Weekly Bitcoin (BTC) Price Jump Suggests Potential 50% Increase

The price of Bitcoin (BTC) has experienced a notable rise since June 15, reaching its highest point of the year on June 23. However, it has slightly declined since then.

This upward trend indicates that the lowest point in Bitcoin’s cycle has likely been reached. If so, the price is expected to continue increasing at a faster pace towards new yearly highs. Last week’s bullish close is a step in the right direction for this forecast.

Has Bitcoin Confirmed Its Bullish Trend Reversal?

According to the technical analysis on a weekly time frame, the price of BTC has reached a significant resistance level of $30,000. This level has played a crucial role for Bitcoin throughout the years, acting as both support and resistance at different times since January 2021.

The BTC price had increased since June 15, when it bounced at the $25,000 horizontal support area (green icon). The price currently trades slightly above the $30,000 resistance area.

The fact that the price has already closed above it supports the possibility that the correction is complete and a new upward movement has begun.

Moreover, the weekly RSI gives a bullish reading. The RSI is a momentum indicator used by traders to assess market conditions and determine whether to buy or sell an asset, also indicating bullish sentiment.

A reading above 50, along with an upward trend, suggests that buyers still have an advantage, while a reading below 50 suggests the opposite. Currently, the RSI is above 50 and rising. It recently rebounded from the 50 line two weeks ago (green circle), indicating a bullish trend.

The fact that the RSI bounced simultaneously as the price further supports the bullish trend.

Long-Term Wave Count Gives Bullish BTC Price Prediction

A more detailed daily time frame analysis reveals a strong positive outlook because of both the wave count and price action.

To analyze price patterns and investor psychology, technical analysts often utilize the Elliott Wave theory, which helps them identify recurring long-term price patterns and predict trend directions.

The wave count suggests that the BTC price is in wave three of a long-term five-wave increase (black). Wave three is usually the sharpest out of the bullish waves. The sub-wave count is given in white.

If we assign waves one and three a 1:1 ratio, a high near $42,700 can be anticipated. Should wave three extend and reach a length 1.61 times that of wave one, the price could potentially reach as high as $53,600.

The price action also supports this count. More specifically, the breakout from a descending parallel channel is a sign that a new bullish movement has begun. Since such channels contain corrective structures, the movement inside it was likely part of the corrective wave two.

Is the Local BTC Bottom In?

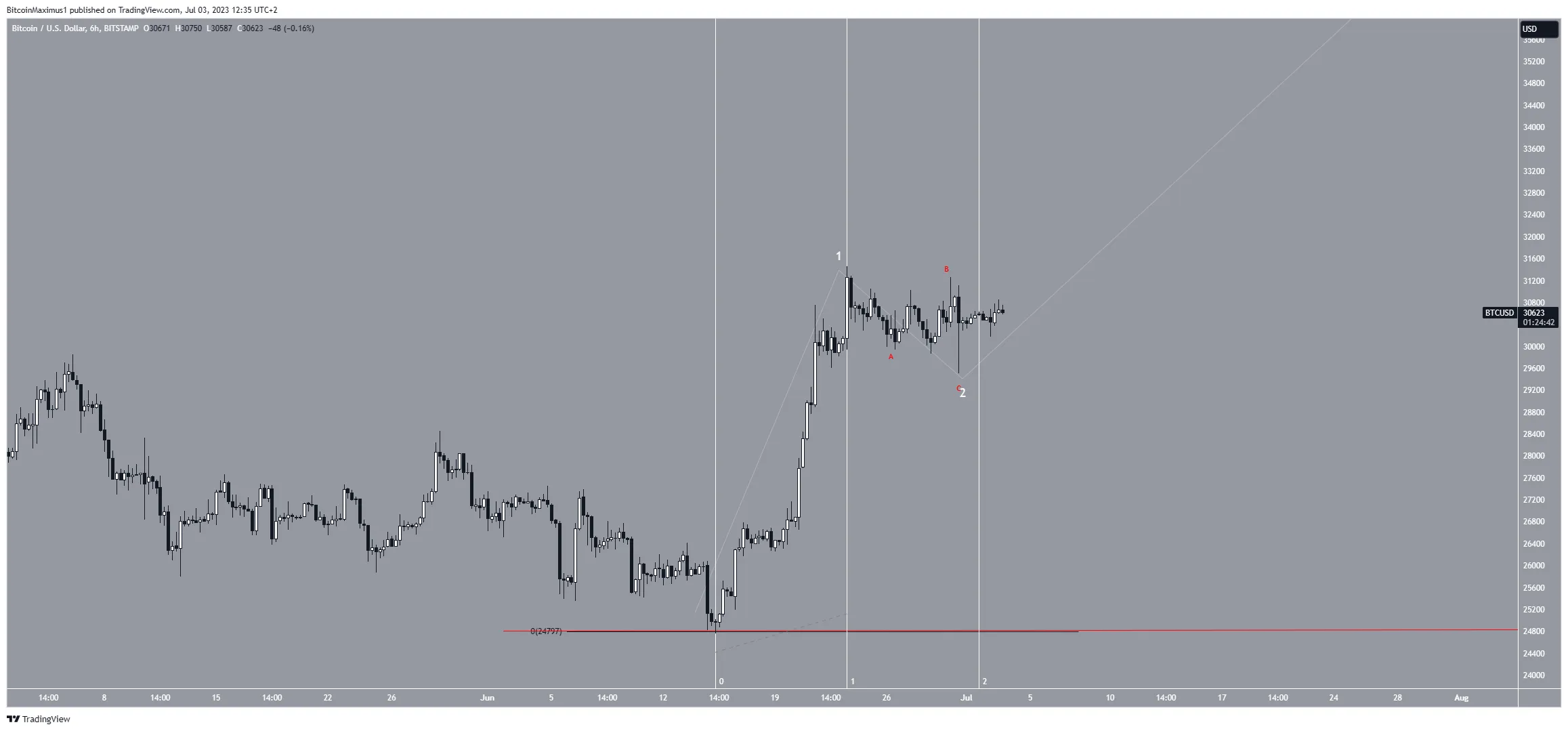

Since the long-term readings are decisively bullish, looking at the short-term six-hour time frame can help determine where the short-term bottom will transpire.

In line with the long-term outlook, the short-term one also shows signs that suggest the local bottom is in.

Firstly, the movement since the high of sub-wave one looks like a completed A-B-C correction (red). Additionally, the correction has taken the same length as the previous upward movement.

It is unusual for the correction to be significantly longer than its preceding increase, especially when the retracement is shallow, as is the case in BTC.

So, the most likely future outlook suggests that the BTC price will not fall below $29,000. Rather, it will continue its increase to $40,000 and beyond.

Despite this bullish long-term BTC price prediction, moving below the sub-wave one low of $24,800 (red line) will mean the trend is still bearish. In that case, a drop to $20,000 will be likely.

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions.