Ethereum’s 41% fall – Is Solana the reason behind it?

- Trading volumes for top Ethereum-based coins ebbed substantially.

- Ethereum’s weekly DEX volumes plunged 25%.

Ethereum [ETH] witnessed a sharp fall in fee revenue this week, suggesting decreased network traffic and user participation.

Ethereum’s meme coin activity slows down

According to on-chain analytics firm IntoTheBlock, Ethereum validators collected a total of $116 million in fees over the week, representing a significant drop of 41.2%.

The slump came amidst decreasing meme coin trading on the network, a space which Ethereum has historically dominated.

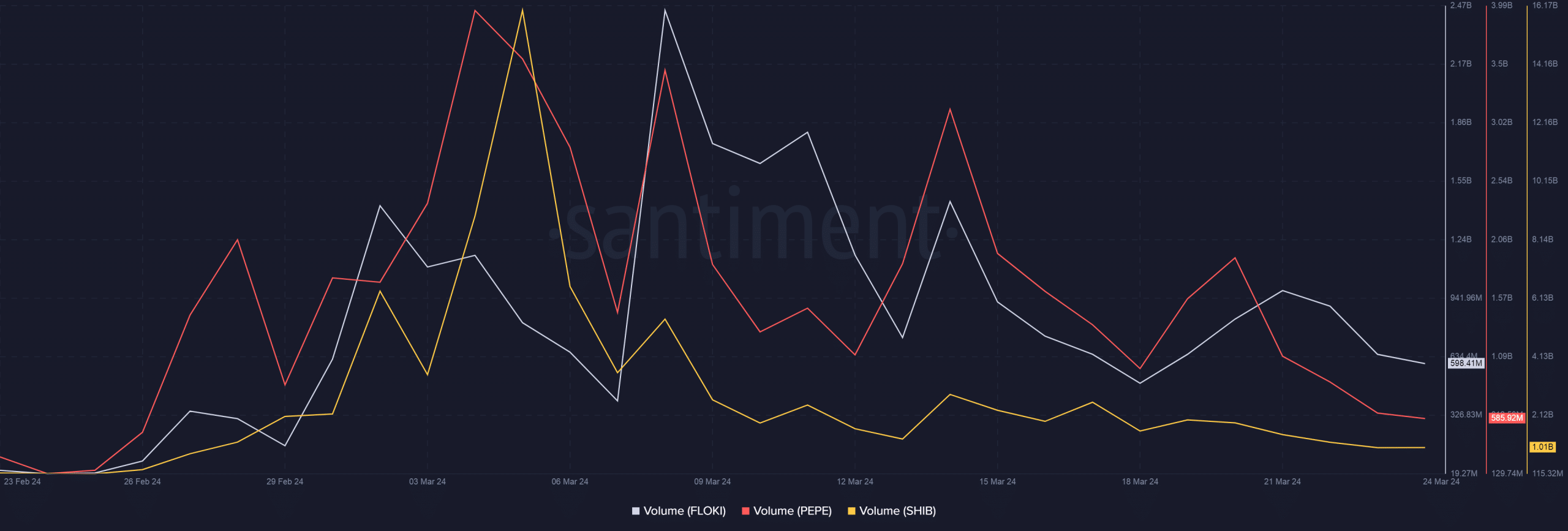

Trading volumes for top Ethereum-based coins such as Pepe [PEPE], Shiba Inu [SHIB], and Floki Inu [FLOKI] ebbed substantially over the week.

This happened post a frenzied demand in the first half of the month, as per AMBCrypto’s analysis of Santiment’s data.

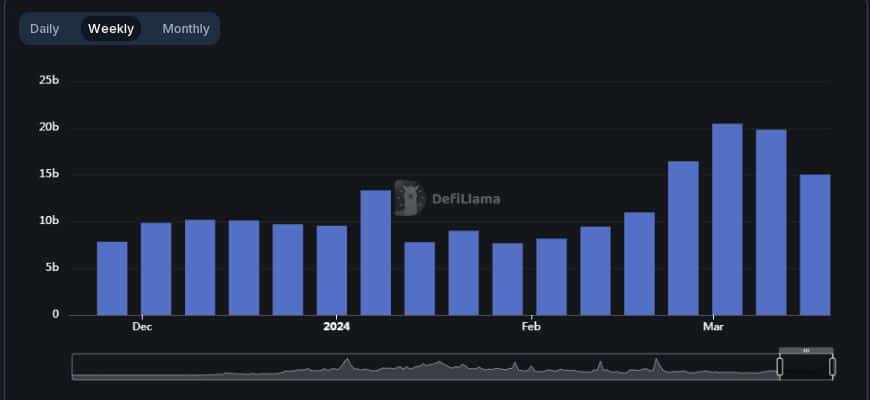

The fading meme coin mania was also reflected in the drop in trading volume of Ethereum-based decentralized exchanges (DEXs) — platforms frequently used by crypto degens to swap tokens.

According to AMBCrypto’s analysis of DeFiLlama’s data, volumes of just over $15 billion were facilitated on Ethereum DEXes in the week, marking a 25% drop from the week prior.

Ethereum’s loss is Solana’s gain

The decline occurred as investors turned to the Solana [SOL] blockchain to satiate their meme coin appetite. Solana’s total DEX volumes rose 3% over the week.

An avalanche of new meme coins created on the network over the week, brought in more users, and consequently more revenue.

Solana offered a faster and cheaper alternative for degens to flip coins in comparison to Ethereum.

Is your portfolio green? Check out the ETH Profit Calculator

The average transaction fee paid by Solana’s users in the last 24 hours was $0.027, as per SOL’s market value at press time. On the other hand, Ethereum charged $1.19 on average to validate a transaction.

The reduced on-chain traffic meant that fewer native ETH tokens moved, in turn implying lower demand. This partly contributed to a decline of 5% in its value over the week, according to CoinMarketCap.