Top Trader Bullish on Two Bitcoin Ecosystem Altcoins, Including One ‘Obvious Long’

A crypto trading veteran is expecting bullish continuation for two altcoins with the Bitcoin (BTC) ecosystem as the digital asset markets flash more strength.

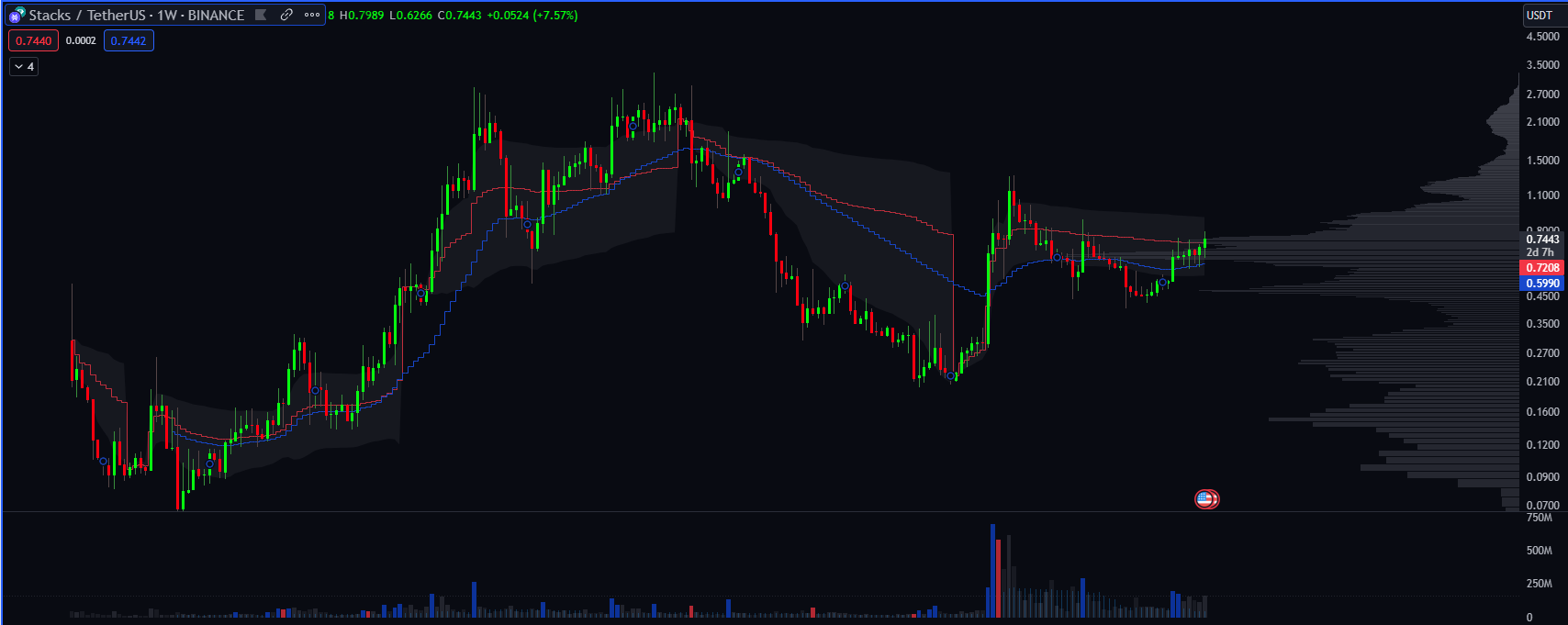

Pseudonymous trader The Flow Horse tells his 188,000 followers on the social media platform X that he’s building a position in Stacks (STX).

Stacks is a project that aims to enable decentralized finance (DeFi), non-fungible tokens (NFTs) and other decentralized apps to be built on top of the Bitcoin network.

Says the trader,

“Started to build a position in STX – also known as ape most, scale what I can after.

From a high timeframe standpoint the trend is beginning to curve up and some basic signals are firing green – all key volume levels being retaken.

Spot CVD (cumulative volume delta) on CB (Coinbase) has been up only the last two weeks, and OI (open interest) came off nicely.

Think we see the market re-rate this soon with the BTC ETFs (exchange-traded funds) coming.”

At time of writing, STX is trading at $0.835, up nearly 5% in the last 24 hours.

Next, The Flow Horse is also bullish on Ordinals (ORDI), a project that aims to add value to each Satoshi, which is the smallest unit of value on Bitcoin.

Says the trader,

“Am I missing something or from a technical and behavioral standpoint is ORDI such an obvious long?

• No gimmicks to this – FDV/MKT (fully diluted value versus market cap) ratio is 1:1

• Low float

• Retaking all levels, also known as if you sold, you sold too early and you were wrong.”

At time of writing, ORDI is trading for $31,82, up over 34% in the past day.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney