Polygon (MATIC) Investors Lose Confidence, Price Struggles

Polygon (MATIC) has slipped below $1.0 for the first time since January 2023. With social sentiment surrounding the Polygon ecosystem trending negatively since the Ethereum Shappela upgrade, is it boom or bust for MATIC price?

Polygon (MATIC) made its name as a critical component of the Ethereum network. It gained prominence as a scaling solution to high gas fees and low throughput on Ethereum and as an interoperability layer.

However, the Shappela Upgrade marked the complete ETH2.0 Proof of Stake transition, which increased Ethereum throughput and reduced energy demands by 99%.

Fears of practical obsolescence have gradually spread across the Polygon (MATIC) ecosystem. Will the Polygon team be able to rekindle investor confidence and trigger a price rebound?

Polygon Investors Are Losing Confidence

According to on-chain data, investors and network participants in the Polygon ecosystem seem to be losing confidence since the completion of the ETH2.0 transition.

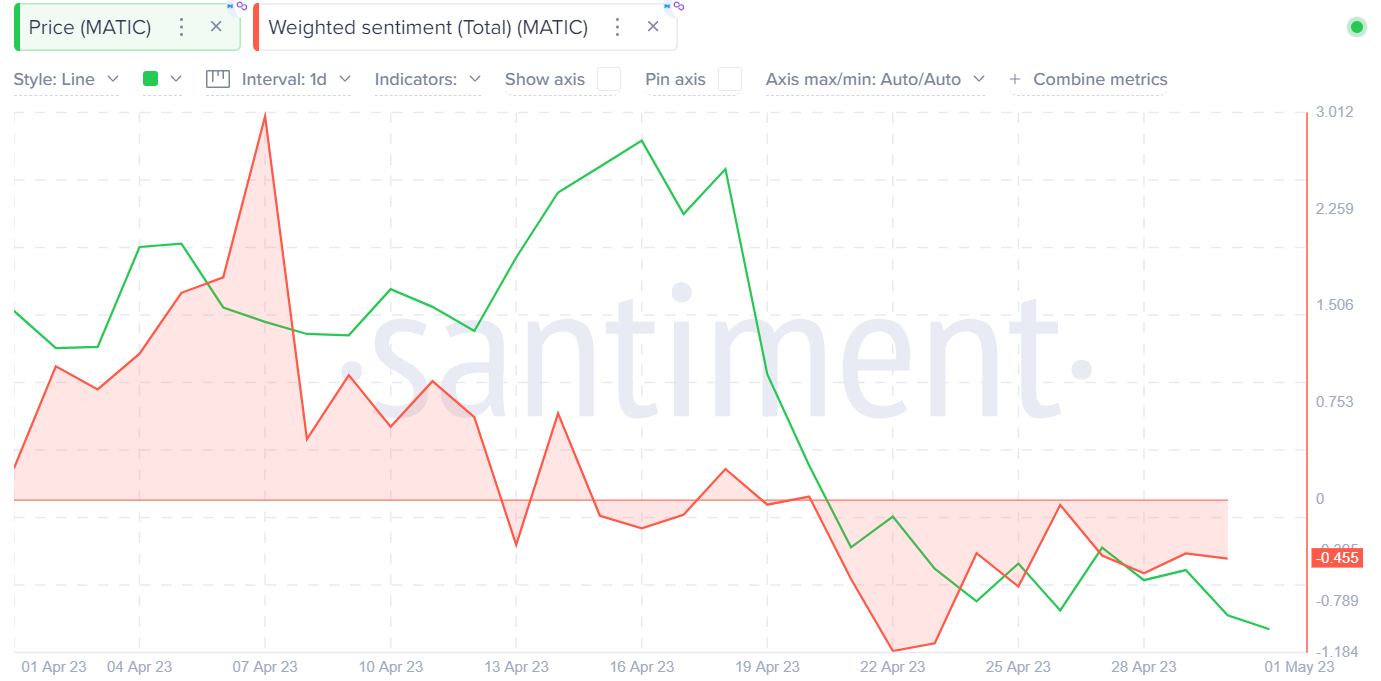

The chart below shows how the Weighted Sentiment began trending negative shortly after the completion of the Shapella Upgrade on April 12.

Between April 12 and May 1, the MATIC Weighted Sentiment dropped 148% from 0.92 to -0.45.

Concisely, the Weighted Sentiment metric evaluates market perception surrounding a project by comparing the ratio of positive mentions to the negatives.

