How Crypto Press Releases Impact Prices

Key Takeaways

- Crypto press releases create hype and FOMO, leading to an increase in demand for certain coins or tokens.

- Prices can drop after big announcements if the coin doesn’t live up to the hype or due to contradictory updates and price corrections.

- Positive news in the crypto world, such as endorsements from famous individuals or major companies integrating cryptocurrencies, can cause price pumps.

Big announcement. Immediate rush. Prices go up. Rinse and repeat. If you are familiar with the ever-unfolding drama in the crypto world, chances are you’re familiar with this pattern.

It’s not news that crypto press releases impact the prices of many coins and tokens. However, knowing how this works is key to protecting your portfolio and becoming an informed crypto investor.

Hype and FOMO: How Announcements Spike Demand

Crypto investor behavior is typically erratic but predictable. Once there is enough hype around a certain coin or token, best believe investors will gravitate toward it. Many call it market sentiment, but we know it for what it really is—fear of missing out (FOMO).

No one wants to sleep on a cryptocurrency that has the potential to turn your thousands into millions. Each time we remember Laszlo Hanyecz purchased two large pizzas with 10,000 BTC, we can’t help but calculate the value in today’s rates.

Hence, the world seems to hop on the bandwagon with each new announcement, press release, or even tweet that hints about a token with potential.

Why Prices Drop After Big Announcements

After all the hype and loud, fancy announcements, sometimes prices drop or even crash. This can be due to a number of factors, none of which sounds good to investors holding on to that cryptocurrency at the time.

When a coin doesn’t live up to the hype, a drop—rather than an increase—in demand is bound to happen. Hype and FOMO-driven buying often lead to market volatility which can trigger selloffs on an unimaginable scale, causing investors to run at a loss.

