Is Bitcoin price set to shine as stock market investors “Sell in May and Go Away”?

- Bitcoin price has maintained an inverse correlation with the stock market, which could push the cryptocurrency up.

- “Sell in May and Go Away” suggests investors ignore the next six months until October, which have historically been bad for the S&P 500 Index.

- The upcoming FOMC meeting could hike the interest rate by 25 basis points, but any more rise would prove harmful for both stock markets and BTC.

Bitcoin price recently decoupled from the stock market, as a result of which even the recent banking crisis held no bearish impact on the cryptocurrency. Now as the “Sell in May” trend comes back to life, it is likely that BTC might reap the benefits of a slow-growing stock market.

“Sell in May” – Banks’ collapse paves the way

In the stock market, as April comes to an end, a common saying among investors comes back to life – “Sell in May and Go Away”. The axiom is used to signal the beginning of the worst six months of the year for traders and investors. Due to the relatively terrible performance of the stock market, i.e., S&P 500 Index (SPX), “Sell in May” suggests simply ignoring the next six months and coming back again in October.

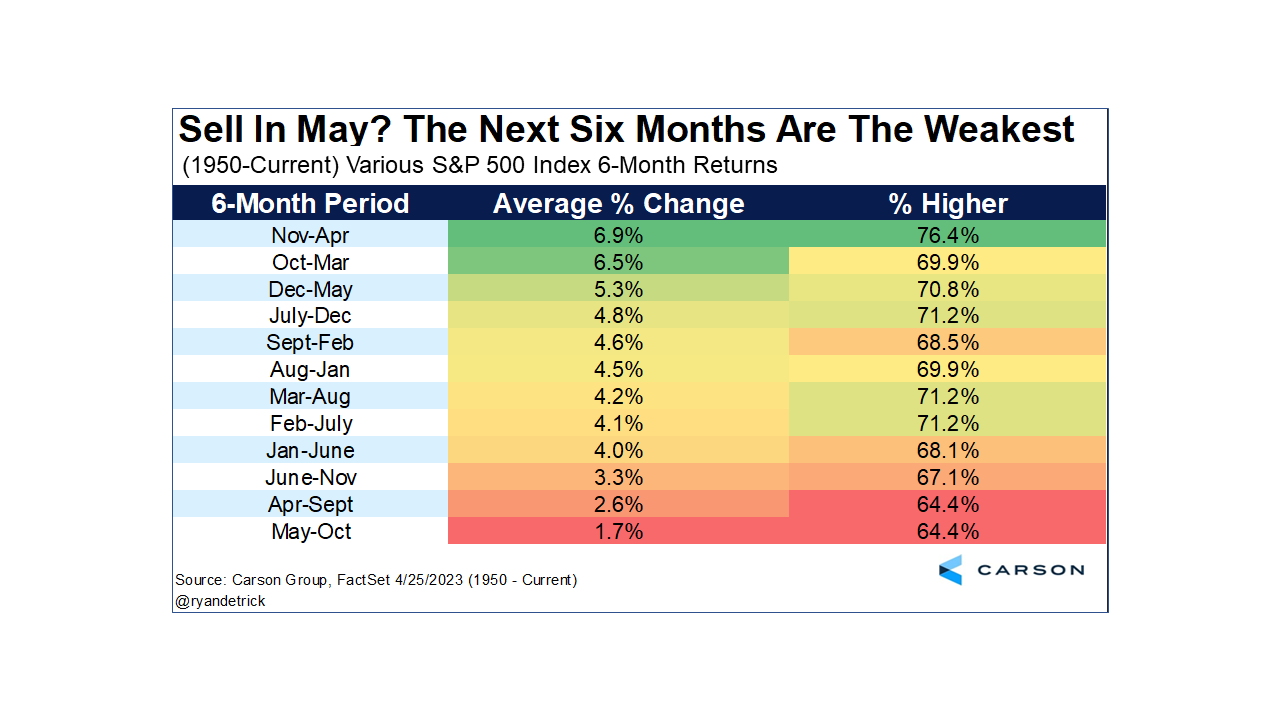

While it may seem like another fad, the saying has historically been proven right. According to a report from Carson, on average, the May to October period has borne the least growth of 1.7% in comparison to other six-month combinations.

SPX performance in different six-month combinations – Carson

But beyond an axiom, the stock market does have a lot to worry about as another bank just collapsed. The First Republic Bank, one of Unites States’ 20 biggest banks, is going to be reportedly taken over by the Federal Deposit Insurance Corporation (FDIC) on April 28. The bank will be placed under imminent receivership as the FDIC said that there was “no more time” for a private sector rescue.

Earlier this year, the Silicon Valley Bank, Silvergate Bank and Signature Bank failed as the entire US faced a banking crisis in Q1. The stock market bore the impacts of the same as within a month, SPX declined by nearly 344.63 points falling by 8.25%.

