Gensler Unhappy with XRP Ruling, Stands Firm on SEC’s Strategy

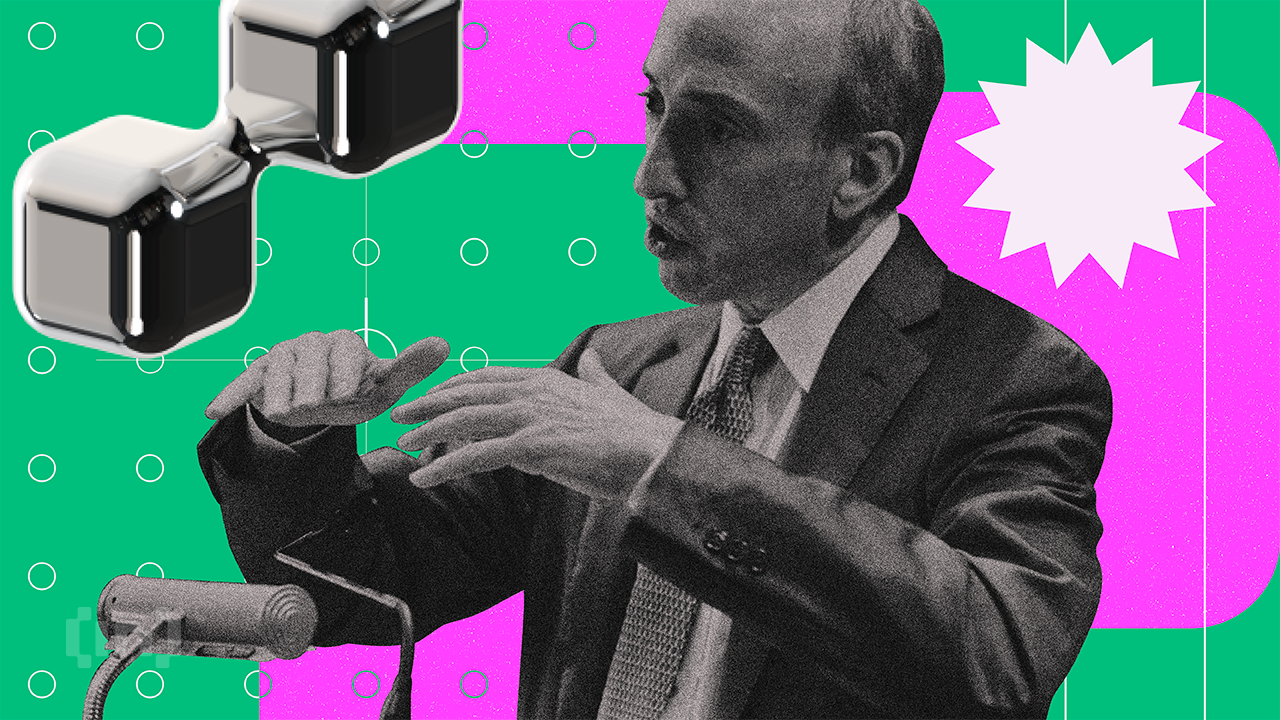

The chair of the Securities and Exchange Commission (SEC), Gary Gensler, has expressed his disappointment at the recent Ripple (XRP) ruling.

At the core of the case was the SEC’s belief that XRP, Ripple’s own cryptocurrency, was a security. Ripple argued that XRP did not meet the criteria for an investment contract. Although, the federal judge in New York did find that XRP was a security when sold to institutional investors. Even so, the coin was not one when trading on public exchanges like Binance and Coinbase, according to the same judge.

SEC Will Not Change Its Strategy, Says Gensler

At a National Press Club event on Monday, Gensler said he was pleased about that part of last week’s decision regarding institutional investors. But the part of the ruling concerning public exchanges left him “disappointed,” Bloomberg reported.

The chair also doubled down on the agency’s aggressive litigation strategy against crypto firms. Last month, the SEC sued two of the biggest players in the industry, Binance and Coinbase, for violating securities laws.

“We’re going to continue to try to bring firms that may not be in compliance into compliance — without prejudging any one of them,” he said.

Congress May Rewrite Crypto Rules

Last week’s landmark prompted widespread celebration as the crypto industry seeks to wrestle power away from the SEC. The decision that XRP is not a security in most contexts essentially removes it from the SEC’s jurisdiction.

Considering the industry widely perceives Gensler as anti-crypto, this is seen as a positive step. Gensler also appears unfazed by the challenges of applying 1940s-style securities laws to modern technology.

Lawmakers in Washington have used the ruling to argue for greater and clearer Congressional oversight of crypto.

Many politicians who are sympathetic to the industry are urging for a new set of regulations.

Industry players have long argued that the Howey Test, and other archaic rules, aren’t fit for their purpose. And that it is long past time to overhaul the whole set of rules and guidelines.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.