the bullishness of Onyxcoin. As institutional and retail interest in Layer-2 solutions grows, Onyxcoin’s expansion and enterprise adoption will be key to its price.

Stacks (STX): Potential Breakout Toward $2.50 and Beyond

Stacks (STX) has been one of the most promising projects within the Bitcoin Layer-2 ecosystem, enabling smart contracts and DeFi applications on Bitcoin. With BTC surging past $109K, interest in Bitcoin’s layer-2 projects is growing, positioning Stacks as a prime beneficiary.

Stacks (STX) remains a key player in the Bitcoin Layer-2 ecosystem, enabling smart contracts and decentralized applications while leveraging Bitcoin’s security. With Bitcoin surpassing $109K, investor interest in Bitcoin’s Layer-2 solutions has surged, positioning STX for a potential breakout.

STX is currently testing a critical support zone between $1.27 and $1.29. Crypto analyst Michaël van de Poppe identifies $1.40 as a major resistance level. A breakout above this point could push STX toward $2.50 – $3.00 in the coming months.

STX looks bullish, Source: X

If STX sustains support at $1.25 – $1.30 and successfully reclaims $1.40, analysts anticipate an upward trend toward the next resistance at $2.06. Should the token clear this level, it could potentially reach $2.50 or higher.

Stacks is gaining attention for integrating AI with Bitcoin’s blockchain, adding functionality beyond traditional smart contracts. Additionally, the Stacks 2.0 upgrade introduced the Clarity programming language. This was to enhance security and predictability in decentralized application development.

Technical indicators show neutral RSI levels, suggesting room for further upside. Declining sell volume further signals a potential trend shift toward bullish momentum.

As demand for Bitcoin Layer-2 solutions increases, STX remains positioned for long-term growth, with its next major price target at $2.50 and beyond.

Ondo (ONDO): Ondo (ONDO) Targets $2.60 as Institutions Buy

Ondo (ONDO) is getting a lot of attention in the crypto space due to tokenized real-world assets (RWAs). The token just broke out of a bullish flag and is still trending up with investors. With ONDO at $1.41, institutions and retailers are watching ONDO as it consolidates before moving to $2.60.

ONDO Coin’s weekly price chart. Source: Brave New Coin

ONDO’s recent price action is looking good technically, with key levels emerging as support and resistance. The break above $1.75 has made $1.75 a new support and traders are watching the $2.00 – $2.10 range as the next resistance. A move above this resistance could take ONDO to $2.40 – $2.60.

The RSI is still in the buy zone, so there is room for improvement. Historical price data shows that the last time ONDO’s RSI was at this level, ONDO went up by over 200% in a month.

Traders are also watching the 50-day moving average (20DMA) at $1.49 which has been a key indicator for short-term price action.

ONDO daily chart. Source: Santiment

Several fundamental factors have driven ONDO’s price up. One of the biggest is Ondo Finance’s partnership with BlackRock which has made ONDO a leader in tokenized securities and RWAs.

Another big catalyst is the deployment of Ondo Short-Term US Government Treasuries (OUSG) on the XRP Ledger. This will increase liquidity and scalability in the tokenized asset space and allow investors to access real-world financial instruments through blockchain.

Adding to the bullishness is the Ondo Summit on February 7. Historically project related events have driven big price moves and traders are expecting new developments or announcements at the summit to continue the uptrend.

The BlackRock connection and the fact that tokenized securities are being endorsed by big financial players like VanEck has put ONDO in a strong position in the growing RWA space.

Recently BlackRock CEO Larry Fink said tokenized treasury bonds and stocks are the future. Which is exactly what ONDO is doing. This has shifted the market sentiment to ONDO as traders are speculating on its long term play in the $50 billion RWA market.

Final Thoughts: Is Now the Time to Buy?

With Bitcoin preparing to surge back past $109,000, the stage is set for what could be a prolific altcoin season. Onyxcoin, Stacks, and Ondo stand out, each backed by robust fundamentals and bullish trends. Onyxcoin’s impressive 20x rally highlights surging investor confidence, suggesting a possible climb to $0.10 – $0.15.

Stacks, on the cusp of a breakout, eyes a target of $2.50 – $3.00, while ONDO, fueled by a partnership with BlackRock, may ascend to $2.40 – $2.60.

These movements, along with macro factors like institutional adoption, and Trump’s pro-crypto agenda hint at substantial growth potential in the market, making now a compelling time to consider these assets.