Altcoin Prices Are Surging | InvestorPlace

Nearly 20 altcoins have doubled in 2023 … can Bitcoin break long-term resistance? … fundamental bullish tailwinds … the Fed could ruin everything tomorrow

So far in 2023, nine of the top 100 cryptocurrencies have doubled in price.

If we broaden our analysis to the top 200 cryptos, nearly 20 have doubled.

Last week alone, Bitcoin popped 9%… Cardano climbed 10%… Polygon tacked on 20%… and two smaller altcoins, Threshold and Aptos, soared more than 100%.

Again, that’s all from just last week.

Pulling back, it’s Tuesday, so in keeping with recent tradition, let’s check in on the crypto sector with the help of our expert Luke Lango.

From Luke’s Crypto Investor Network weekend update:

…It’s not even the end of January and already, about 15% of the top 200 cryptos have risen more than 100% this year.

Does that sound like a new boom cycle to you?

It certainly does to us…

While our “Boom Cycle 2023” prediction for cryptos may have seemed outlandish and misplaced a month ago, it is now starting to look like a consensus belief.

As Bitcoin goes, so goes the sector

For newer Digest readers, Luke is our hypergrowth investment expert, and few sectors offer greater potential for hypergrowth than cryptocurrencies.

Before the 2022 bear market, altcoins were some most lucrative investments of the prior five years – some rising, literally, thousands of percent.

Luke’s Crypto Investor Network newsletter focuses on these cutting-edge altcoins, but Bitcoin remains the barometer of the crypto sector. In general, its trend sets the momentum direction for the broader altcoin world.

So, to get a sense for where the sector is heading, our analysis must begin with Bitcoin.

On that note, let’s return to Luke:

At this point, pretty much every technical buy signal has been triggered.

Perhaps most potently, Bitcoin has crossed above its 30-week moving average (MA) for the first time in this bear market cycle.

Every time BTC has crossed above its 30-week MA, BTC proceeded to soar by at least 100% over the next few months.

Source: Bloomberg

Now, though “100% gains” might be in Bitcoin’s future, how the crypto handles a key upcoming resistance level will influence how quickly it gets there.

Bitcoin stands at the cusp of the $24,000 to $24,500 level, which is a critical technical range

Regular Digest readers will recognize it from last Wednesday’s Digest. That’s when we analyzed Bitcoin through a “Stage Analysis” lens (you can read that issue here).

In short, it appears that Bitcoin wants to break out of its Stage-1 sideways consolidation stage into its Stage-2 growth stage.

However, for that to happen, the crypto needs to push north through its Stage-1 resistance line with heavy volume.

As you can see below, that level is roughly $24,000 to $24,500 (ballpark 4%-5% higher than Bitcoin’s price as I write Tuesday morning).

Source: StockCharts.com

Luke believes the macro fundamentals support a breakout

Back to his Crypto Investor Network update:

The fundamental drivers of this rally look very solid, too.

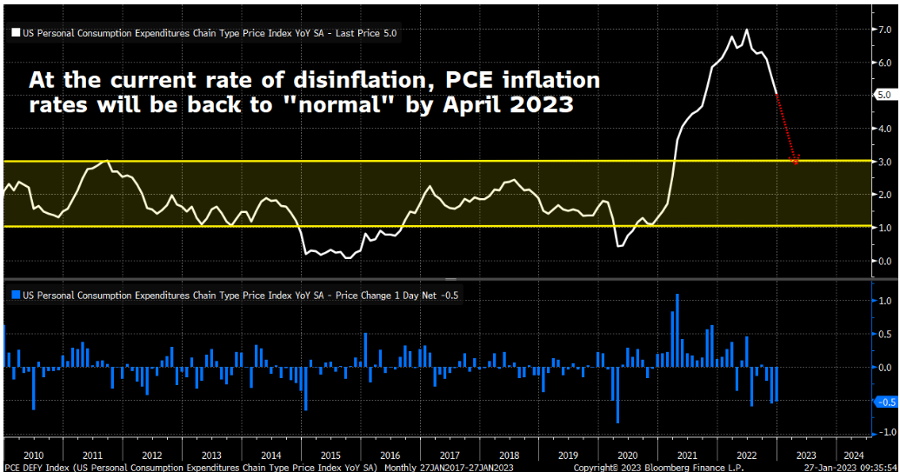

On the macro front, we got more data [last] week that inflation is falling apart, with PCE and core PCE inflation cooling off rapidly in December. Those inflation rates are on track to get back to “normal” levels by the spring.

