Can this latest Uniswap development put CAKE and its investors at risk

- PancakeSwap observed growth in terms of TVL, however, the growth could come to a halt.

- Uniswap’s deployment may impact PancakeSwap’s growth.

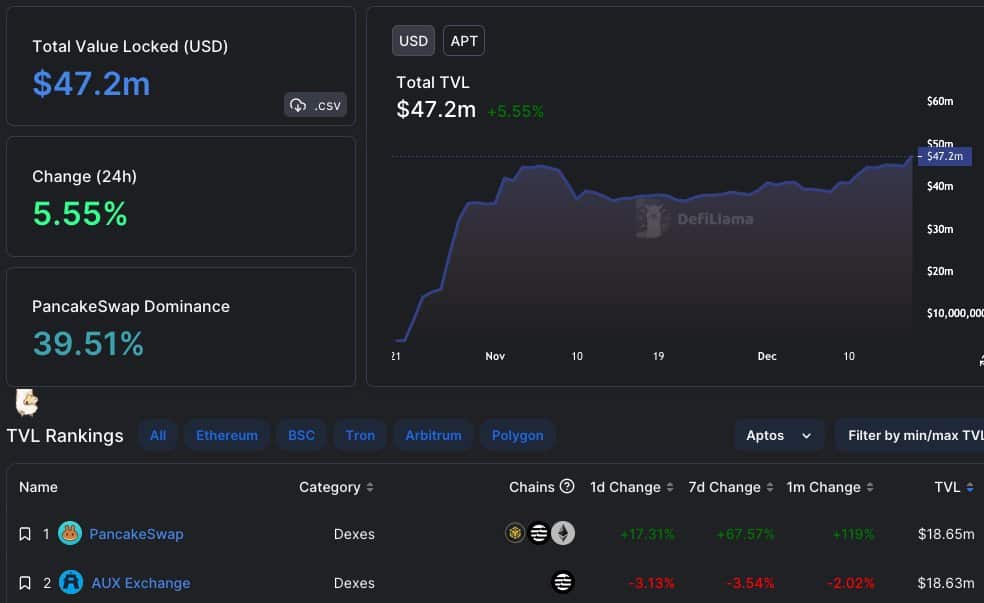

A 17 December update by PancakeSwap [CAKE] revealed that despite the market’s bearish conditions, the DEX had witnessed a spike in its total value locked (TVL). According to DefiLlama’s data, PancakeSwap’s TVL grew materially over the last few months. During press time, its TVL was around $47.2 million.

— PancakeSwap 🥞 #Multichain (@PancakeSwap) December 17, 2022

Read PancakeSwap’s [CAKE] Price Prediction for 2023-24

However, PancakeSwap’s dominance and growth could soon end.

This is because Uniswap [UNI] has decided to deploy on BNB. If Uniswap goes through with its plan, it would compete with PancakeSwap amongst other DEXes. This decision by Uniswap could threaten the former’s market share and growth.

