FTX Distances Itself From FUD Token Causing Price to Tank

FTX Users’ Debt (FUD) token has seen a drop in its trading volume after FTX announced that it is not associated with the token.

In a Feb. 17 tweet, the bankrupt firm said it had not issued any debt token, and any such offer was unauthorized.

“The FTX Debtors remind stakeholders to be on alert for scams from entities claiming to be affiliated with FTX,” the company said. “The FTX Debtors have not issued any debt token, and any such offers are unauthorized.”

FUD Token

The FUD token was issued by DebtDAO on Feb. 4 and was listed by the crypto exchange Huobi. The issuer released 20 million FUD, stating that its fair value was between $1 and $5. However, early interest in the token took its value to as high as $115, forcing the DAO to burn 18 million tokens, roughly $1.26 billion at the time, according to a Justin Sun tweet.

Meanwhile, the token attracted several criticisms from community members who said it was similar to a security. Some community members also pointed out that the token was not associated with FTX and was a scam. They added that the DebtDAO has no official website, and its Twitter account was created earlier this month.

Also, Sun’s support for the token generated mixed reactions from community members. He previously described the FUD Token as a “top quality FTX debt asset.”

FUD Trading Volume Drops

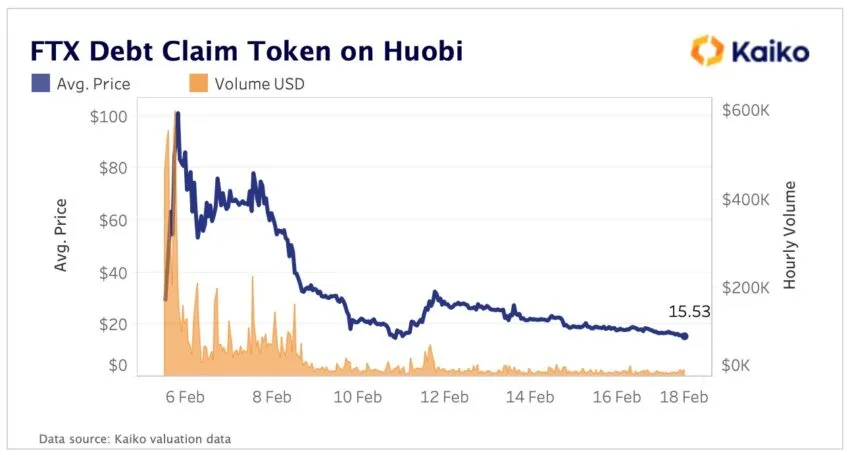

With FTX disassociating itself from FUD, the token’s trading volume has significantly dropped. According to Kaiko Data, FUD’s hourly trading volume fell to $8,000 from around $600,000.

Kaiko added that the token issuer “has no connection to the bankrupt FTX exchange and offered no proof that they hold any claim to user debt.”

CoinMarketCap data also corroborates the above. According to CoinMarketCap, the token’s trading volume in the last 24 hours dropped 8.08% to around $215,000. This might reflect the realization by many investors that the debt associated with the token might not be claimable as it is not associated with FTX.

Meanwhile, FUD dropped by 3.36% in the last 24 hours to $14.70 as of press time. The token has declined by roughly 50% in the previous seven days.

Disclaimer

BeInCrypto has reached out to company or individual involved in the story to get an official statement about the recent developments, but it has yet to hear back.