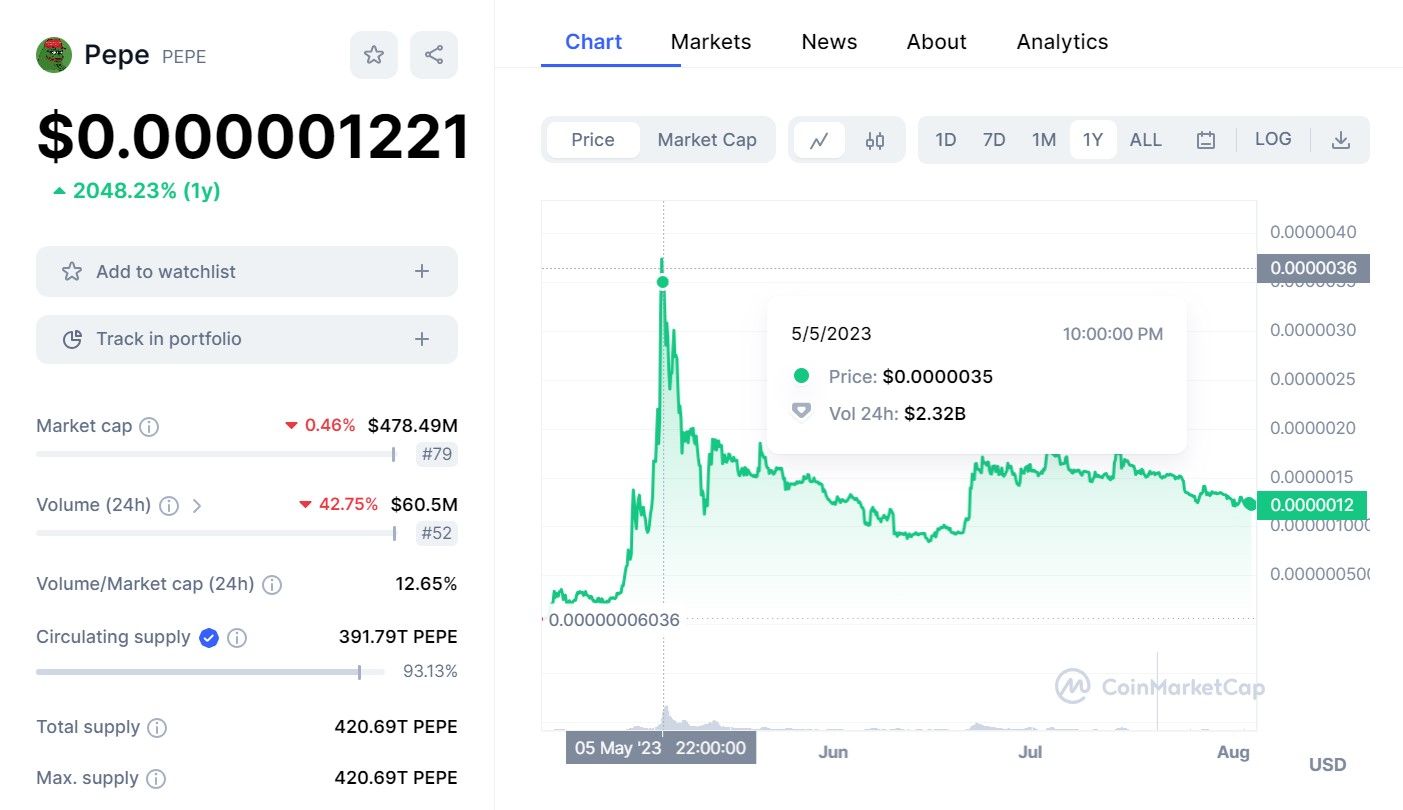

Let’s consider the PEPE coin. PEPE rose to about $0.000004 on the May 5th, 2023 (over 7000% up from its April 14th launch price of $0.00000002764) due to increased demand in the first week of May after Binance announced that it would list the coin.

About three months later, PEPE had lost much steam due to its lack of utility, dropping to about $0.000001, with a $60 million 24-hour trading volume against the earlier $2.3 billion.

Contradictory updates and price corrections have also been linked to major price drops. Price corrections occur when there is a progressive drop of about 10% over an extended period, as opposed to all at once in one day.

Negative news (such as Binance’s two-time pause on Bitcoin withdrawal as reported by Cointelegraph and US regulators clamping down on crypto) has a way of orchestrating price drops. By May 2023, BTC, SOL, and ETH dropped significantly following negative news, including a regulatory clampdown on crypto assets and hikes in interest rates.

Skrill reported that the market sentiment greatly reduced in May 2023, along with cryptocurrency trading. FTX’s bankruptcy in 2022 is also one example of negative news that impacted the market.

No investor wants to run at a loss, so once they hear the inkling that trades might be affected for one reason or another, people instantly pull out, leading to a devaluation of sorts.

When News Leads to Price Pumps

The good news in the crypto world has generally been linked with price pumps. Even a famous person’s testimonial about the potential of a coin can cause it to skyrocket easily.

There are a few examples of announcements that have spiked demand in recent times:

1. Tesla’s Bitcoin Investment

In February 2021, Tesla revealed that it had purchased Bitcoin worth $1.5 billion and would accept BTC as payment for its electric vehicles. This news created a massive surge in demand for Bitcoin, driving its price to new all-time highs.

Soon, Tesla CEO Elon Musk spun around and announced that due to environmental concerns, Tesla would stop accepting Bitcoin as a viable payment option. You can guess what happened. Bitcoin, Ether, and even XRP instantly plummeted, with the crypto market losing as much as $365 billion.

2. PayPal’s Crypto Integration

In 2020, PayPal announced a new service, facilitating the buying, selling, and holding of cryptocurrencies on its platform, much to the joy of many a PayPal user. This new service initiated a surge in demand for cryptocurrencies like Bitcoin, Ethereum, Litecoin, and Bitcoin Cash.

