Stablecoin & Staking in UK: Minister Expects Swift Action

The UK government appears to be considering an ambitious six-month timeline to implement new regulations governing stablecoins and staking services for cryptoassets.

This initiative comes as the nation braces for a forthcoming general election, with lawmakers feeling the heat to deliver concrete proposals.

UK Turns Up Heat on Stablecoin and Crypto Staking

Economic Secretary to the Treasury Bim Afolami, during an industry event in London, emphasized the government’s dedication to this cause.

“We’re very clear that we want to get these things done as soon as possible. And I think over the next six months, those things are doable.”

This development follows the Treasury’s pledge last October to offer greater clarity on specific crypto areas by 2024. The move is seen as a response to a previous consultation on fiat-backed stablecoins and the enactment of the broader Financial Services and Markets Act.

Read more: Crypto Tax 2024: A Complete UK Guide

Elliptic anticipates these new rules would bring fiat-backed stablecoins and their issuers under existing payment laws. This would then grant the UK’s financial regulator the authority to determine the types of assets backing a stablecoin.

In a January 2024 report, Elliptic said:

“In the UK, the Bank of England will continue to progress work around addressing the risks of systemic payment stablecoins that could have wider implications for financial markets given their size and scale.”

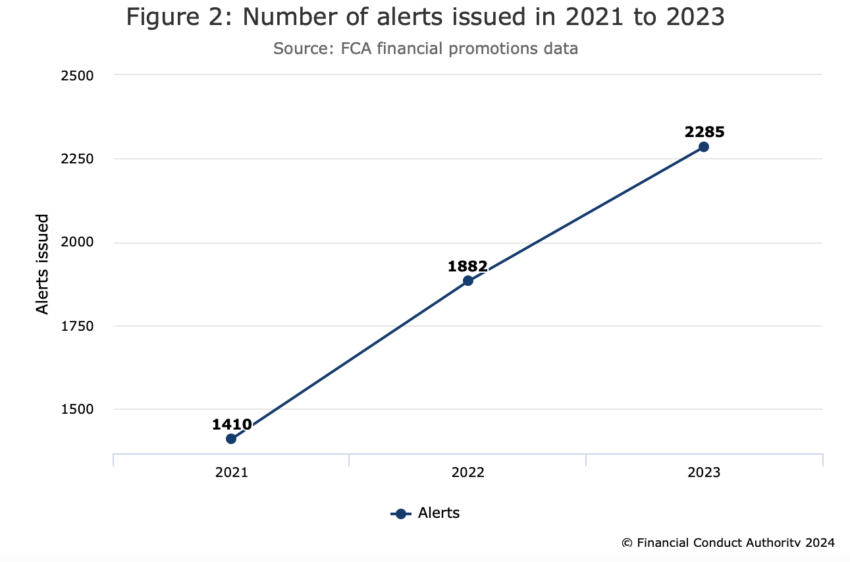

Meanwhile, the UK’s Financial Conduct Authority (FCA) has been ramping up its oversight of cryptocurrency firms. In the final quarter of 2023 alone, the FCA issued 450 consumer warnings against crypto firms for advertising violations.

This stringent approach includes the implementation of the s21 license. This particular license allows authorized firms to approve crypto advertisements, albeit under strict regulations. The FCA’s stance underscores its commitment to ensuring investors are not misled or deceived by crypto advertisements.

‘Invest in Britain’

Parallel to these regulatory advancements, Afolami is advocating for a significant shift in investment habits, particularly among the youth. He urged young investors to pivot from the volatile allure of crypto and invest in more stable assets like shares in domestic giants such as NatWest.

“That’s one of the things that I want to change — to say, don’t just own crypto, own a share of NatWest, don’t just own crypto, invest with your savings through automatic enrollment, invest in Britain.”

Read more: Crypto vs. Stocks: Where To Invest Your Money

This call for a balanced approach to investment arrives at a crucial time. The UK stock market is facing challenges, with a marked contraction in the number of liquid stocks, a trend echoed in global markets. Afolami’s strategy aims to mitigate risks for investors and rejuvenate the UK’s financial markets.

As the UK navigates these regulatory and market dynamics, this transition period demands informed decision-making from investors. The government’s swift action in regulating crypto, coupled with the push for diversified investments, illustrates a pivotal moment in shaping the future of the UK.

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

This article was initially compiled by an advanced AI, engineered to extract, analyze, and organize information from a broad array of sources. It operates devoid of personal beliefs, emotions, or biases, providing data-centric content. To ensure its relevance, accuracy, and adherence to BeInCrypto’s editorial standards, a human editor meticulously reviewed, edited, and approved the article for publication.