Competition arises

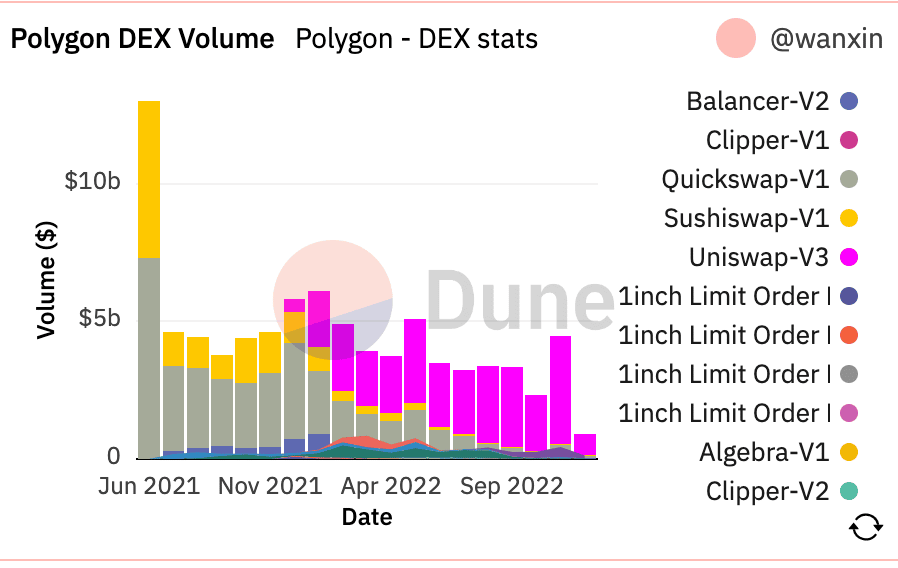

If Uniswap dominates PancakeSwap on the BNB chain, it won’t be the first time that the DEX would overshadow a network. After Uniswap deployed on Polygon [MATIC], it outperformed other DEXes such as SushiSwap [SUSHI] and Quickswap on the chain in terms of volume, according to data provided by Dune Analytics.

If Uniswap replicates its Polygon network success on the BNB chain, it could put PancakeSwap in a tough spot.

Can NFTs rescue PancakeSwap?

The way in which PancakeSwap could retain the interest of its users would be through its NFTs.

Recently, the network tried to take advantage of the hype surrounding the 2022 FIFA World Cup. They incorporated the world cup events into a game through which users could win NFTs if they could accurately predict the outcome of a game.

🏟️ It’s a day for the FINAL of the #FIFAWorldCup 2022 ⚽

🏆 Which team will lift the trophy? Will it be #Argentina or #France?

👉 Predict your winning team, and mint the winning team NFT on Galxe: https://t.co/6FyaMcSOyE

🎁 50 lucky winners will win 30 GAL each.