3. Dogecoin Spike and Crash

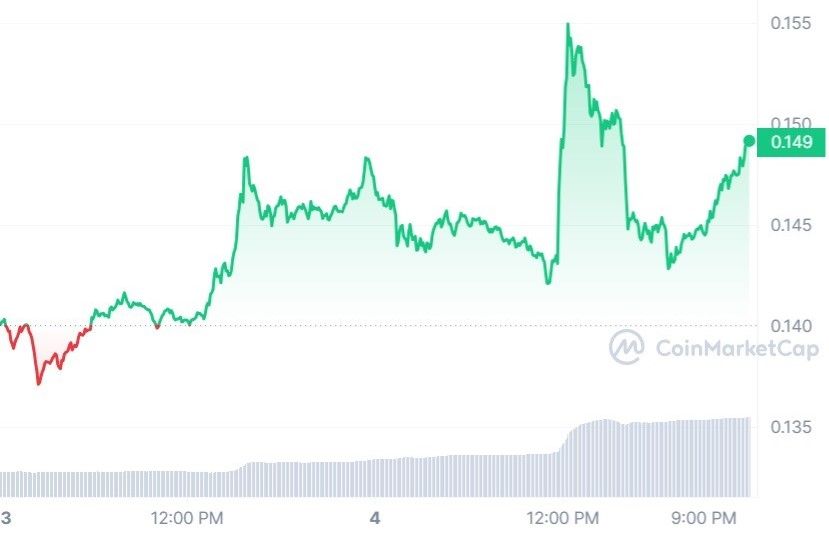

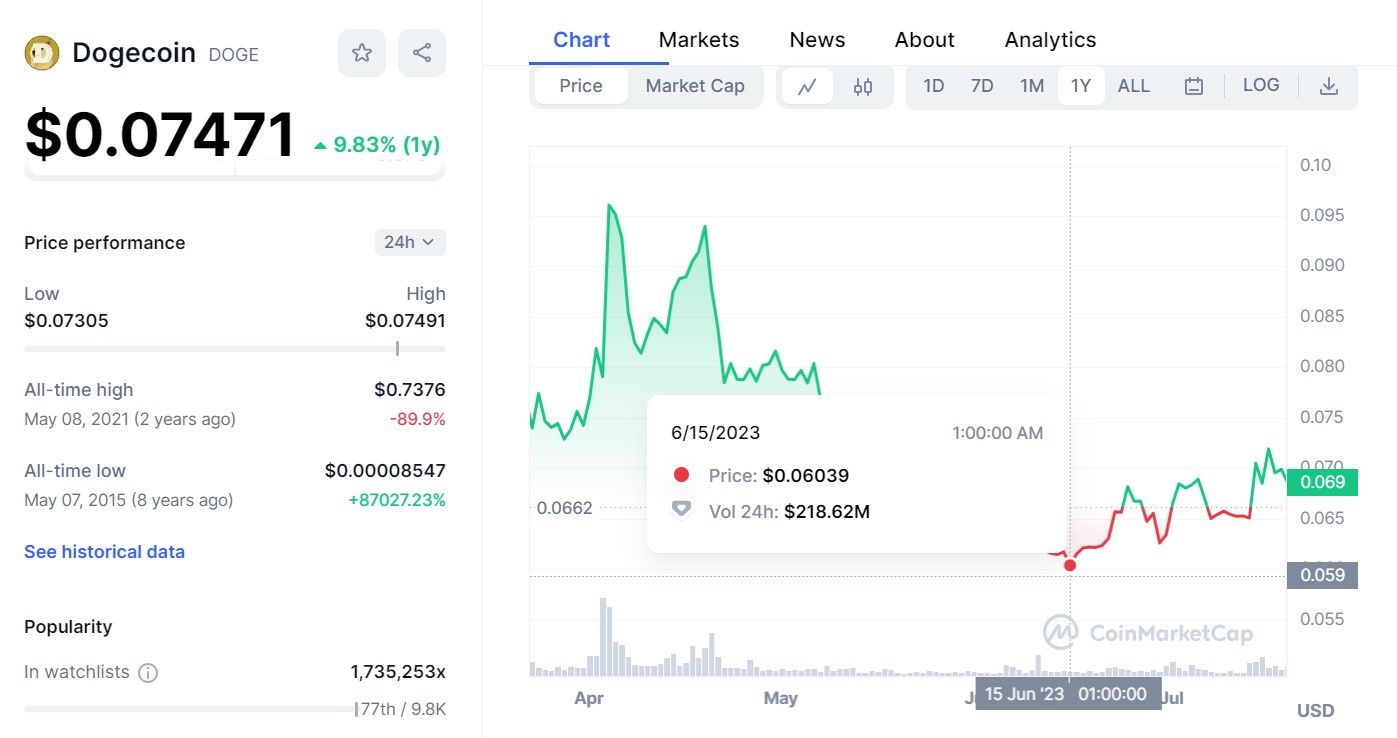

Originally an innocuous meme, demand for Dogecoin spiked by 20% within a day following suggestive tweets by Elon Musk and Mark Cuban in April 2021. Experts warned about it not being a feasible cryptocurrency, but that did not stop another 30% spike on April 4th, 2023 after Elon Musk briefly changed his website logo to a Shiba Inu graphic.

Elon Musk racked up several lawsuits in this regard, including a lawsuit claiming that Musk’s tweets induced DOGE price pumps. This is likely one of the reasons Dogecoin crashed to $0.0615 on June 16th, 2023, marking a 92% crash from its all-time high of $0.7376 recorded on May 08, 2021.

Tips for Making the Right Moves Based on Press Releases

If you’ve read a crypto press release and sense you should make a move, here are a few tips to ensure you make the right moves for your investment:

1. Ensure Press Releases Are Accurate and Unbiased

Only listen to sources that are verified and have been proven to be accurate in the past. This will help to reduce the risk of falling for pump and dump scams or being misled, generally.

2. Check the Tone

When listening to releases or announcements, check the tone and content to ensure it is not purely promotional. If it has a mostly promotional undertone, chances are you’re being enticed to buy a coin or token that isn’t very promising.

3. Consider if It Has a Short or Long-Term Effect

When analyzing a press release, check whether the information disclosed will immediately impact the market or if its effects will be more long-lasting, so you can make informed decisions.

For example, if a company announces a new token, the short-term effect may be a spike in the price, but the long-term impact will depend on how well other investors will receive it.

4. Be Willing to Adjust to Changing Market Conditions

Staying flexible and ready to adjust your investment strategies based on these changing market conditions is crucial. For instance, if a press release reveals a regulatory change that may impact the profitability of the crypto market, you may need to reassess your investments and make appropriate adjustments to mitigate risks and seize new opportunities.

Press Releases as Price Regulators

Crypto press releases drive crypto market dynamics in no small way. If positive, they can drive up prices, but if negative, they can cause panic selling and crashes.

You must base your trading decisions on verified sources of credible information only. It would do you good to avoid reacting to every crypto-related news to minimize the risk of losses.