When the weighted sentiment of a project remains negative for extended periods, it denotes that investors are growing increasingly concerned about the long-term viability of the project.

Unless the Polygon (MATIC) team can launch new unique product offerings or community campaigns to rekindle investor interest, this negative perception may have a long-term impact on MATIC’s price prospects.

Despite Falling Prices, MATIC Still Appears Overvalued

Furthermore, the rising Network Valuation to Transaction Volumes ratio suggests impending bearish pressure for MATIC price. Essentially, the NVT ratio compares a network’s market valuation to its current rate of adoption and traction transaction.

The chart below indicates how MATIC has lost fundamental traction since April 12. Between April 11 and May 1, the MATIC NVT ratio soared nearly 630% from 41.28 to 298.74.

As stated above, the NVT ratio is a metric that compares a cryptocurrency’s network value (market capitalization) to the transaction volume on a blockchain. It is used to assess the level of adoption and activity on the network.

The higher the NVT ratio, the higher the network valuation relative to its underlying transaction volume, which could indicate that the network is overvalued.

Hence, this 630% surge in the NVT ratio adds credence to the growing bearish concerns among Polygon investors. Unless the team responds robustly, the MATC may experience more price downsizing in the coming days.

MATIC Price Prediction: Possible Price Drop to $0.91?

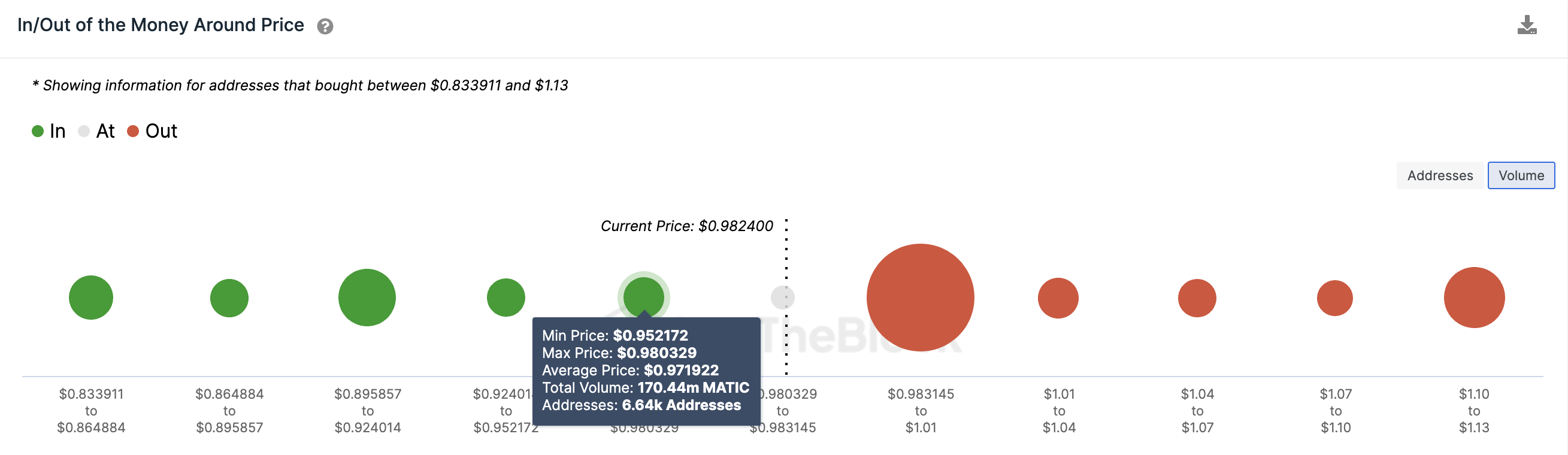

Polygon(MATIC) looks set to drop below $0.95, according to the In/Out of Money Around Price (IOMAP) data compiled by IntoTheBlock.

Although, the 6,000 addresses that bought 170 million MATIC coins for a minimum price of $0.95 would try to prevent the drop.

But, if the bearish scenario plays out as expected, MATIC’s price will likely drop to $0.91. However, MATIC will find a more significant support level of 31,000 addresses holding 630 million coins here.

Still, the bulls could stage a comeback if MATIC price can break above $1.0 again. But, the massive sell-wall mounted by 13,000 wallet addresses holding 4.08 billion coins will likely prevent it.

Buyers in this cluster could be looking to break even at $0.97 and $1.01. The large number of buys in this cluster could dramatically halt any further upward push in price.

However, If Polygon bulls can manage to breach that resistance, MATIC holders can anticipate a rebound toward $1.10.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions.