BIS, Hong Kong, and Israel

The Bank for International Settlements (BIS), Hong Kong, and Israel’s central banks collaborated to experiment with retail central bank digital currency (rCBDC) for enhancing digital payments as a public service.

“Can a well designed rCBDC system retain the desirable attributes of cash while also creating user experiences functioning as well as, or better than, today’s payment systems? These are questions that Project Sela seeks to answer,” the report stated.

Project Sela: Can rCBDC Work?

According to the report, the project aims to determine if it’s possible to create a secure and user-friendly rCBDC:

“Sela tests the feasibility of an accessible and cybersecure rCBDC proof of concept (PoC).”

The project extends its scope by incorporating the ongoing investigations into Central Bank Digital Currencies (CBDCs) by global central banks.

This includes the digital shekel by the Bank of Israel and the digital pound by the Bank of England. It also cites the digital euro by the European Central Bank (ECB).

Retail CBDC’s Need A Wide Range Of Participants

The report outlines that technological developments in the DeFi space have demonstrated the ability to disentangle financial services. It explains this is conducted through “open access to financial data” and end users controlling their own funds.

The report also notes that it must incorporate a wide range of participants to ensure a balanced approach to rCBDCs:

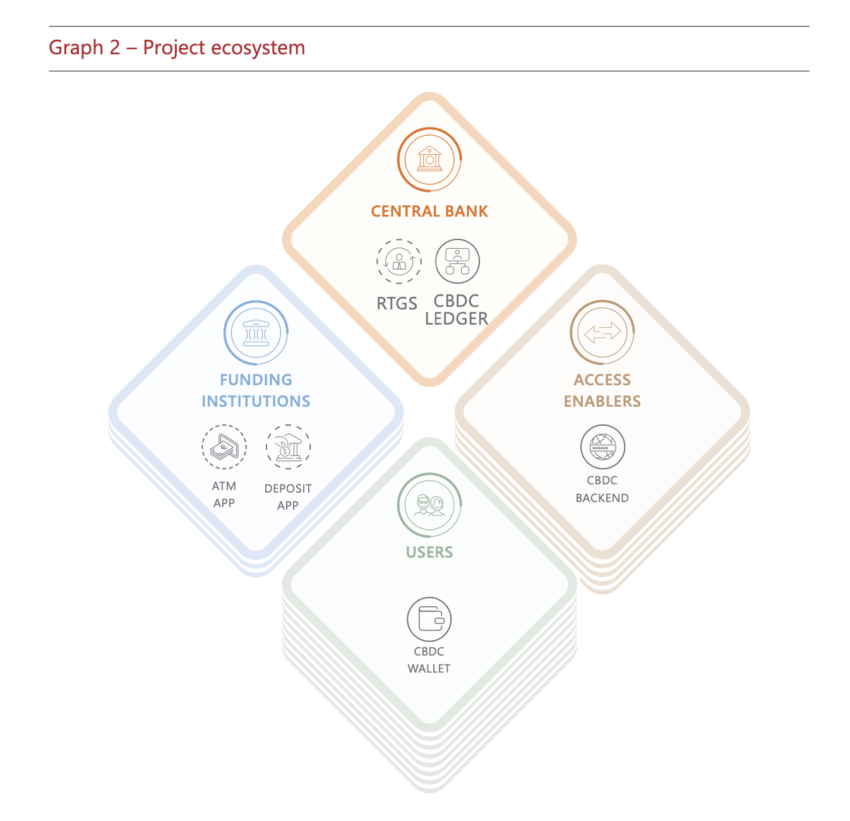

“It is therefore important for an rCBDC system to enable a diverse and vibrant community of private sector intermediaries in the provision of rCBDC services,” it noted.

The Sela ecosystem’s design relies on four important pillars: policy, legal aspects, cybersecurity, and technology/proof-of-concept (PoC) implementation. We organized project participants into four matching workstreams to harness their combined expertise.

Each workstream followed an agile methodology throughout the six-month duration of the project.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.