Also on the inflation front, short-term consumer inflation expectations dropped again in January, while natural gas prices plunged below $3 this week.

Inflation is collapsing.

Source: Bloomberg

Meanwhile, the economy looks positioned to avert a recession.

Mastercard (MA) and Visa (V) reported earnings [last] week. Both payment card giants said that consumer spending was impressively resilient in the last three months of 2022 and is picking up steam here in January.

The consumer is 70% of the economy. If they’re still chugging along, the economy will, too.

Perhaps most important of all, Luke points toward the S&P’s technical breakout.

As we noted in yesterday’s Digest, the S&P has finally broken above its long-term down-sloping trendline. This didn’t happen once in 2022.

Back to Luke for why this is so bullish for crypto:

This looks like a classic technical breakout from a bear market. And that’s bullish for cryptos because stocks and cryptos have recently developed a strongly positive correlation.

The one massive overhang that remains

With Bitcoin and the broader altcoin sector surging in 2023, combined with a fundamental picture that’s firming up, why hasn’t Luke recommended new altcoin investments?

Because there’s one very large elephant in the room that holds the power to make or break this budding rally…

The Fed.

Tomorrow, the Fed announces its latest policy decision, and we hear from Chairman Jerome Powell.

It’s widely-expected that the Fed will raise rates only 25 basis points, but what’s unclear is Powell’s tone and forward-looking comments in his press conference.

And given the potential for curveballs, Luke wants to sit this one out – for now.

Back to his update:

We do not want to front-run this event in the crypto world.

Powell will either light a fire under the crypto markets by saying the Fed’s job is nearly done, or he will cause a massive crash by saying the Fed needs to keep hiking for a lot longer.

We want to issue new Buy Alerts after that event.

Why?

Because while we cannot predict what Powell will say, we can predict with reasonable confidence that inflation is cooling fast enough to allow the Fed to pause its rate-hike campaign by the summer, at the latest, regardless of what Powell says on Wednesday.

Therefore, if Powell lights a fire under risk assets on Wednesday, we will join the rally because it will last for a while longer.

If Powell causes a crash, we will buy the dip because we are confident cryptos will rebound.

Either way, it simply makes the most sense to us to wait for Powell to do whatever he is going to do next Wednesday, and then either join the rally or buy the dip.

While we don’t know how tomorrow will play out with the Fed, let’s end with a few more reasons for crypto optimism

The on-chain analytics platform CryptoQuant publishes a “Profit and Loss (PnL) Index.”

The index attempts to normalize cycle top and bottom signals using combined data from three other on-chain metrics. When it’s value climbs above its one-year moving average, that triggers a long-term “buy” signal.

And that just happened.

The PnL Index just issued a “definitive buy signal” for Bitcoin. Notably, this is the first such signal since early 2019.

But it’s not the only bullish indicator that’s triggering today.

Here’s another from Coin Telegraph:

CryptoQuant is not alone in eyeing rare recoveries in on-chain data, some of which were absent throughout Bitcoin’s trip to all-time highs following the March 2020 COVID-19 market crash.

Among them is Bitcoin’s relative strength index (RSI), which has now bounced from its lowest levels ever.

PlanB, the creator of the stock-to-flow family of Bitcoin price forecasting models, noted that the last rebound from macro lows in RSI occurred at the end of Bitcoin’s previous bear market in early 2019.

Bottom line: Green shoots are popping up in the crypto world today, but the Fed holds the power to mow them down tomorrow.

On the other hand, if Powell sounds more dovish than anticipated, hold onto your hats – crypto could be off to the races.

We’ll keep you updated.

Have a good evening,

Jeff Remsburg