SPX 1-day chart

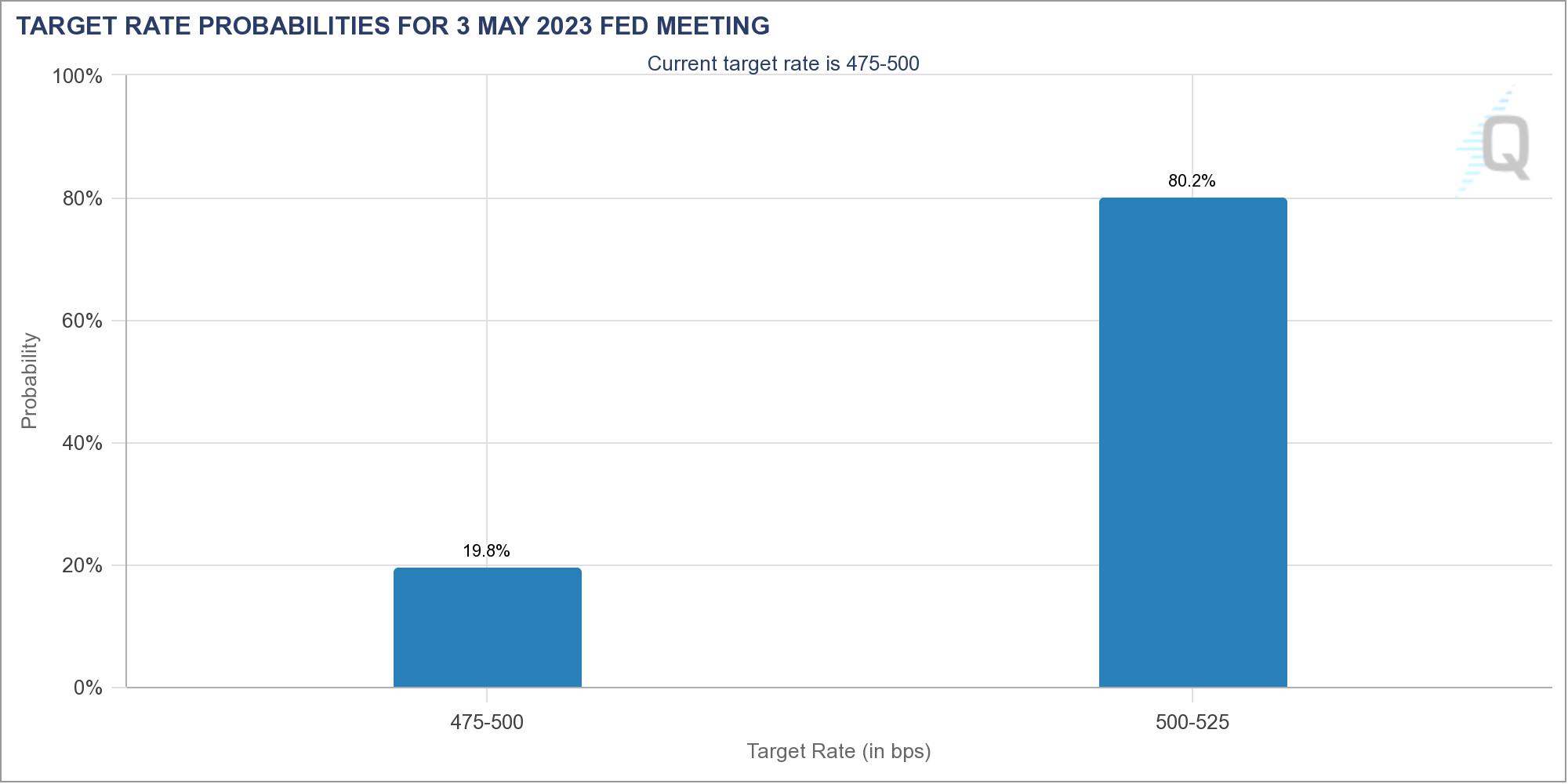

Now as May begins following First Republic Banks’ crisis, the Federal Reserve is also set to conduct its Federal Open Market Committee (FOMC) meeting on May 2 – 3. In this meeting, the next interest rate hike will take place, and the Fed is likely to increase the rates by 25 basis points (bps).

The probability of the same is currently at 80%, rising from 75% that was observed a few days ago after reports of First Republic Bank being taken over by the US government first came to light.

Fed interest rate hike probability

Read more – Bitcoin price climbs back above $28,000 as First Republic Bank crashes by 50%

All these instances could have a bearish impact on the stock markets, translating into a bullish impact on Bitcoin price.

Bitcoin price could rise

Bitcoin price in the past has had a rather surprising reaction to not just the stock market decline but the banking crisis as well.

While the banks collapsing in the first quarter of the year brought down the stock and crypto market collectively initially, BTC started rallying soon after and over the next ten days, the biggest cryptocurrency in the world shot up by 40%.

BTC/USD 1-day chart

This is because, towards the end of 2022, Bitcoin decoupled itself from the stock market and regained its “safe have” status and “inflation hedge” label akin to Gold. Even this week, as the initial reports of First Republic Banks’s failure arrived, BTC shot up by nearly 8%.

Thus as the “Sell in May” trend takes shape and stock market performance remains sub-par, Bitcoin price will have room to welcome traders and investors from the stocks’ world.

Furthermore, Bitcoin supply profitability is still pretty low at 74%. While the profitability did increase over the last four months from 45% to a 12-month high, there is still room for growth before a market top is observed.

Usually, when more than 95% of the supply becomes profitable, a market top is marked, which induces sell pressure. Until then, BTC is good to chart gains.

Bitcoin supply in profit

Conclusion

Looking at the broader market conditions, it does seem likely for Bitcoin price to observe some green candlesticks on the charts potentially. That is unless the alt season takes over and Bitcoin’s dominance falls from the current 48.63% to less than 40%.

At the same time, traders and investors should also watch out for the upcoming interest rate hike, as a more than 25 bps hike could cause a price crash.

Read more about the same here – Bitcoin Weekly Forecast: Fed’s interest decision will be key to BTC directional bias