More ⬇️ https://t.co/RznT7MrXHk

— PancakeSwap 🥞 #Multichain (@PancakeSwap) December 18, 2022

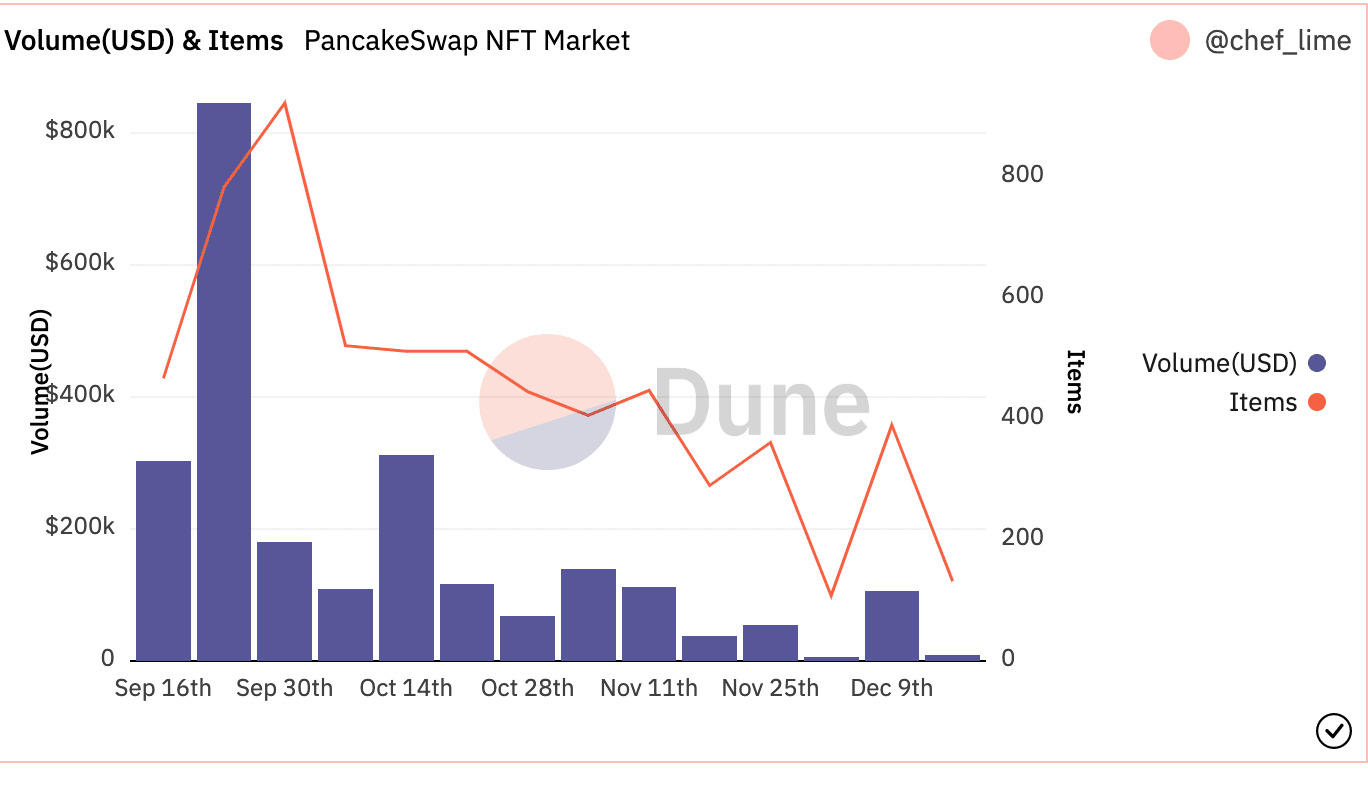

However, despite PancakeSwap’s attempts to generate interest in its NFTs, the volume of its NFT market continued to decline. According to data provided by Dune Analytics, the volume of NFTs on the DEX went from $845,400 in September to $106,00 at the time of writing. This drastic decline in interest could impact CAKE negatively.

A glance at the tokens

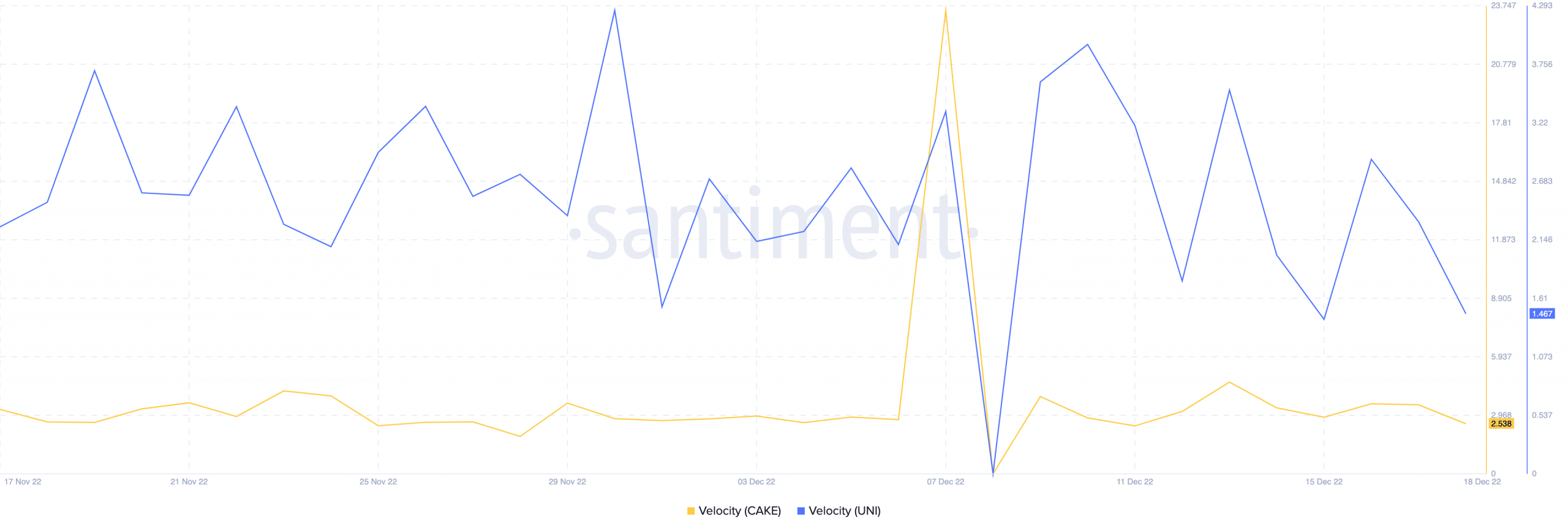

In terms of their tokens, both CAKE and UNI observed a decline in terms of prices and were affected by the bear market. One reason for the same could be the declining activity of both tokens, which was indicated by their decreasing velocity.

From data gathered by Santiment, it was observed that over the past month, the velocity of both tokens depreciated. A declining velocity indicated that the frequency at which UNI and CAKE were moving from one address to another had decreased.

It remains to be seen whether PancakeSwap can continue growing despite new competition.

At the time of writing, UNI was trading at $5.35 and CAKE was trading $3.39, according to CoinMarketCap.